Installment Loan Contract With Monthly Payments In Cook

Description

Form popularity

FAQ

An installment contract offers a buyer less protection than a traditional mortgage. This is true mainly because of forfeiture provisions, which give the buyer no right of redemption and allow a buyer to lose all interest in the property for even the slightest breach.

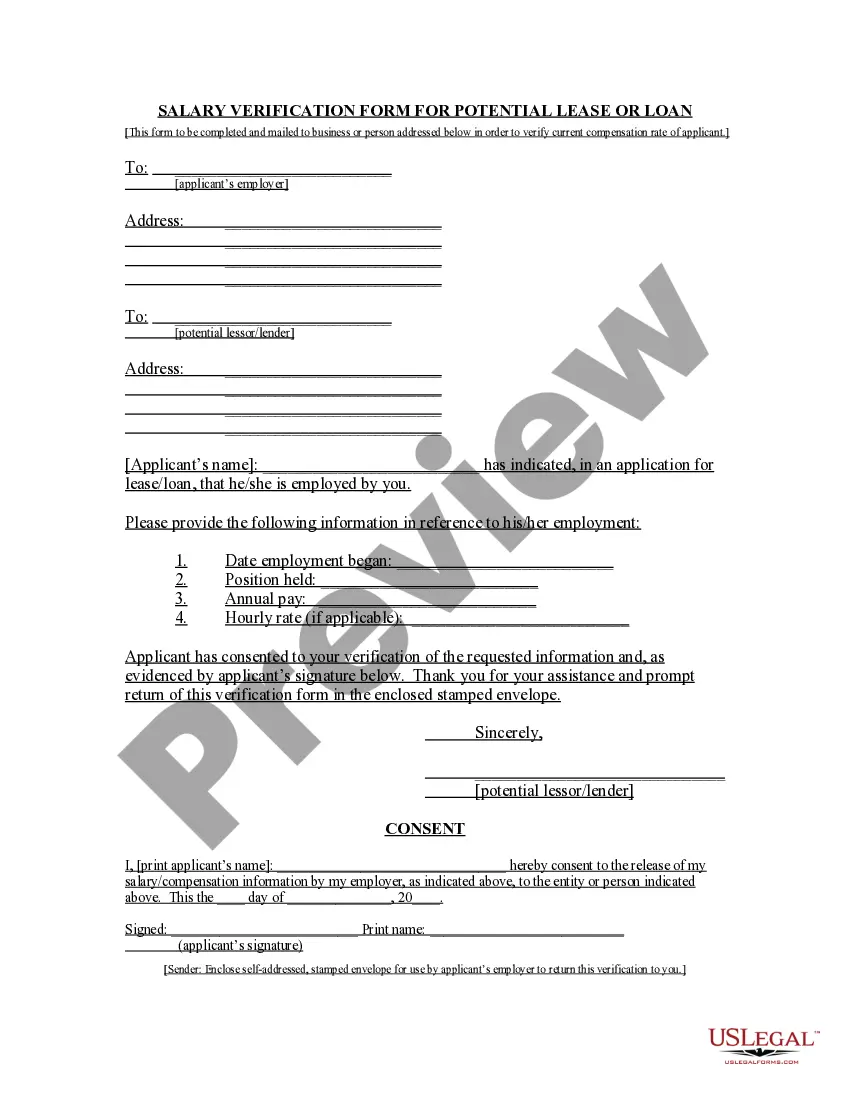

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.

While the IRS typically doesn't allow taxpayers to have two separate installment agreements, adding a new tax debt to an existing installment plan is possible. However, taxpayers must act swiftly before the IRS assesses the new tax balance and potential default occurs, triggering enforcement actions.

Typically, the IRS does not allow taxpayers to have two separate installment agreements simultaneously.

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

Your minimum monthly payment for an IRS installment plan is generally what you owe divided by 72, if you don't specify a different amount. You can start an IRS installment plan by applying online, over the phone, or by mailing Form 9465 to the IRS.

Installment – An agreed upon amount the borrower pays each month.

If the IRS approves an installment agreement, it will generally keep any tax refunds and apply them to your debt. If the IRS agrees to an installment agreement, it may still file a Notice of Federal Tax Lien. For more information, see Publication 594, The IRS Collection Process.