Installment Agreement With Irs Online In Utah

Category:

State:

Multi-State

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

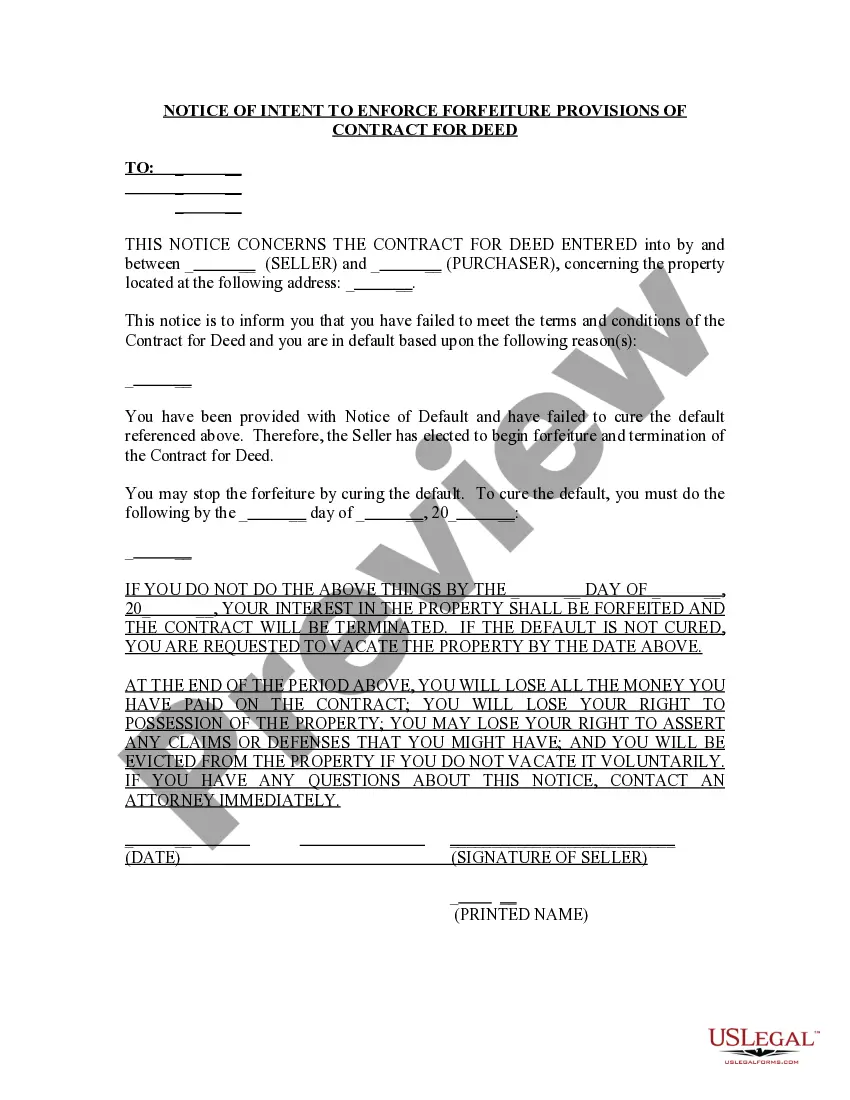

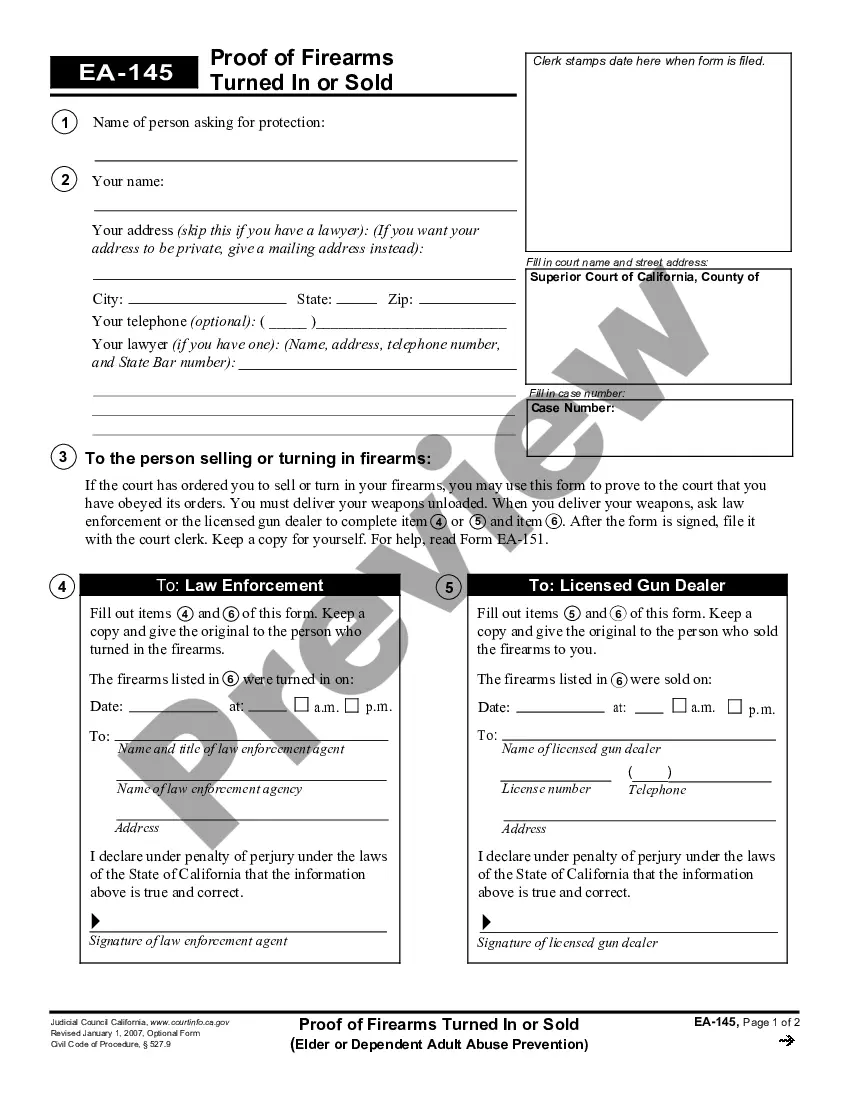

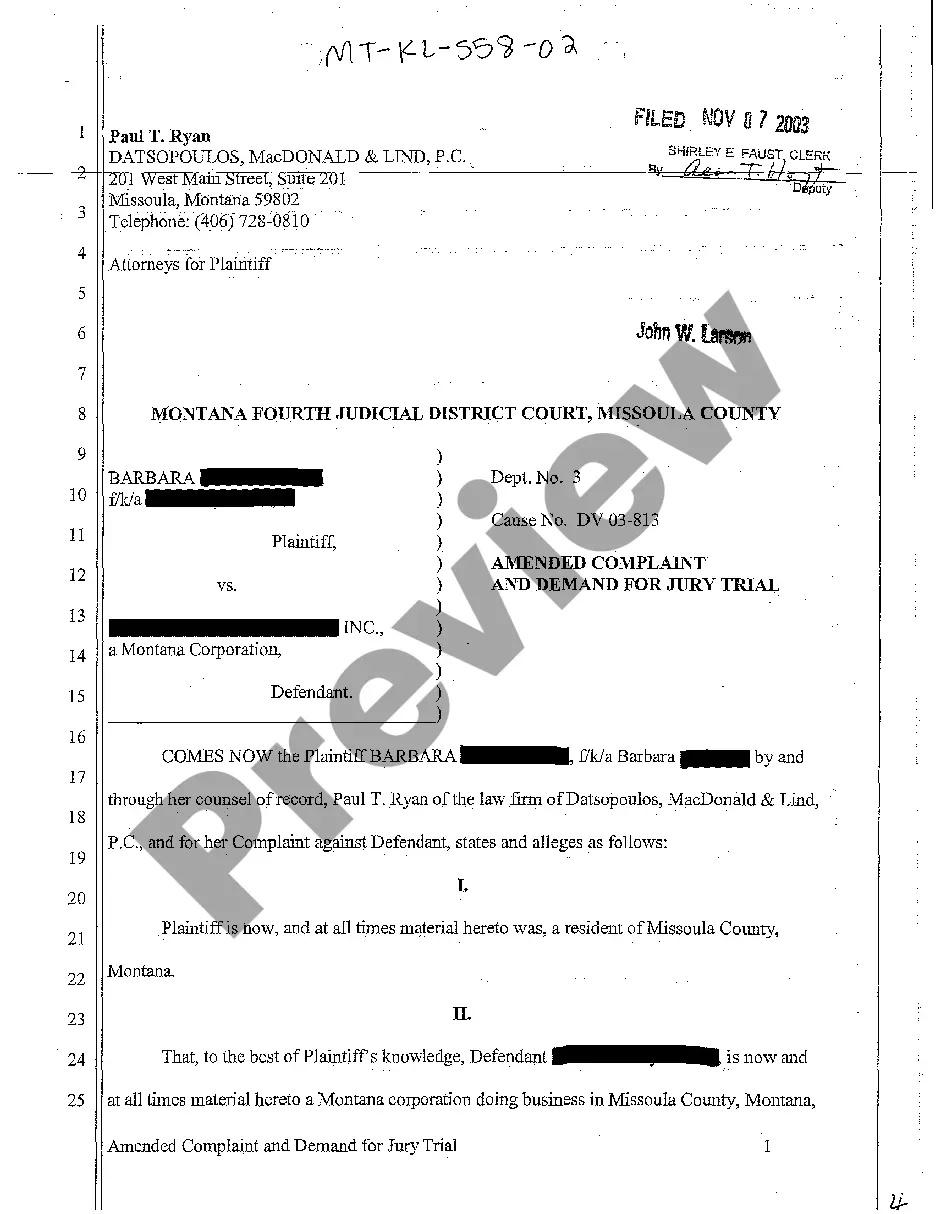

The Installment Agreement with IRS online in Utah is a legal document designed for individuals who wish to establish a structured payment plan with the Internal Revenue Service (IRS) for outstanding tax liabilities. Key features include details about the total amount owed, interest rates, payment terms, late fees, default conditions, and remedies for the seller, ensuring comprehensive coverage of the financial obligations. The form is user-friendly, allowing simple editing to fill in specific information such as payment amounts and due dates. This agreement is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who need to assist clients in managing tax debts effectively. The target audience can leverage the form to facilitate negotiations with the IRS, thereby providing a clear framework for repayment that avoids severe penalties. Additionally, it serves as a record of the agreement, which is vital for both parties in case of disputes. The clarity and structured format enable legal professionals to guide clients through the installment process with confidence.

Free preview

Form popularity

FAQ

You can send Form 9465 with the e-return, but the IRS must still approve the installment agreement form.

If you don't qualify for an IA through OPA, you may also request an IA by submitting Form 9465, Installment Agreement Request, with the IRS. When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected.