Confirmation Letter Sample For Audit In Sacramento

Description

Form popularity

FAQ

(FTB 3904)We send this notice when we need you to confirm if you filed a specific personal income tax return. If you did not file this tax return, call 916.845. 7088 within 15 days from the notice date.

Filing Compliance Bureau at (916) 845-7088. Withholding Services and Compliance section (non-wage withholding) at (888) 792-4900.

If there are significant discrepancies between federal and state returns, the state return may be flagged for audit; The FTB's CP-2000program which is based on the IRS's automated computer 2000 program was developed to identify taxpayers who underreport their income.

Filing Compliance Bureau at (916) 845-7088.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Fill out the "Reply to FTB" form included with your notice. It allows you to tell us that you (A) already filed a tax return or (B) you do not have to file or you are unsure if you have to file.

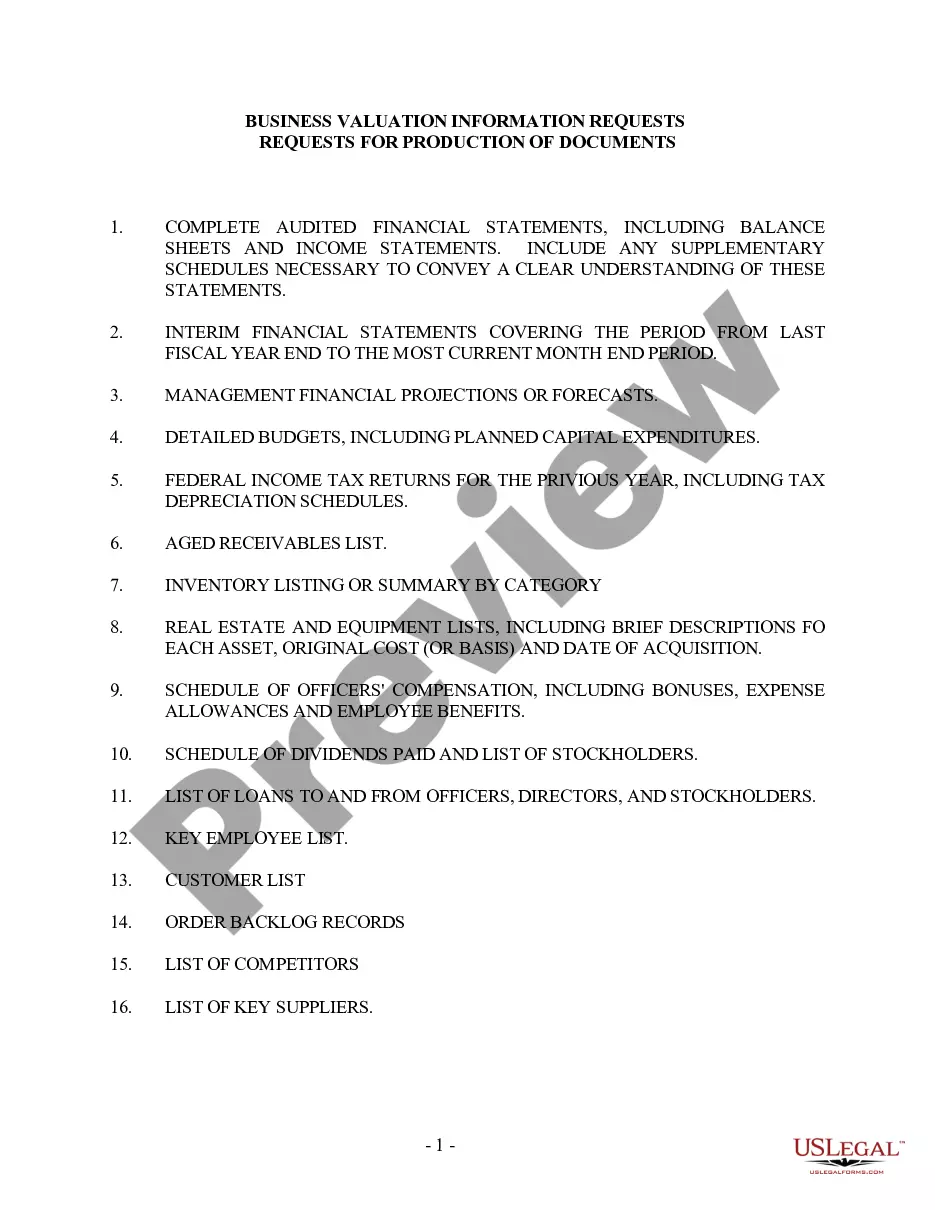

As mentioned, auditors send confirmation letters to third-parties. This could be a bank, lawyer or supplier. For example, a letter may be sent to a company's lawyers to determine whether there's any pending litigation that needs to be reported or disclosed in the company's audited financial statements.

The Legal Confirmation Process In coordination with the client, auditors prepare an audit inquiry or legal representation letter. The letter is signed by the client, and the auditor must then control delivery of the letter to the law firm.

To the extent possible, your response should be direct and should not divulge more information than necessary. Stick to template, transactions, time period and other criteria stipulated in the request to limit follow up questions or requests in an attempt to reconcile any differences.

As mentioned, auditors send confirmation letters to third-parties. This could be a bank, lawyer or supplier. For example, a letter may be sent to a company's lawyers to determine whether there's any pending litigation that needs to be reported or disclosed in the company's audited financial statements.