Application For Residential Homestead Exemption For 2023

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

Whether for commercial aims or for individual matters, everyone must navigate legal issues at some stage in their existence.

Completing legal documents mandates meticulous focus, starting from selecting the appropriate form template.

With a comprehensive US Legal Forms library available, you never need to waste time scouring the internet for the suitable template for any event.

- Locate the template you require by using the search function or browsing the catalog.

- Review the form’s description to ensure it aligns with your circumstances, state, and county.

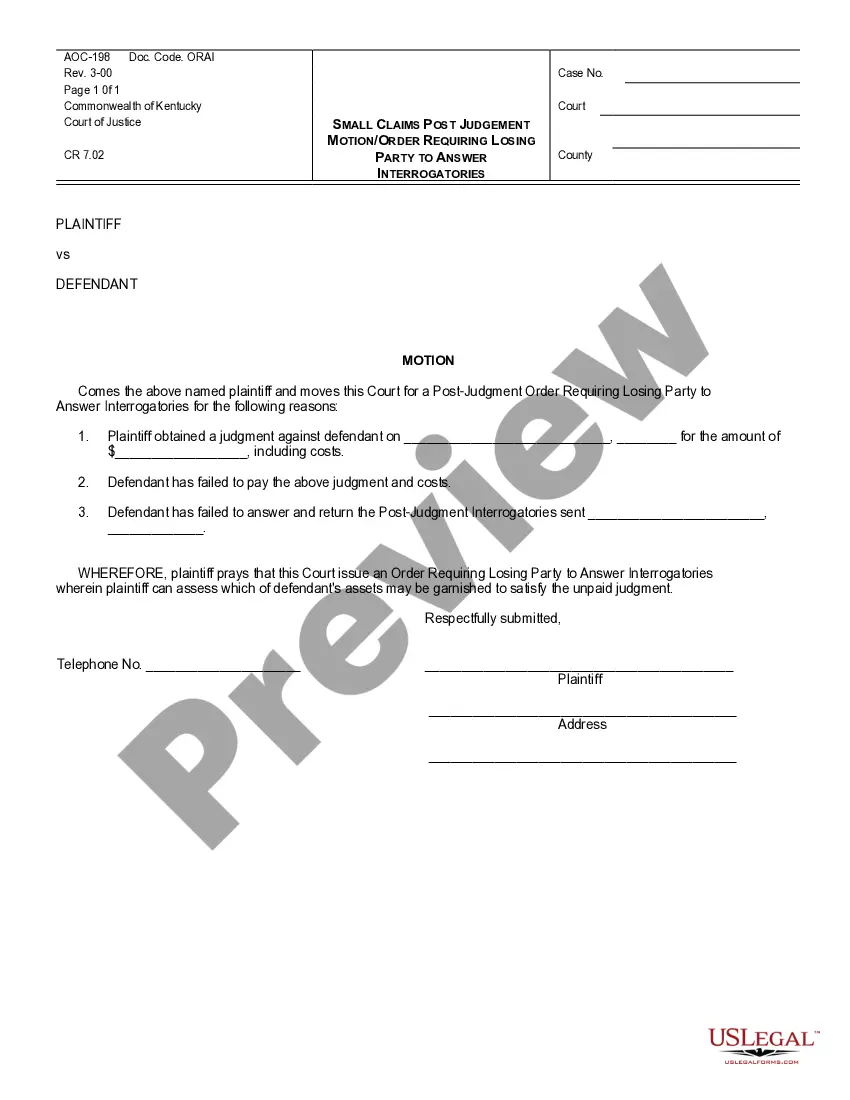

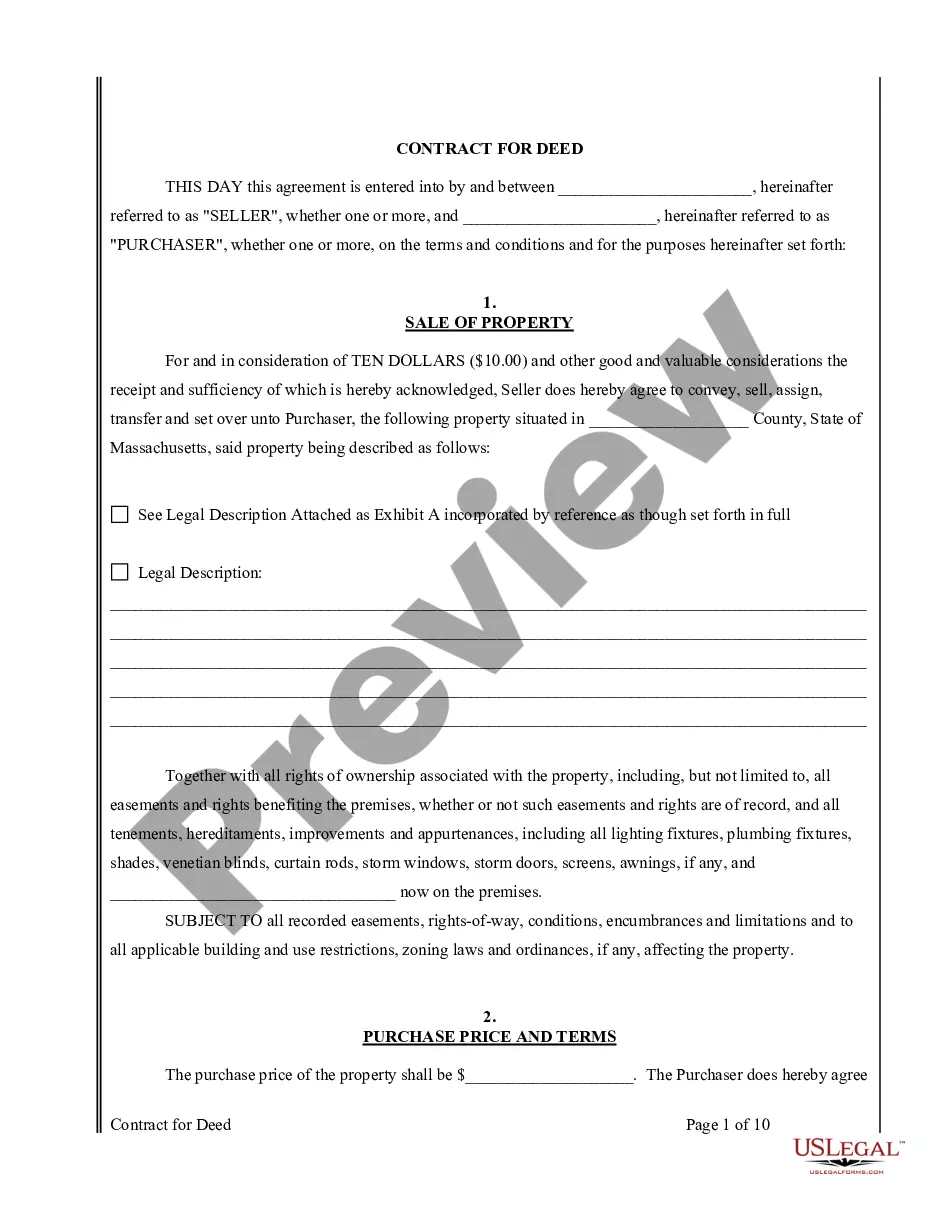

