Applying For Homestead Exemption In Texas

Description

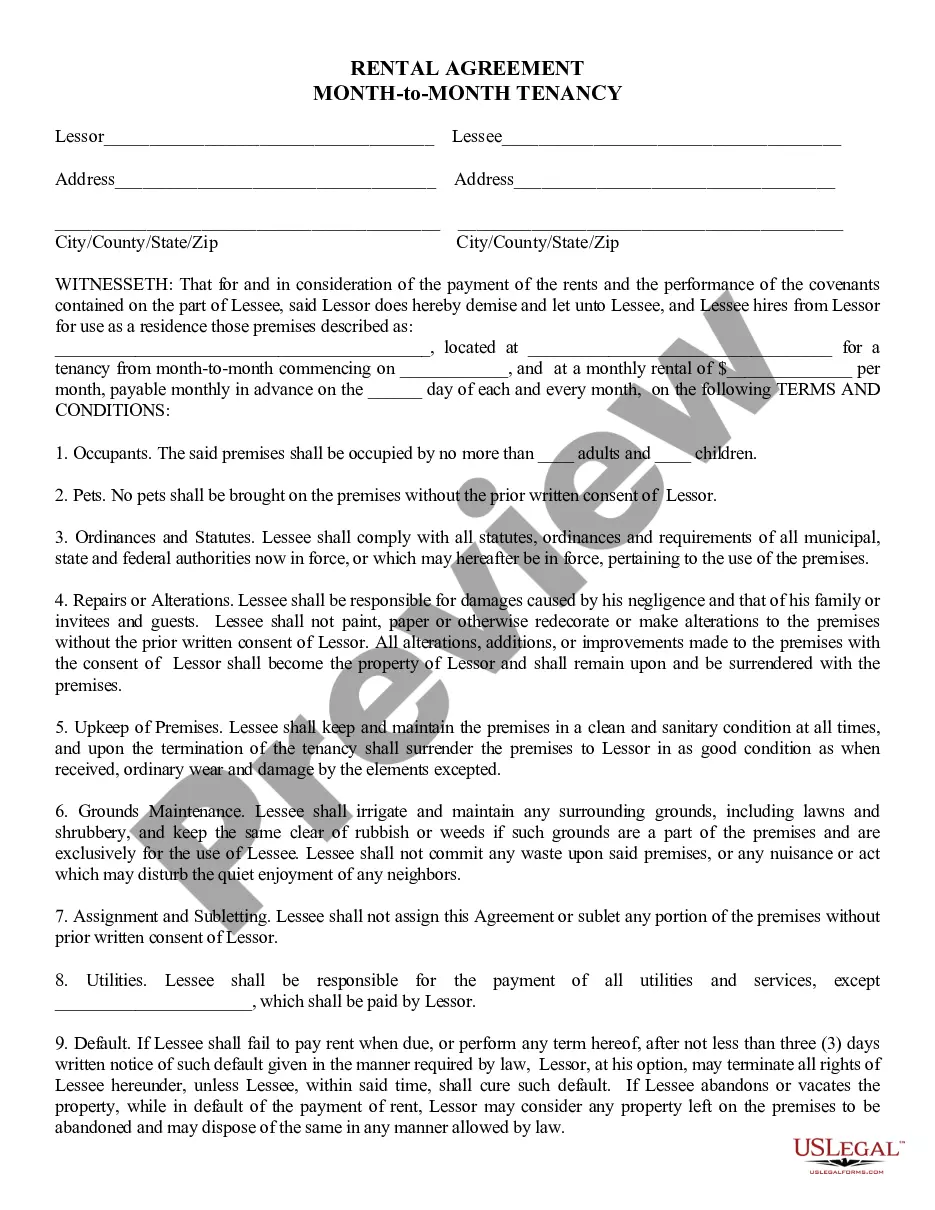

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

Creating legal documents from the beginning can occasionally feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you're seeking a simpler and more economical method for completing Applying For Homestead Exemption In Texas or other documents without unnecessary hurdles, US Legal Forms is always available to assist you.

Our digital repository of over 85,000 current legal forms covers nearly every element of your financial, legal, and personal matters. With just a few clicks, you can immediately access templates that align with state and county regulations, meticulously crafted by our legal professionals.

Ensure that the form you select meets the criteria of your state and county. Choose the appropriate subscription plan to purchase the Applying For Homestead Exemption In Texas. Download the form, complete it, sign it, and print it out. US Legal Forms boasts an impeccable reputation and more than 25 years of experience. Join us today and simplify document handling to make it effortless and efficient!

- Utilize our site whenever you require dependable and trustworthy services to swiftly find and download the Applying For Homestead Exemption In Texas.

- If you're a returning user with an existing account, simply Log In, select your desired form, and download it instantly or access it again from the My documents section.

- Don't have an account? No worries. Registering takes only a few minutes and allows you to browse the library.

- Before directly downloading Applying For Homestead Exemption In Texas, please follow these guidelines.

- Review the document preview and descriptions to confirm that you have located the specific document you need.

Form popularity

FAQ

The completed application and required documentation are due no later than April 30 of the tax year for which you are applying. A late residence homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1.

You may apply between January 1st and April 30th of the tax year you qualify.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property.

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

Put simply, a homestead exemption lowers the taxable value of your property. This means you will pay less property tax on your home. As of August 2023, you're entitled to up to $40,000 in value reductions. This is only a general guideline figure, though.