Notification With Service Worker In Massachusetts

Description

Form popularity

FAQ

Forms and notices for newly-hired employees Form I-9 Employment eligibility verification form, US Dept. of Homeland Security. Form M-4: Massachusetts employee's withholding exemption certificate, Mass. Dept. Form NHR: New hire and independent contractor reporting form, Mass. Dept. Form W2 Federal tax withholding, IRS.

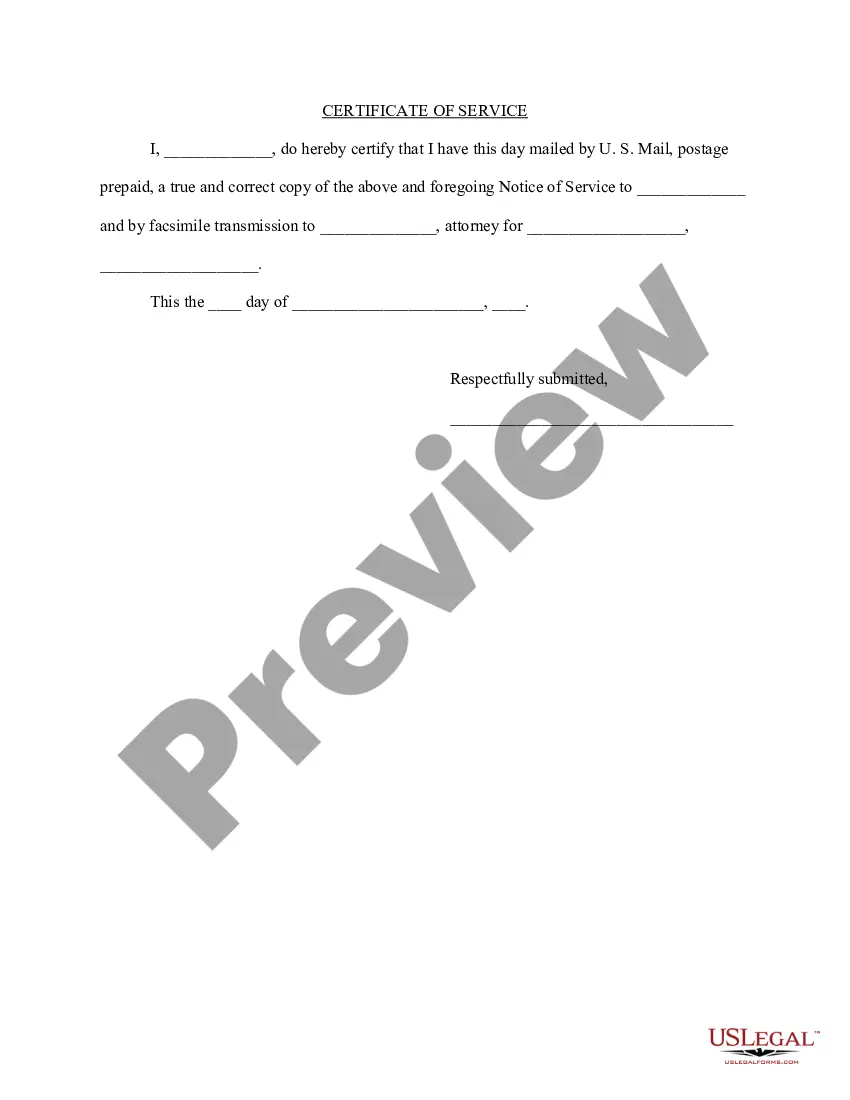

If service is made by mail, then proof of service must include a signed receipt or other evidence of successful personal delivery to the defendant that will satisfy the court where the case is filed.

The term “lack of work” is often used to describe the reason for discharge upon which the UI benefits are almost certain. Lack of work could signal a discharge; however, it refers to when an employee is not working 40 hours per week.

Forms and notices for newly-hired employees Form I-9 Employment eligibility verification form, US Dept. of Homeland Security. Form M-4: Massachusetts employee's withholding exemption certificate, Mass. Dept. Form NHR: New hire and independent contractor reporting form, Mass. Dept. Form W2 Federal tax withholding, IRS.

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form.

Both Federal W-4 Form and California DE 4 Withholding Certificate must be provided to newly hired employees.

✓ Once you apply for benefits, DUA contacts all the employers you listed on your claim and asks them for information regarding your past wages and the reason(s) you were separated. Each employer has 10 days to respond.

In 1988, Congress enacted the Worker Adjustment and Retraining Notification Act, commonly known as WARN. It ensures workers have ample time to prepare for job transitions. This may include sharing information on new job opportunities or offering retraining before job loss.