Pay Foreign Independent Contractor With Paypal In King

Description

Form popularity

FAQ

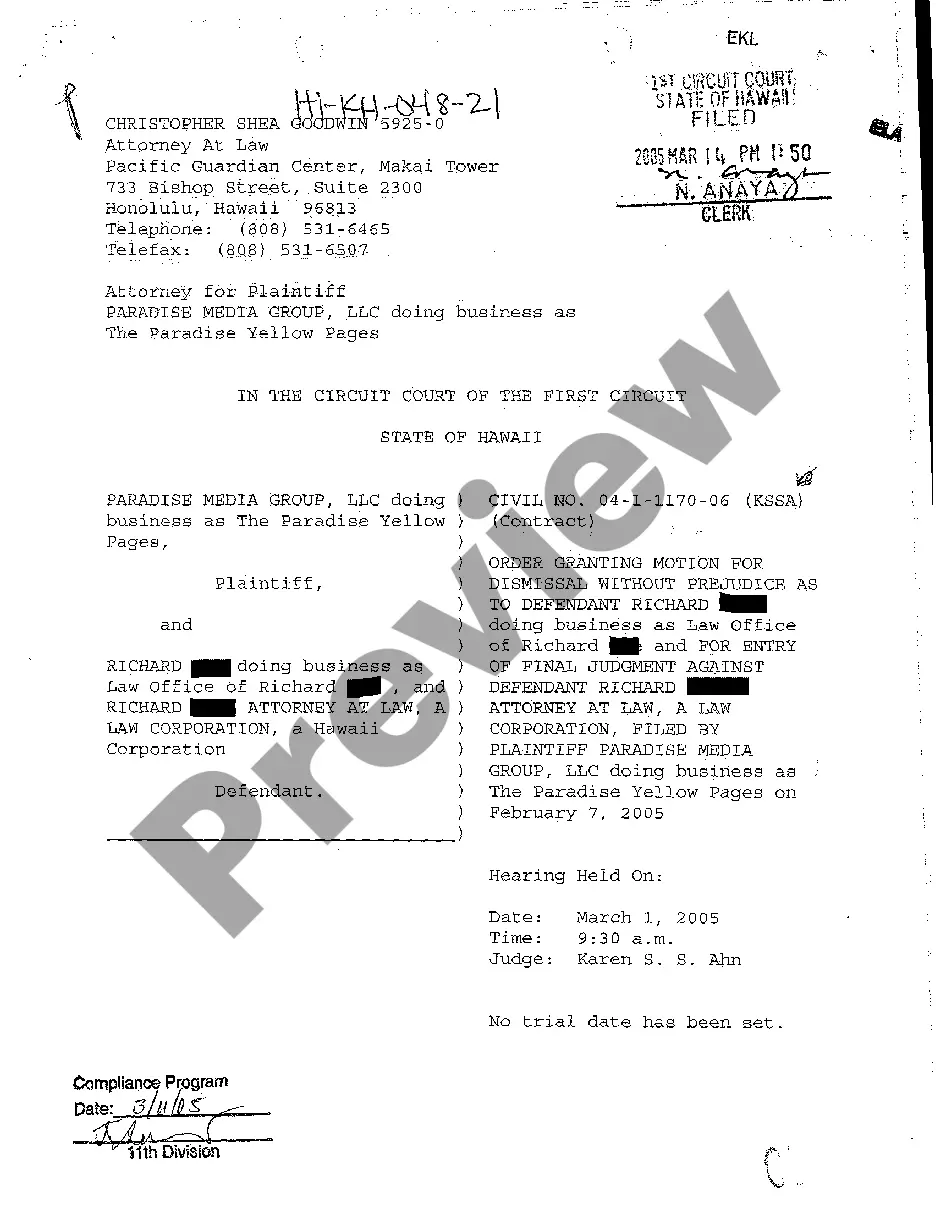

The IRS requires a flat 30% withholding on ALL types of payments to foreign national individuals UNLESS: The individual has a U.S. tax identification number (SSN or ITIN) and qualifies for a tax reduction under the tax treaty between the U.S. and their country of tax residency.

While this opens doors to diverse talent and skill sets, it also introduces unique challenges in terms of tax compliance. One critical aspect of this compliance involves Form 1099, which US-based businesses may need to issue to foreign contractors for reporting payments made during the tax year.

