Installment Contract Agreement With Irs In Middlesex

Category:

State:

Multi-State

County:

Middlesex

Control #:

US-002WG

Format:

Word;

Rich Text

Instant download

Description

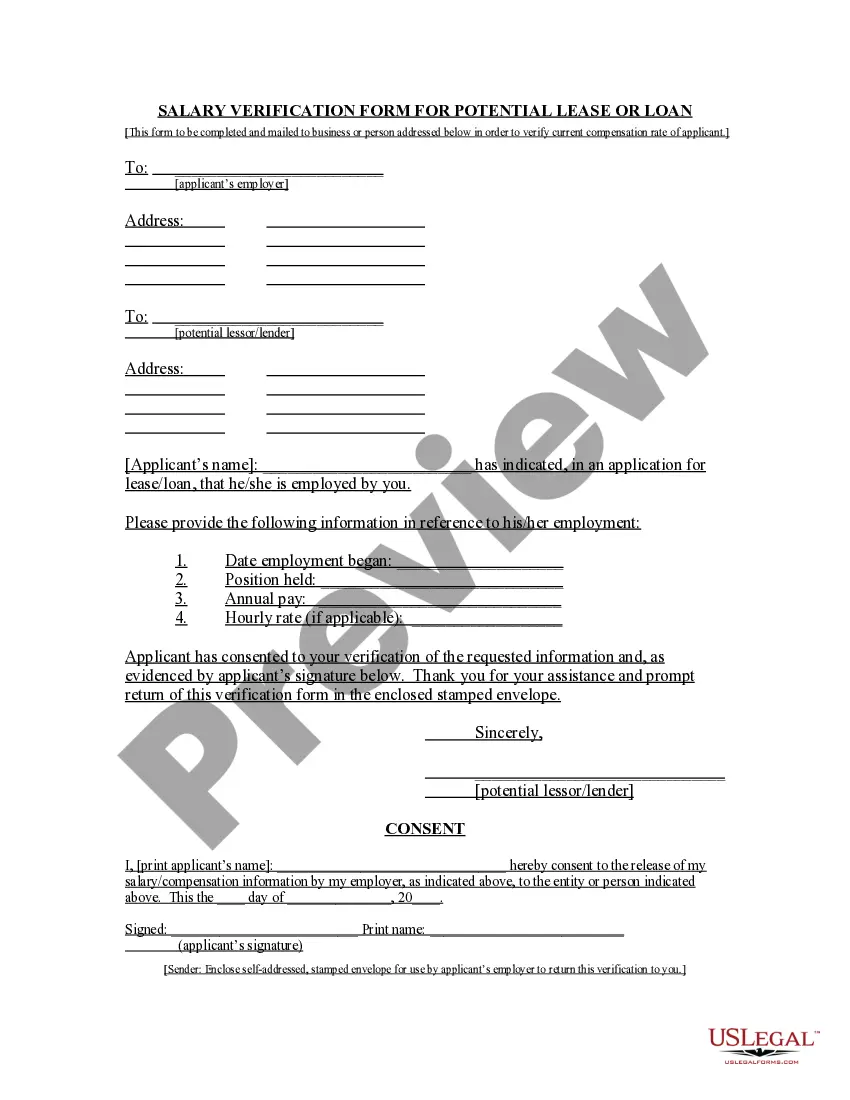

The Installment Contract Agreement with IRS in Middlesex outlines the terms and conditions between a Seller and a Purchaser for the purchase of goods through installment payments. Key features include setting a purchase price, interest rate, and detailed payment terms, which specify the due dates for monthly installments. It includes provisions for late fees, default conditions, and remedies available to the Seller in case of non-compliance. The agreement protects the Seller's interests through a purchase money security interest in the collateral and outlines the governing law and severability clauses to ensure enforceability. The form's utility for attorneys, partners, owners, associates, paralegals, and legal assistants lies in its structure, which allows for easy adaptation to unique client situations while ensuring compliance with state regulations. It aids these professionals in creating clear, enforceable agreements that facilitate transactions while mitigating risks associated with defaults. Additionally, users can edit the template to accommodate specific terms, enhancing its applicability in various transaction scenarios.

Free preview

Form popularity

FAQ

If you don't qualify for an IA through OPA, you may also request an IA by submitting Form 9465, Installment Agreement Request, with the IRS. When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected.

If you are unable to revise an existing installment agreement online, call us at 800-829-1040 (individual) or 800-829-4933 (business).

You can use your Online Account to make offer in compromise (OIC) payments or check if you're eligible to submit an OIC. We'll review your OIC and decide if you qualify. An offer in compromise allows you to settle your tax debt for less than the full amount you owe.