New Zealand Foreign Contractor Withholding Tax In Collin

Description

Form popularity

FAQ

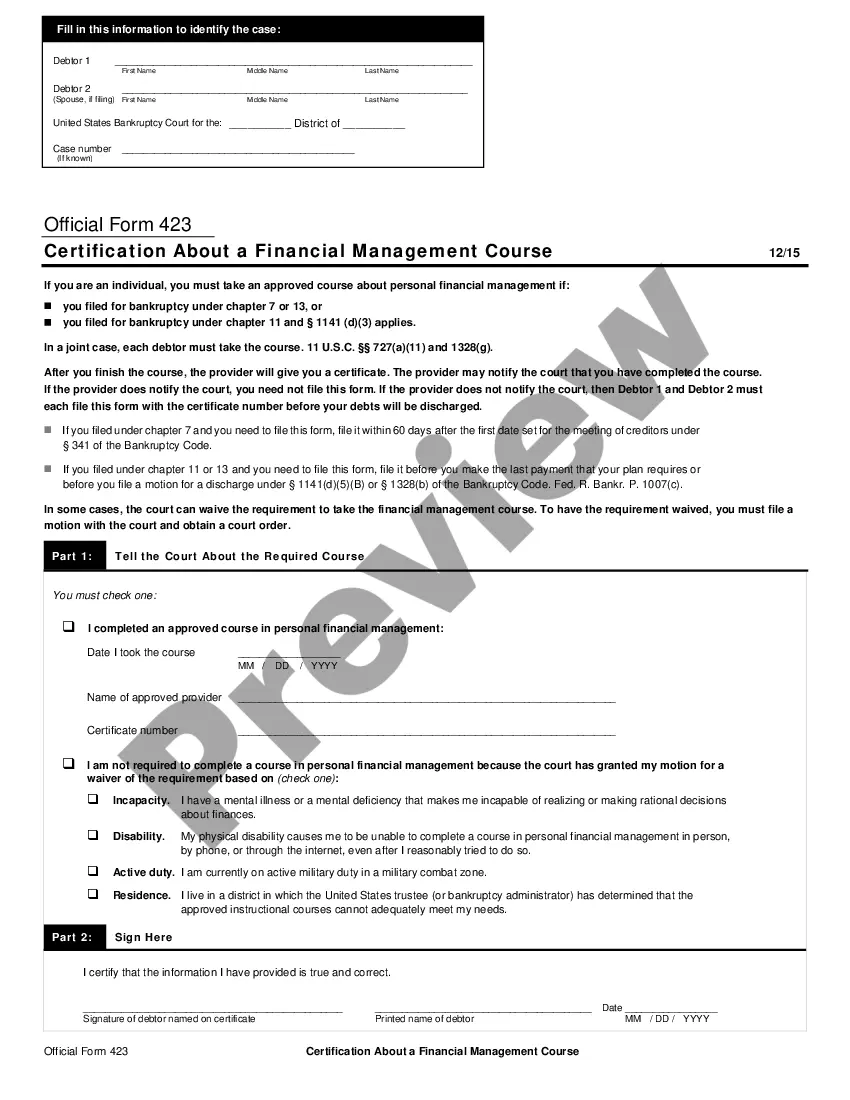

Withholding tax on payments to non-resident contractors The default rate is currently 15%. Higher rates are used if the form is not complete. These are called 'no-notification' rates. You will need an IRD number unless you have full tax relief under a treaty between New Zealand and your country of tax residence.

Form 1099 is used to report payments made to an independent contractor. Expat business owners may need to file Form 1099 when working with contractors abroad. Failing to file Form 1099 as required could result in penalties.

The form confirms that the contractor isn't a U.S. citizen and isn't working within the United States. If both of these things are true, the contractor isn't subject to American taxes. Without this form, you must withhold 30% of your payments to foreign contractors for taxes.

Non-resident withholding tax is imposed on every person who derives non-resident withholding income such as interest and dividends. NRWT is generally a final tax on such income. Non-resident withholding tax is imposed on interest at 15 percent, and dividends at 30 percent or 0 percent if fully imputed.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

Foreign vendors do not complete the Substitute Form W-9; foreign persons or entities must submit one of five available forms. The vendor must determine the one most appropriate to their United States tax status for reportable transactions.

If you are a U.S. citizen or U.S. resident alien, you report your foreign income on your tax return where you report your U.S. income. That is, on line 1 of IRS Form 1040.