International Contract Agreement Template For Services In Nassau

Description

Form popularity

FAQ

International contracts are legally binding agreements between parties who are based in separate countries. As with any contract, it will require the parties to do or refrain from doing particular actions.

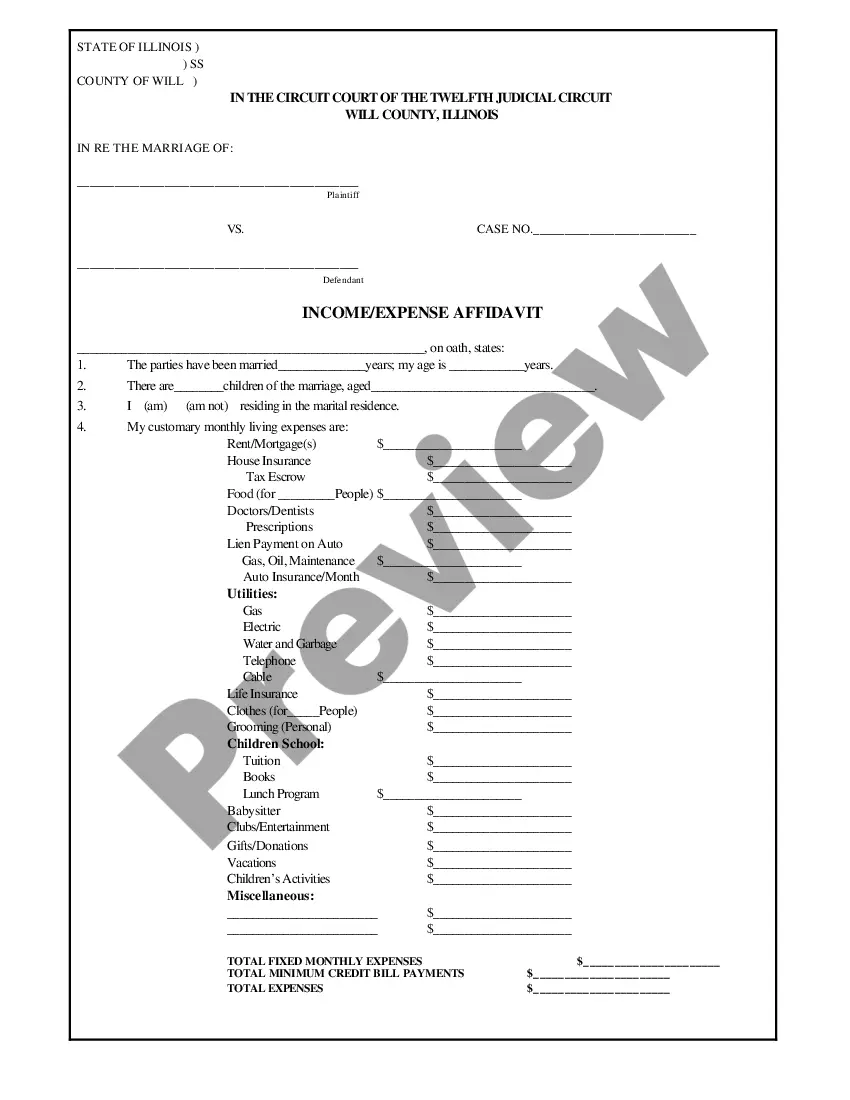

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Some common types of international contracts include sales agreements, distribution agreements, licensing agreements, joint venture agreements, and employment contracts.

Top ten tips in drafting and negotiating an international contract Avoiding retaliation claims. The language of the contract. Clear contract prose. Common law versus civil law. Jurisdictional issues. Terms of art. Personnel. In negotiations, expect the unexpected.

The Most Common Types of International Employment Contracts Salary. Benefits. Annual leave. Sickness. Termination. Confidentiality requirements. Notice periods. Other important conditions or exclusions.

In an international business contract, it's essential to define the jurisdiction that will govern the contract and the laws that will apply in the event of a dispute. Your dispute resolution section should also detail the agreed-upon dispute resolution mechanism.

Write the name of the contract at the top of the page. Follow with the names or company names of all parties, in this format: This agreement is between ____ and ____. Contracts involving a business should include the business' full legal name, including descriptions such as “Ltd.” or “Inc.”

Departure Tax (Passenger Tax) Departure Tax is collected from all persons departing for a port outside The Bahamas. $29.00 for every passenger leaving The Bahamas other than sea. $23.00 for every cruise ship passenger leaving The Bahamas by sea from the Harbour of Nassau, Freeport OR Bimini.

The government levies an annual real property tax on homes in The Bahamas. For non-Bahamians, the rate depends on the property's value. It starts at 1% for properties valued between $500,000 and $7 million. Luxury homes above this value are taxed at 0.75%.

The Bahamas are considered a tax haven given the lack of income tax, capital gains tax, inheritance tax or company tax. Government tax revenue is instead derived from consumption, property and import taxes as well as licence fees.