Installment Loan Contract With Mortgage In Pima

Description

Form popularity

FAQ

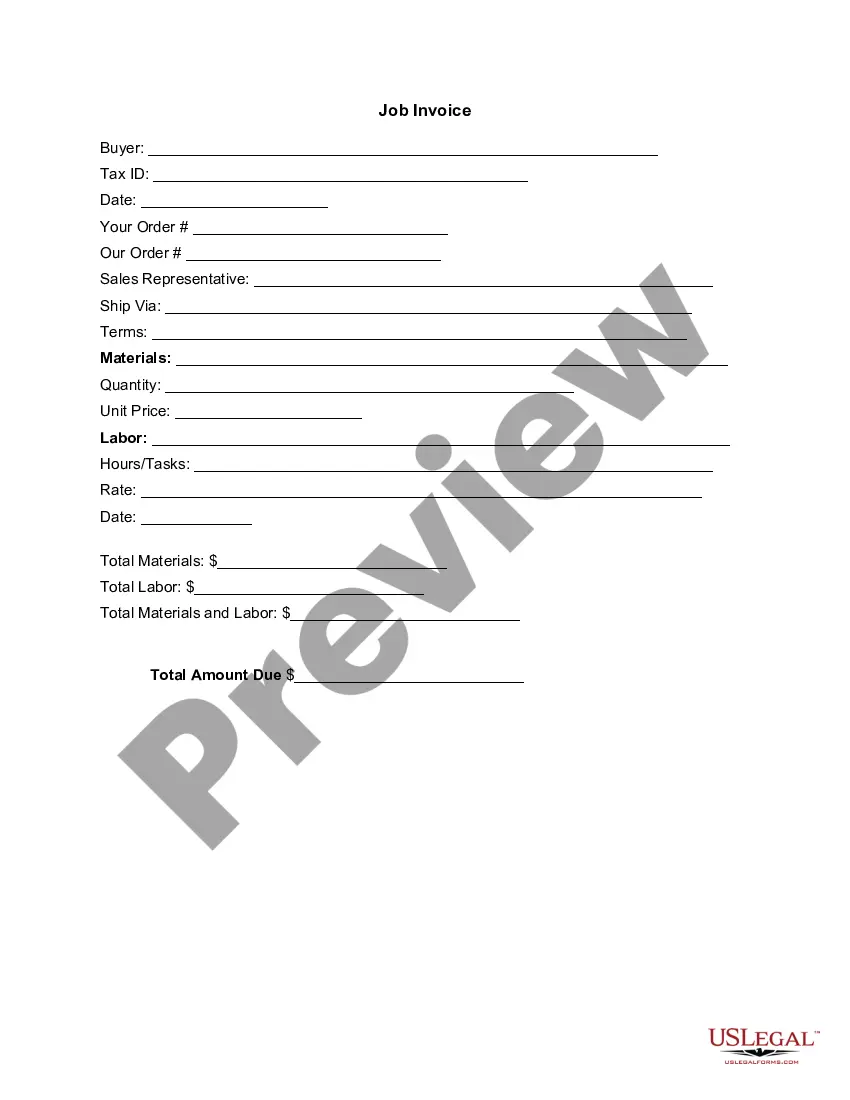

MORTGAGE INSTALMENT means all or any part of any amount of principal or interest payable by a Mortgagor under or secured by a Mortgage on a periodic basis.

