Letter For Recovery Of Outstanding Dues In Middlesex

Description

Form popularity

FAQ

The 7-in-7 rule, established by the Consumer Financial Protection Bureau (CFPB) in 2021, limits how often debt collectors can contact you by phone. Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt.

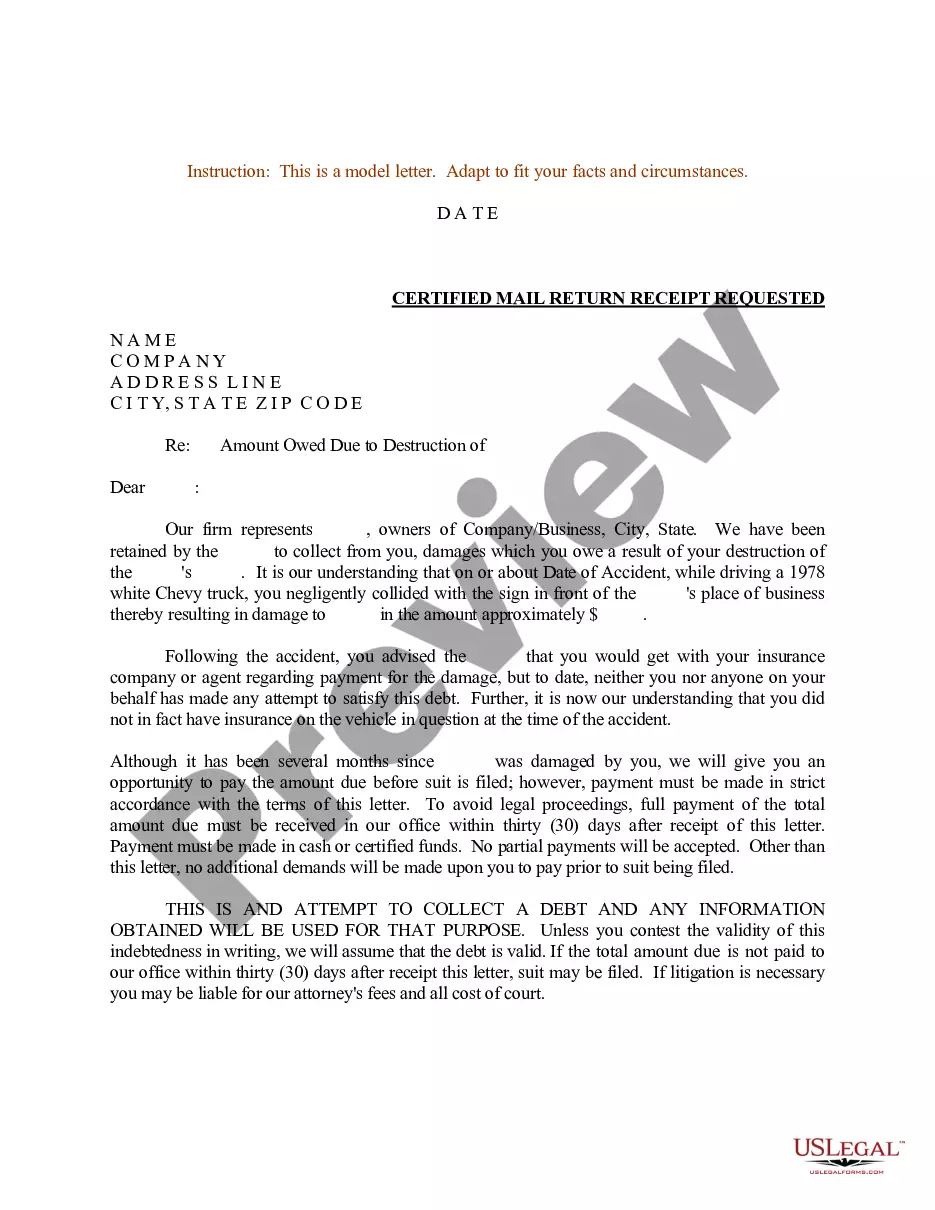

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

A final demand letter about arrears lays out what must be done to prevent further action, which may or may not be legal action. A final demand is not a statutory notification; meaning it is not explicitly required in law, but is it something the court would expect to have been sent should legal measures be taken.

Yes it does actually work. Collectors rarely actually validate the debt because most of the debts in fact are not valid. Some just back off because receiving a well worded debt validation letter means you have consulted the FDCPA (or at least a good debt/credit forum) and know what you're doing.

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

How to write a debt collection letter: Step by step guide Step 1: Use a professional format. Step 2: Write a clear subject line (if sending via email) ... Step 3: Address the recipient. Step 4: State the purpose of the letter. Step 5: Provide detailed information on the debt. Step 6: Include payment instructions.

Dear Name, Further to my previous correspondence, I am contacting you regarding late payment for invoice invoice number. The invoice was due on due date, and payment is now overdue by number of days overdue. Be advised that late payment interest may be applied if we do not receive payment within 30 days.

How to write a debt collection letter: Step by step guide Step 1: Use a professional format. Step 2: Write a clear subject line (if sending via email) ... Step 3: Address the recipient. Step 4: State the purpose of the letter. Step 5: Provide detailed information on the debt. Step 6: Include payment instructions.

Dear Name, This is a friendly reminder that we haven't received payment for invoice Invoice Number. The payment was due on Due Date. We're not aware of any outstanding issues or reasons for non-payment, so we would like to respectfully ask you to make payment as soon as possible.

Consider the following: Be as direct as possible, Come up with a clear call to action, Ask the client to confirm they received the invoice email, Emphasize the time the invoice is overdue, and. Include a copy of the original invoice in the attachment.