Installment Loan Contract With Bad Credit In Phoenix

Category:

State:

Multi-State

City:

Phoenix

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

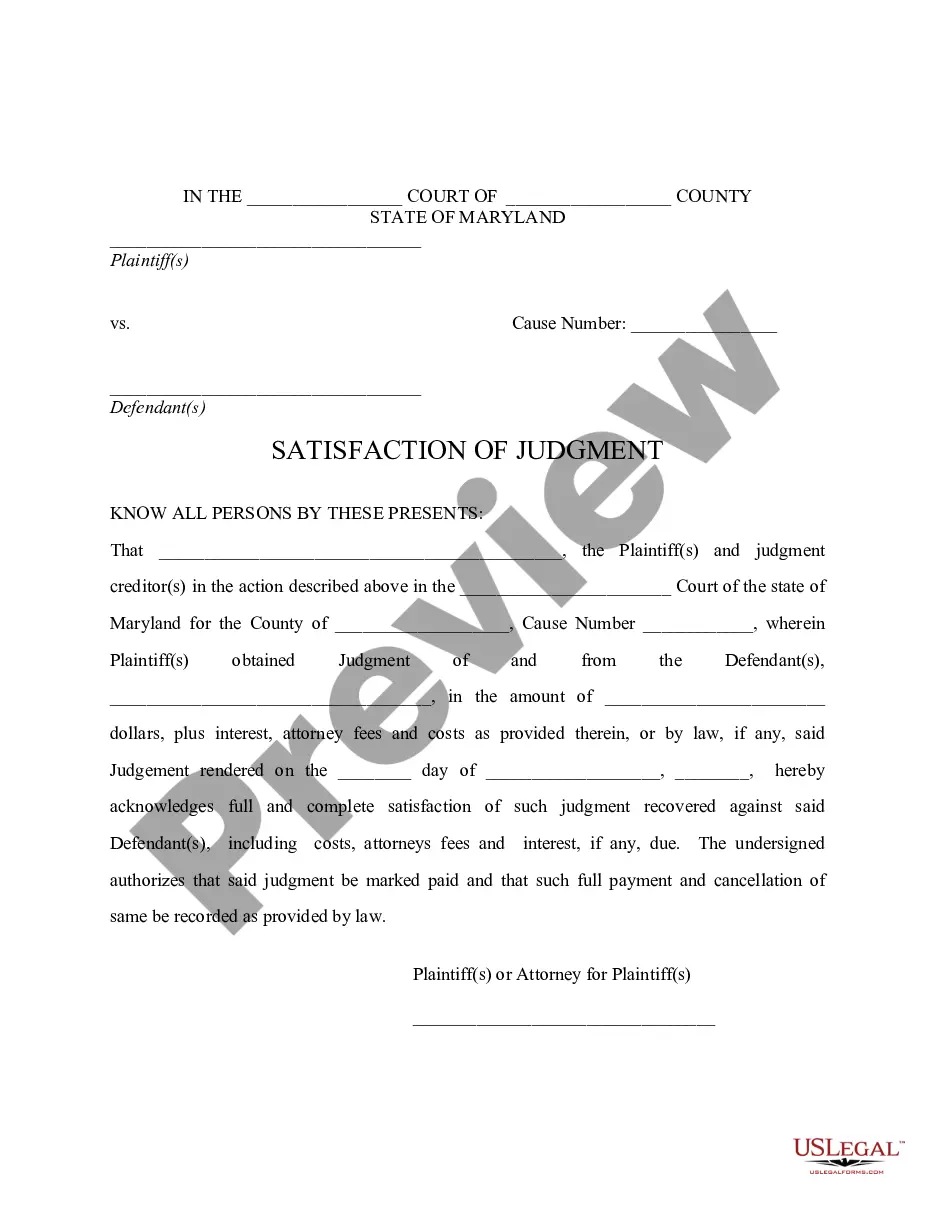

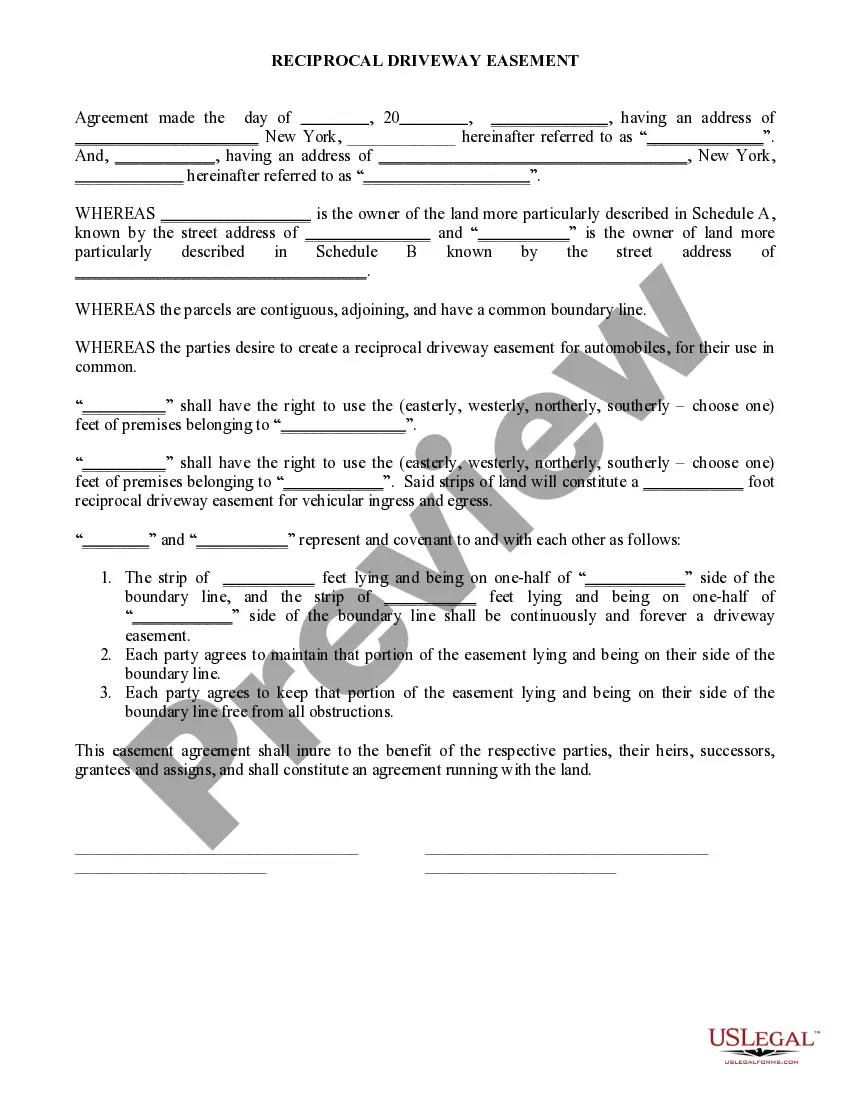

The Installment Loan Contract with Bad Credit in Phoenix is designed to facilitate financing for individuals with less-than-perfect credit histories. This contract outlines the total purchase price, interest rate, payment terms, and late fees associated with repayment. Users will fill out pertinent details such as the loan amount, interest rate, and establish a payment schedule with specified monthly payments. The form also includes provisions for late fees, events of default, and remedies for the seller, ensuring a structured approach to loan management. Notably, it emphasizes a purchase money security interest, which secures the loan against collateral, protecting the seller's financial interest. For target users like attorneys, partners, and legal assistants, this form serves as a legally binding agreement that clearly defines the obligations of both parties and the consequences of defaults, thus aiding in risk management for lenders. It's crucial for users to ensure compliance with state regulations, sign the document, and retain copies for records, clarifying their respective rights and responsibilities under this agreement.

Free preview

Form popularity

FAQ

Credit Score Required for Personal Installment Loans by Lender LenderMin. Credit ScoreLoan Amounts Upstart 580 $1,000 - $50,000 LendingClub 600 $1,000 - $40,000 FreedomPlus 620 $5,000 - $50,000 Best Egg 640 $2,000 - $50,0003 more rows •