Installment Loan Contract With Bad Credit In Texas

Category:

State:

Multi-State

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

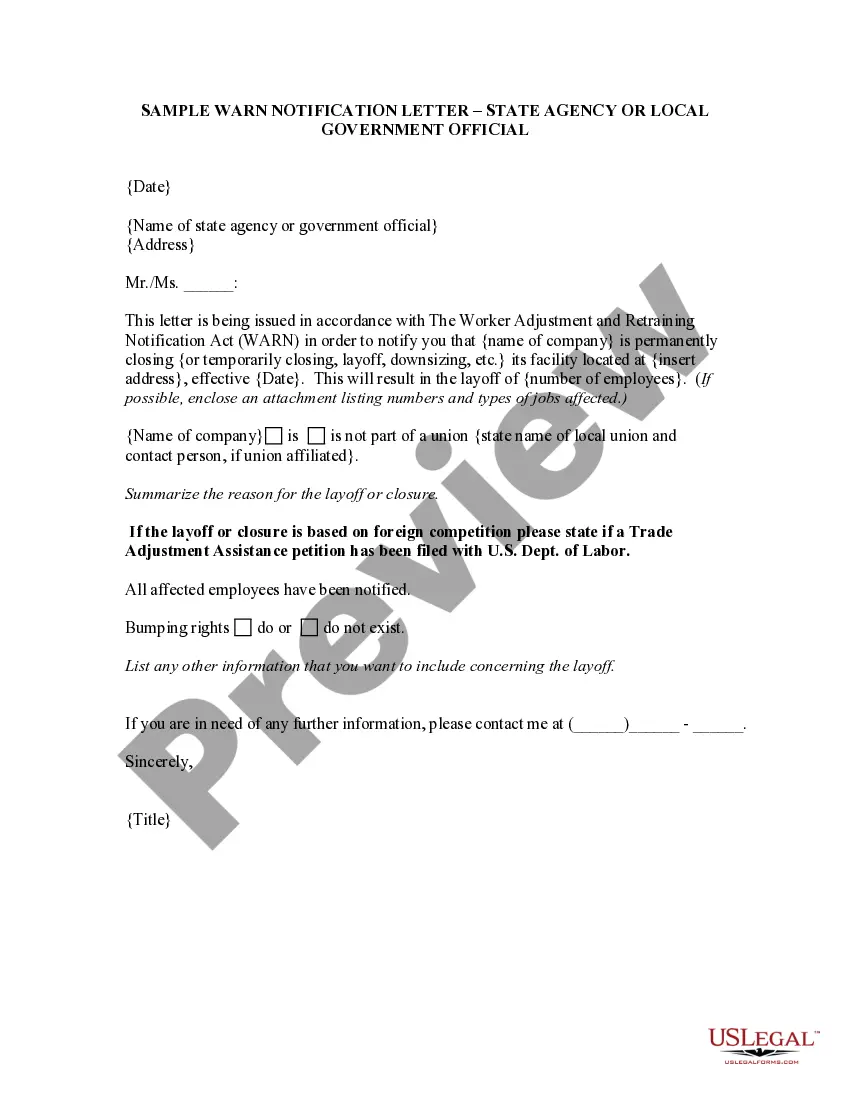

The installment loan contract with bad credit in Texas is a legal agreement that outlines the terms between a seller and a purchaser for financing a purchase when credit history may be less than ideal. Key features of this form include specifying the total purchase price, interest rates, payment schedules in consecutive monthly installments, and provisions for late fees. Users will fill in details regarding the purchase price, interest percentage, installment amounts, due dates, and collateral. The contract also includes important clauses about default conditions, remedies available to the seller, and a disclaimer of warranties. Besides standard terms, it allows for modifications and prepayments without penalties while outlining that the governing law applies to the state. This form is especially useful for attorneys, partners, owners, associates, paralegals, and legal assistants working with individuals who need financing options despite bad credit, providing clarity on rights and obligations while facilitating financial transactions. With its straightforward structure, the form aids users in ensuring legal compliance and understanding their financial commitments.

Free preview

Form popularity

FAQ

Credit Score Required for Personal Installment Loans by Lender LenderMin. Credit ScoreLoan Amounts Upstart 580 $1,000 - $50,000 LendingClub 600 $1,000 - $40,000 FreedomPlus 620 $5,000 - $50,000 Best Egg 640 $2,000 - $50,0003 more rows •