Independent Contractor Contract Example In San Jose

Description

Form popularity

FAQ

Form 1099-NEC and independent contractors | Internal Revenue Service.

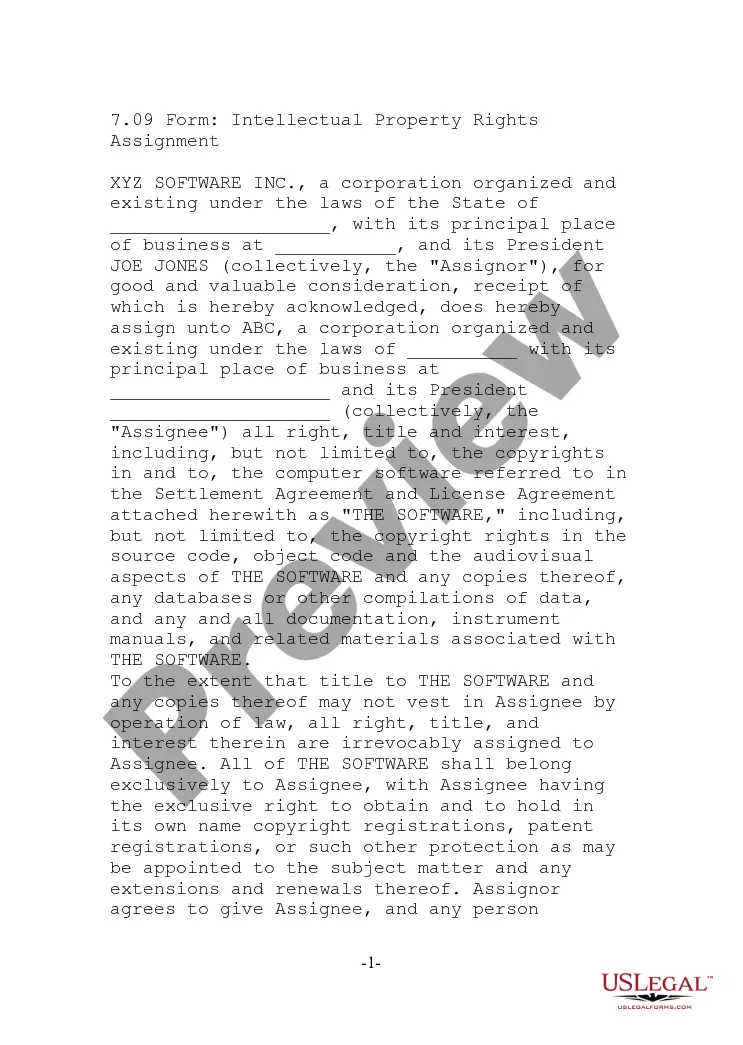

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

The new rule, which becomes effective March 11, 2024, rescinds the 2021 independent contractor rule issued under former President Donald Trump and replaces it with a six-factor test that considers: 1) opportunity for profit or loss depending on managerial skill; 2) investments by the worker and the potential employer; ...

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

What Documents Are Needed to Legally Establish Independent Contractor Status? Get a Form W-9. The first step to working with an independent contractor is getting a W-9 form. Agree on the agreement. Request an invoice. Finally, the 1099-NEC.

How to Send Someone a 1099: Step-by-Step Guide Step 1: Gather Information. Step 2: Determine the Correct Form. Step 3: Fill Out the Form. Step 4: File Copy A with the IRS. Step 5: Provide Copy B to the Recipient. Step 6: Retain Copy C for Your Records. Step 7: Consider Electronic Filing.

Complete and send Form 1099 Copy A is the version you'll submit to the IRS, and Copy B is the form you'll send to your contractor. Both copies must be submitted by January 31 regardless of whether you file electronically or by mail. You can also upload 1099s to a secure website or use a third-party service.

Submit a paper Report of Independent Contractor(s) (DE 542) using one of the following options: Downloading a fill-in DE 542 (PDF). Ordering the form to be mailed to you through our Online Forms and Publications. Printing your data directly from your computer to the DE 542 by following the Print Specifications (PDF).

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.