Foreign Independent Contractor Agreement For Employees In Los Angeles

Description

Form popularity

FAQ

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

Manage the paperwork Contractors must complete a Form W-9 if they're US citizens or residents and a Form W8-BEN if they're based entirely abroad. Both forms are available to download from the IRS website. From the moment the contract begins, you must store these documents for at least four years.

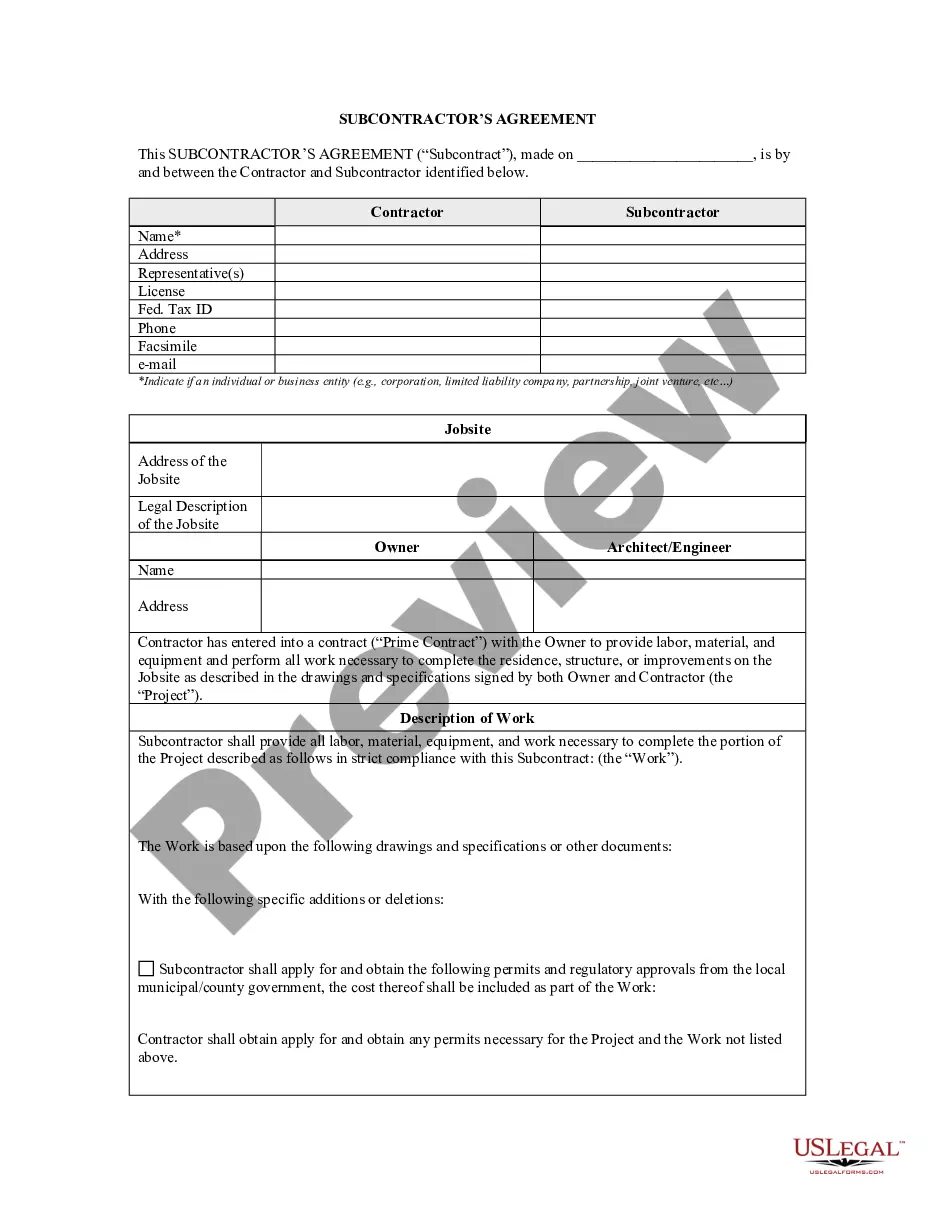

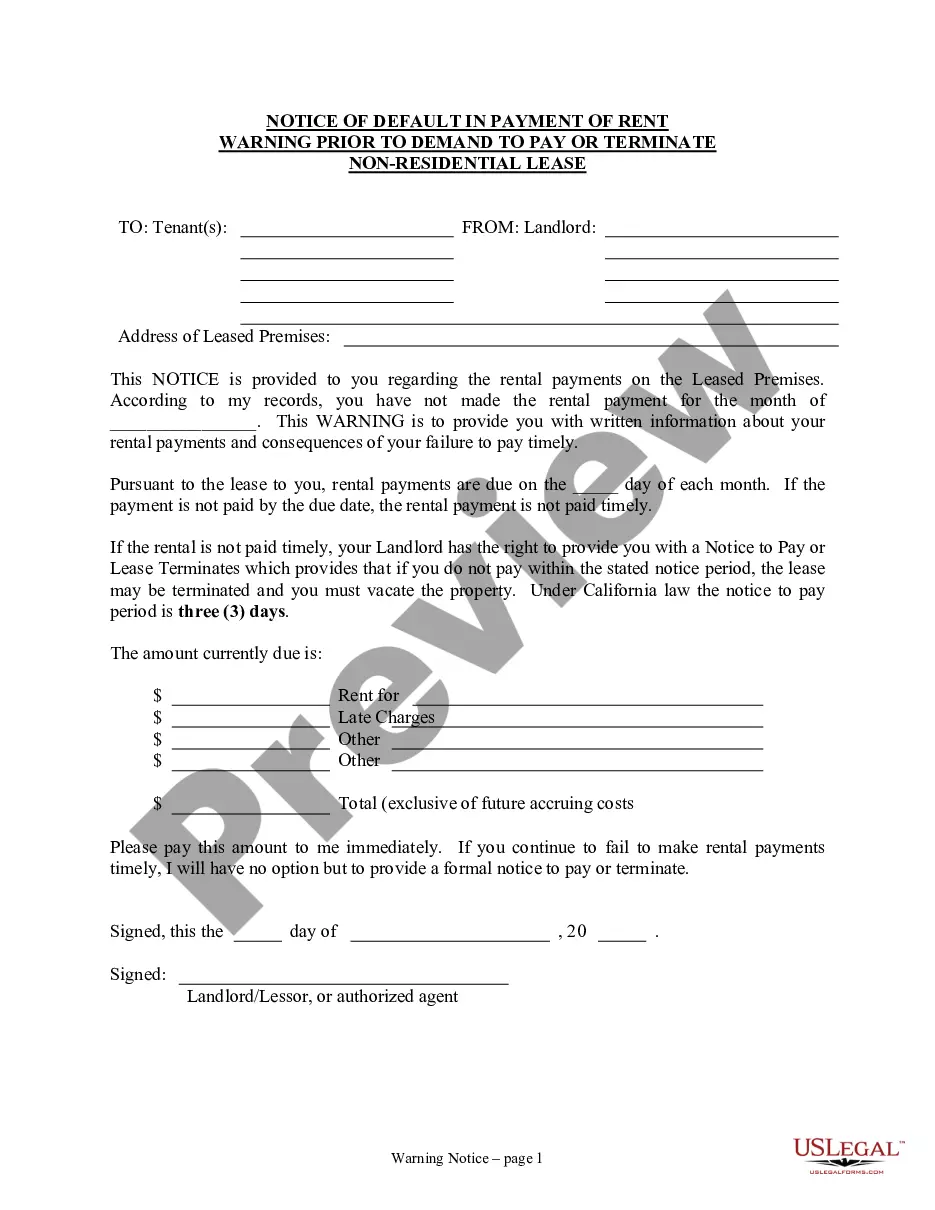

Do I need a written contract if I have an independent contractor working for me? In California, the relationship between businesses and independent contractors is subject to strict legal standards. As of January 1, 2025, having a written contract with certain types of independent contractors is required by law.

U.S. companies can hire non-U.S. citizens as independent contractors without a work visa, provided the contractor performs the work from outside the U.S.

If you decide to hire independent contractors, you'll need to collect the following documentation: Form W-9. Forms W-8BEN or W-8BEN-E. Form 1099-NEC. Form SS-8. Independent contractor agreement. Confidentiality agreement (NDA) Non-compete agreement. Non-solicitation agreement.

Do you issue a 1099 form to international contractors? You do not need to issue or collect Form 1099-NEC from your international contractor. Form 1099 is only used if the company and contractor are based in the U.S. Form W-8BEN declares the contractor's foreign status and will suffice.

The IRS requires a flat 30% withholding on ALL types of payments to foreign national individuals UNLESS: The individual has a U.S. tax identification number (SSN or ITIN) and qualifies for a tax reduction under the tax treaty between the U.S. and their country of tax residency.

Yes, a U.S. company can hire international workers abroad. However, hiring overseas employees comes with unique challenges, such as navigating foreign tax and employment regulations, correctly classifying international workers, and running global payroll.

Independent contractors use 1099 forms. In California, if you report your income on a Form 1099, you are an independent contractor, while if you report it on a W-2 form, you are an employee.

Today, it's possible to hire independent contractors from any part of the world, thanks to improvements in technology and communications. It's a great idea to consider Mexico if you're looking to expand your team. Its proximity and strong economic ties to the US are definite advantages.