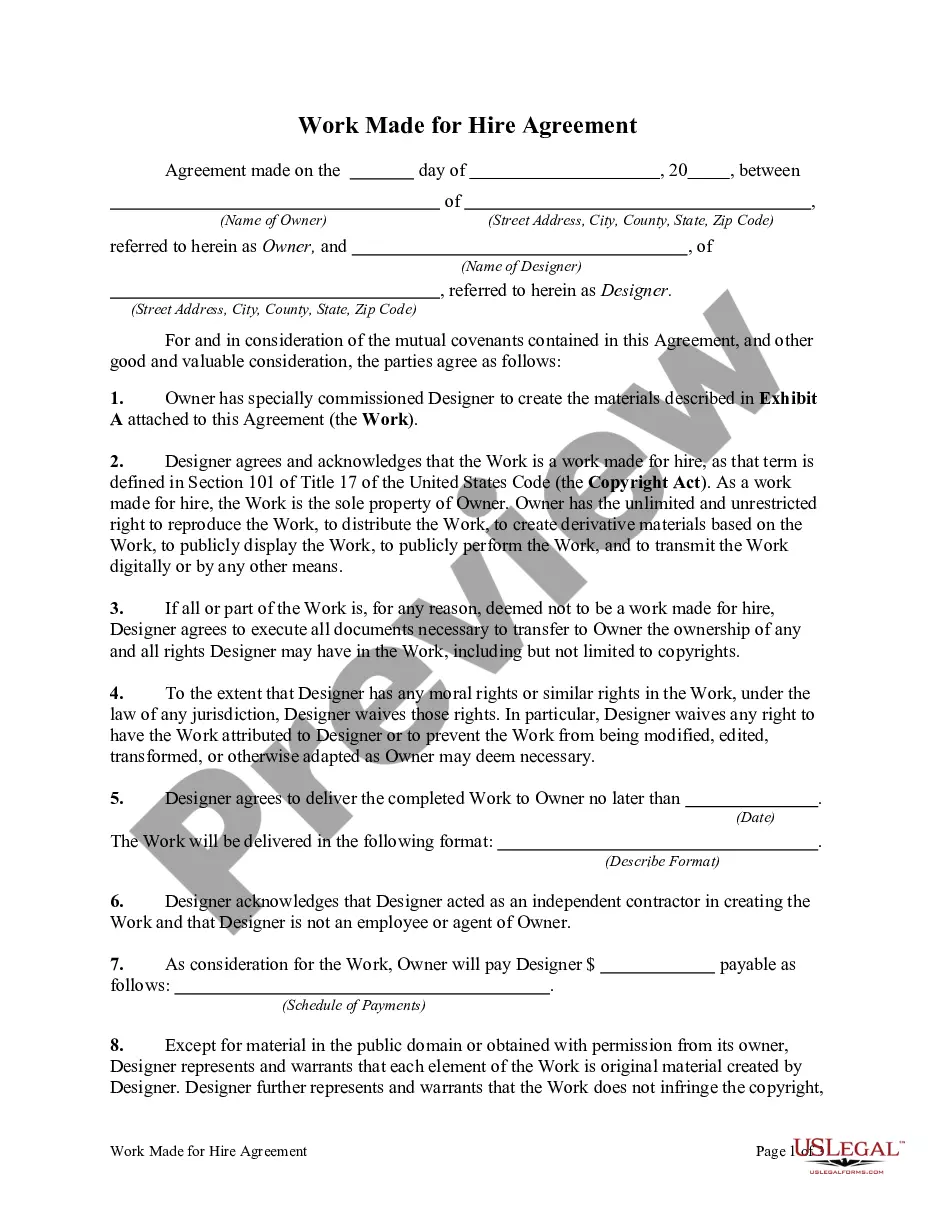

You can sell a property with a land contract at any time. However, selling a home on a land contract while having an underlying contract may violate the agreement. So that is why you need to get the land contract reviewed. As you only have an equitable interest in the title.

If you need to obtain a copy of your mortgage agreement, you will need to do so at the office where the mortgage is filed.

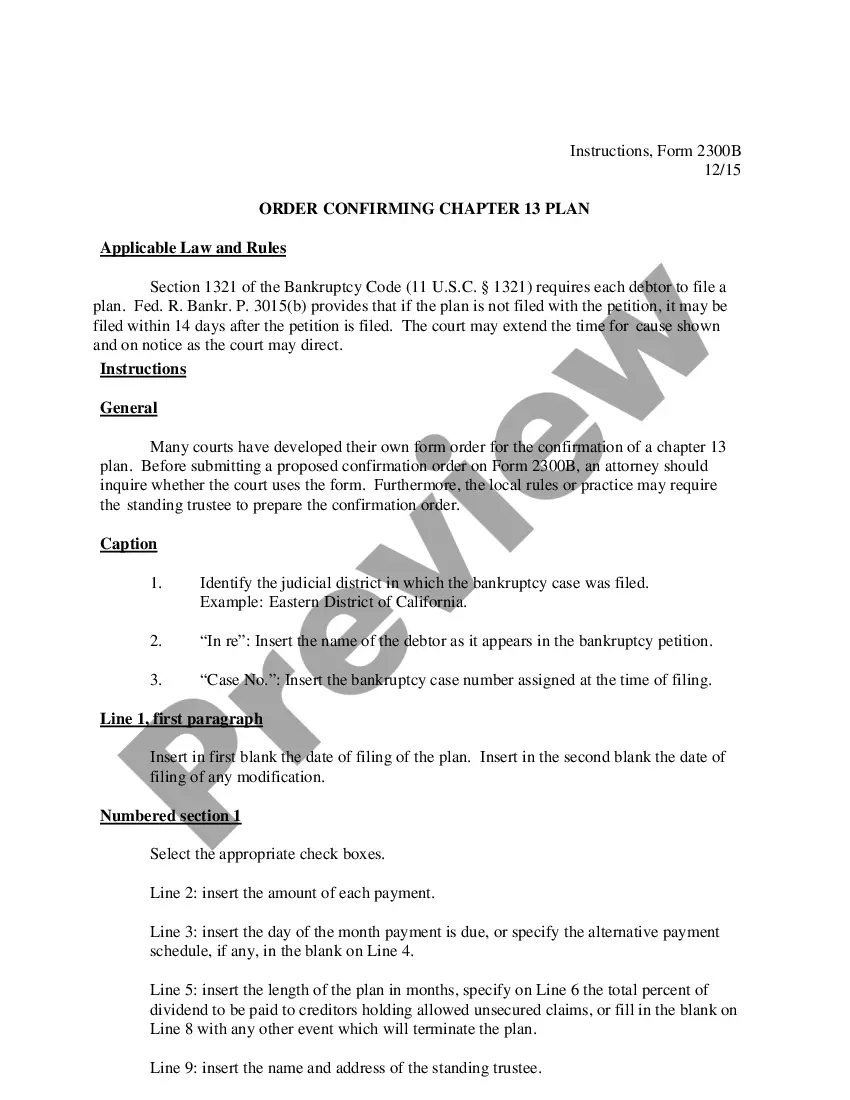

Each document must be an original or a copy of the original, and shall be sufficiently legible for recorder to make certified copies from the photographic or micrographic record. SIGNATURES: Each document must have original signatures or carbon copies of original signatures, except when otherwise provided by law.