Confirmation Letter Sample For Audit In Nevada

Description

Form popularity

FAQ

Professional Reply Acknowledge the Email. Start your reply by acknowledging the audit confirmation request. Provide the Requested Information. Clarify Any Discrepancies (If Applicable) ... Offer Further Assistance. End with a Professional Closing.

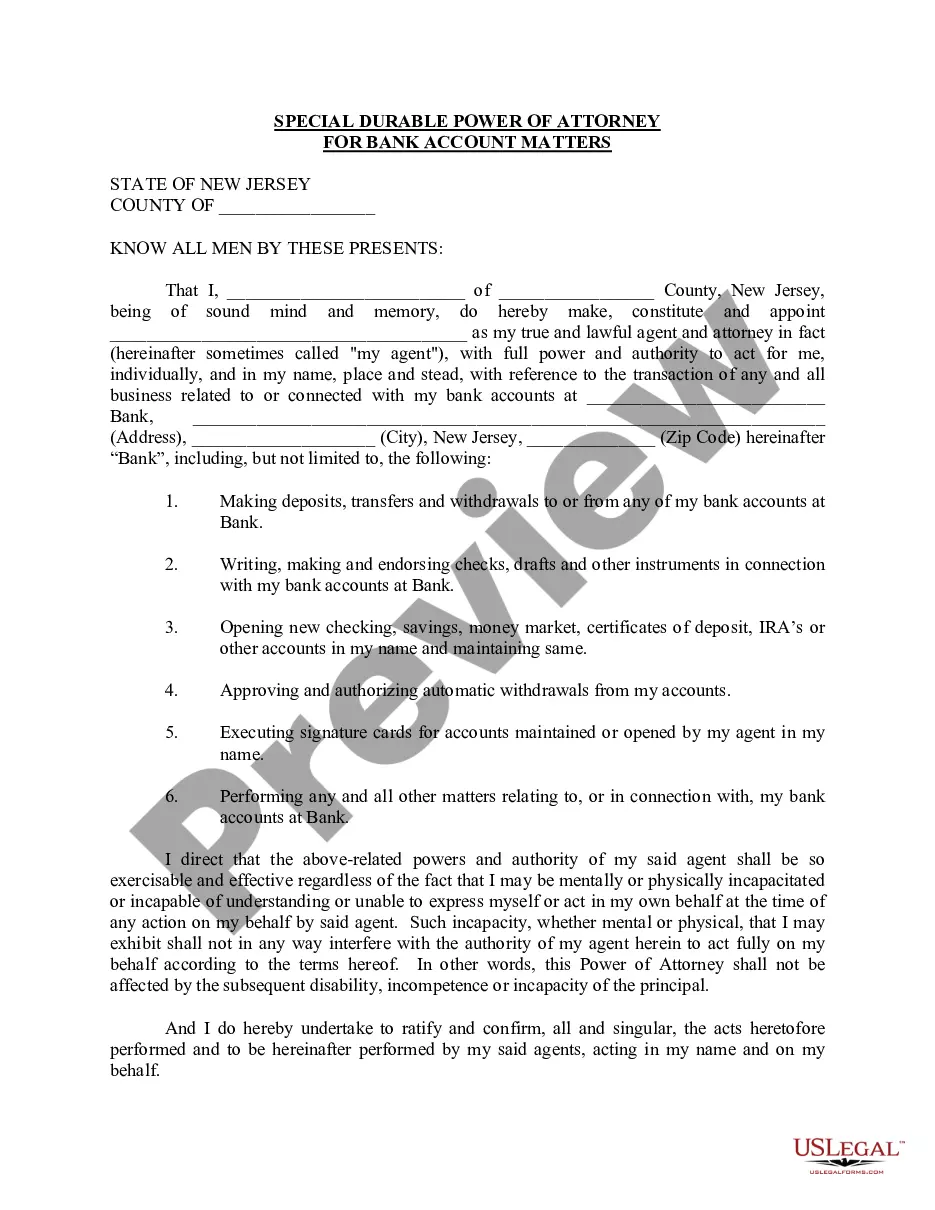

An audit letter is a written request for information about a person or entity being audited, usually sent to an attorney, banker, or other relevant party. The letter asks for details about pending or threatened litigation that may affect the audit.

| Tinh Huynh. Audit confirmations are information requests, typically distributed by email or through secure portals, in which accountants ask third parties to confirm information provided by the company being audited.

Urgent or Fast Track requests must be sent to the bank via Confirmation. Any requests which are posted, faxed or emailed to the bank will be subject to a 25 business day SLA. Provide the full name (as per bank statement), main account number and sort code for every related legal entity required.

The IRS performs audits by mail or in person. The notice you receive will have specific information about why your return is being examined, what documents if any they need from you, and how you should proceed. Once the IRS completes the examination, it may accept your return as filed or propose changes.

An audit letter is a written request for information about a person or entity being audited, usually sent to an attorney, banker, or other relevant party. The letter asks for details about pending or threatened litigation that may affect the audit.

A crucial last step in the audit process is completing a confirmation letter. CPAs send confirmation letters to outside parties to verify account balances, as well as unusual contractual terms and transactions.

An IRS audit letter is a notice from the IRS informing you that your tax return has been selected for review, a formal tax audit. This letter verifies the accuracy of your tax return and ensures all reported income, deductions, and credits are correct.

There are a few reasons why the IRS might send you an audit letter. Maybe your numbers don't match their records, or you forgot to include something on your tax return.