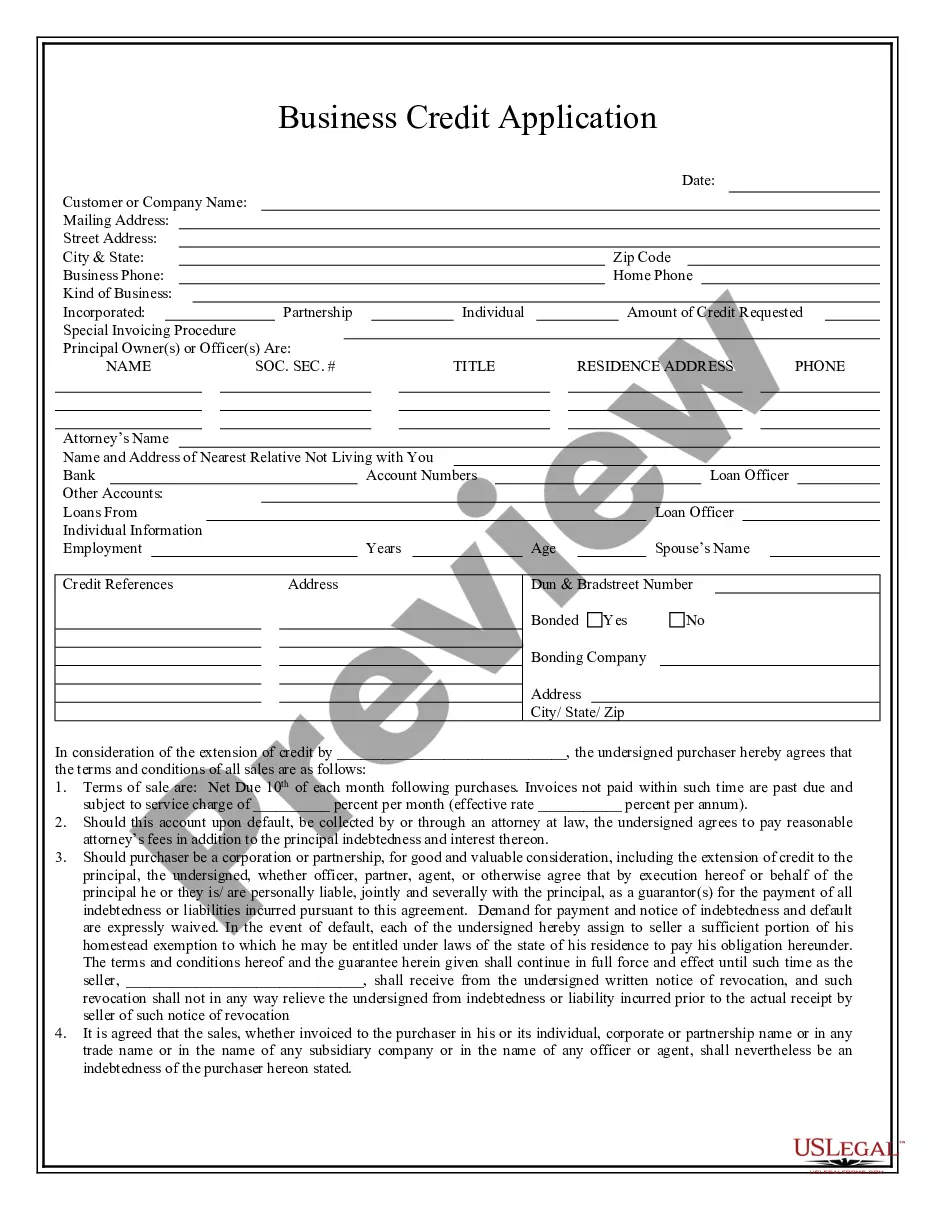

3. Net 10, 30, and 60 Risks: This is the most common payment term for independent contractors, and there are few risks associated with it. Benefits: Because companies have between 10 and 60 days to issue payments, this is generally preferred because it guarantees them enough time to send the payment.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

Yes! Paypal is available in over 200 different countries, giving companies the option to make cross-border payments and transfers via the app or website at PayPal. However, the process differs slightly depending on whether or not both the sender and recipient have a PayPal account.