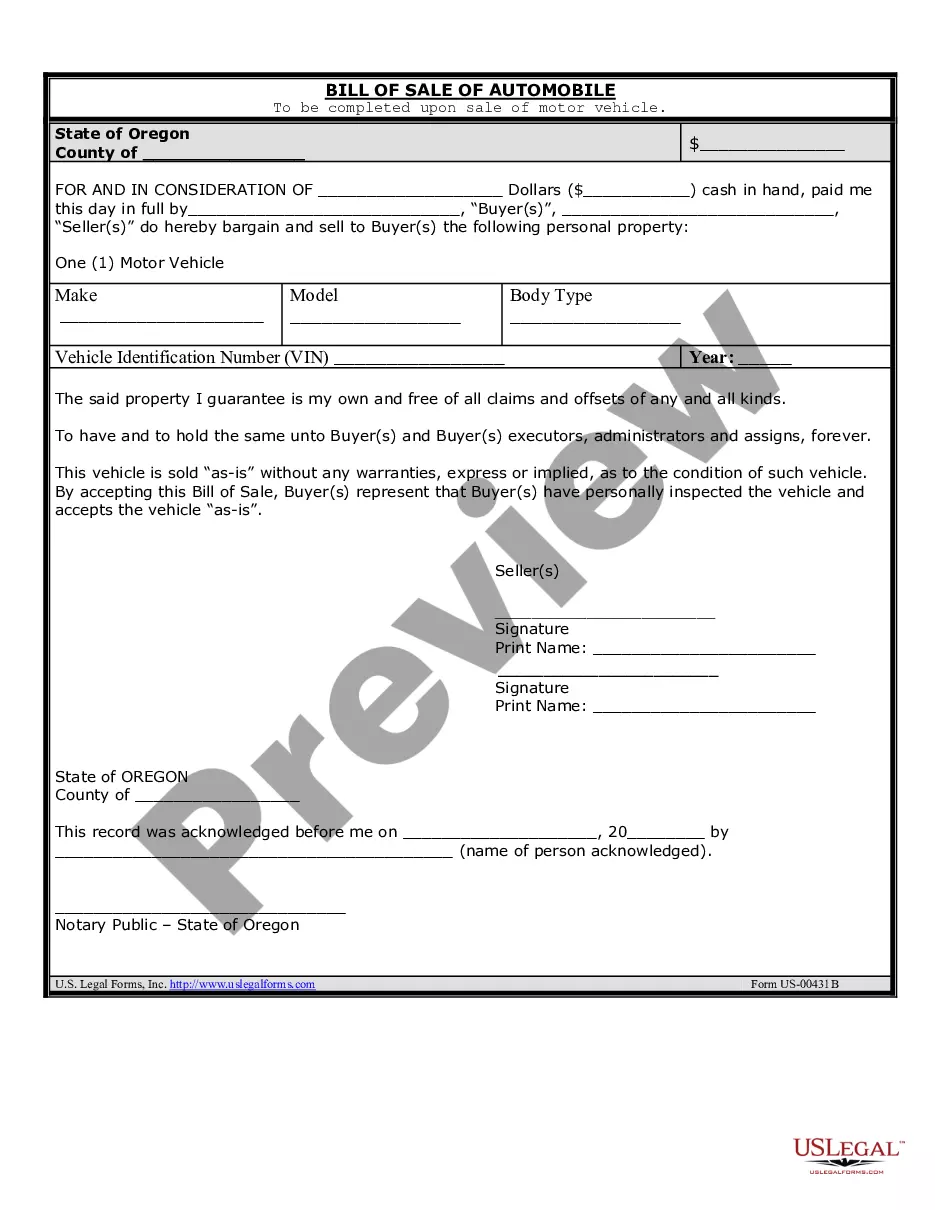

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Application For Residential Homestead Exemption For 2023 template you need.

- Download the document if it satisfies your needs.

- If you already possess a US Legal Forms account, click Log in to reach previously stored templates in My documents.

- In case you do not have an account yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Select the file format you desire and download the Application For Residential Homestead Exemption For 2023.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

February 27, 2023 ? March 1, 2023 Homestead Exemption Application Deadline. March 1, 2023, is the deadline for Florida homestead exemption applications for qualifying residences owned and occupied on the January 1 tax day. Florida property appraisers generally enable applications to be made online.

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes school board taxes and applies to properties with assessed values greater than $50,000.

The completed application and required documentation are due no later than April 30 of the tax year for which you are applying. A late residence homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1.

Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application.

You must apply with your county appraisal district to get a homestead exemption. Applying is free and only needs to be filed once. You can find forms on your appraisal district website or you can use the Texas Comptroller forms. General Exemption Form 50-114.