Ohio Homestead Exemption For Veterans In Alameda

Description

Form popularity

FAQ

Who is eligible for the Homestead Exemption program? Those eligible must be 65 years of age or older or be permanently or totally disabled, meet annual state set income requirements, and own the home where they live as of January 1st or the year in which they apply.

The homestead exemption provides a reduction in property taxes to qualified disabled veterans, or a surviving spouse, on the dwelling that is that individual's principal place of residence and up to one acre of land of which an eligible individual is an owner.

Disabled Veteran Homestead Exemption: Ohio offers a substantial property tax exemption for the principal residence of a 100% disabled veteran. This exemption reduces the assessed value of the property, leading to lower annual property taxes.

Must not have a total household income over $38,600/year if applying in 2024, or $40,000 if applying in 2025, which includes the Ohio adjusted gross income of the owner and the owner's spouse. Must be age 65 by December 31 of the calendar year for which the exemption is sought.

Disabled Veterans' Exemption The Veterans Administration must certify 100% disability. An additional exemption is available for qualified low-income veterans. Unfortunately, there is no provision in the law for a Disabled Veterans' Exemption if you are less than 100% disabled.

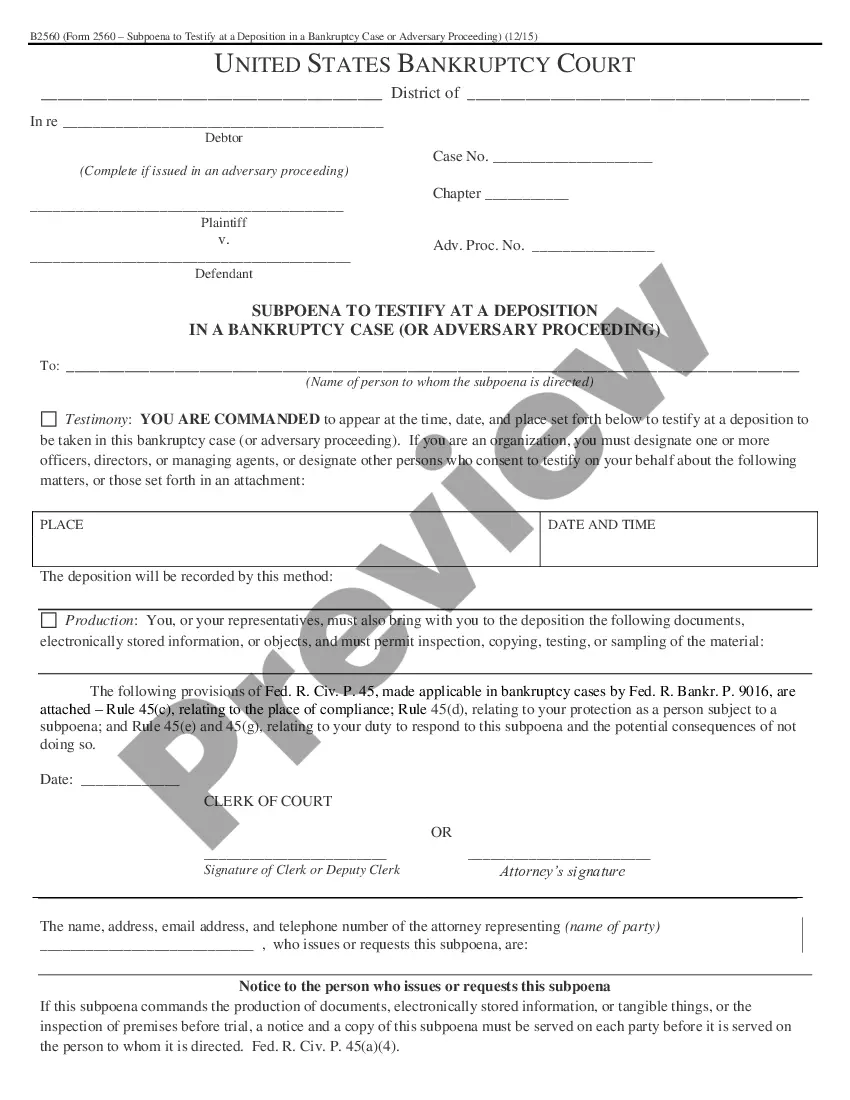

To apply, complete the application form (DTE 105A, Homestead Exemption Application Form for Senior Citizens, Disabled Persons, and Surviving Spouses), then file it with your local county auditor. The form is available on the Department of Taxation's website and is also available from county auditors.

Ohio's Homestead Exemption protects the first $25,000 of your home's value from taxation. For example, if your home is worth $100,000, you will be taxed as if the home were worth $75,000. On average, those who qualify for the exemption save $400 a year.

Line 4: Enter income from any other sources not included above (income reported on Form(s) 1099-MISC, self-employment income, business income). Do NOT include any Social Security benefits as they are not taxable in Ohio.

Must not have a total household income over $38,600/year if applying in 2024, or $40,000/year if applying in 2025, which includes the Ohio adjusted gross income of the owner and the owner's spouse.