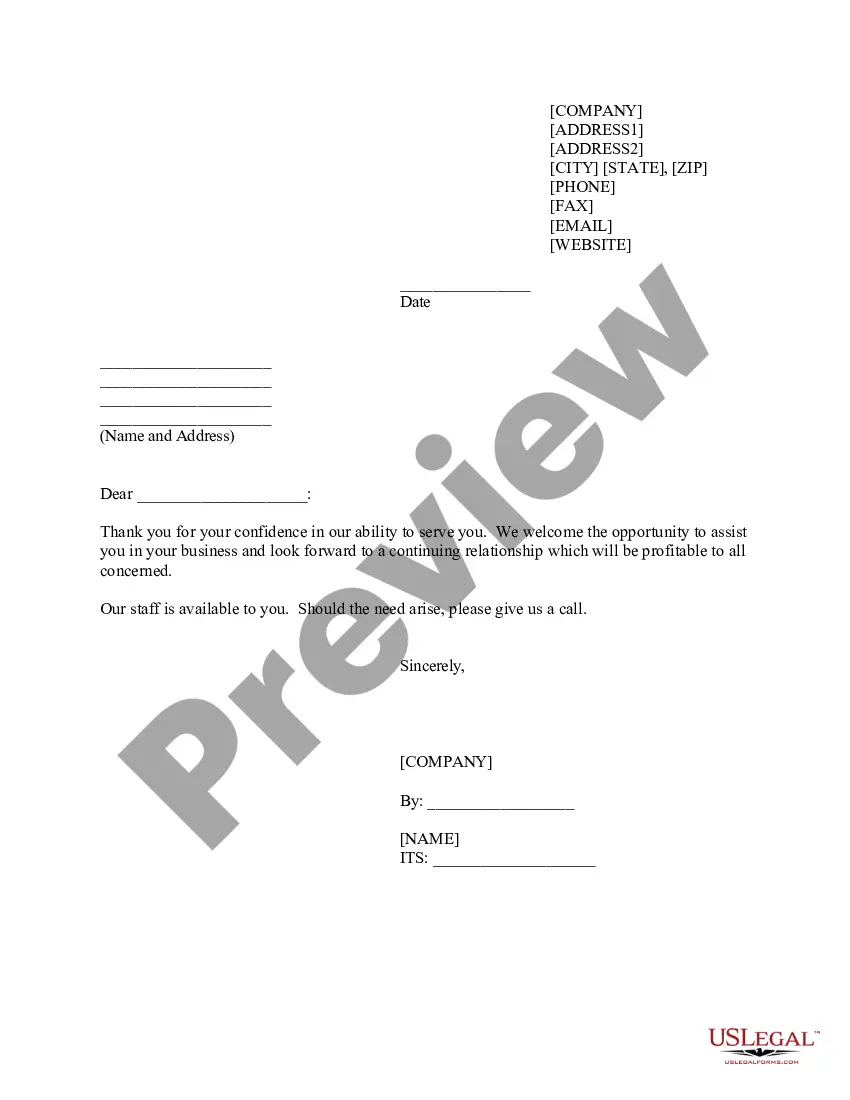

This form is a sample letter in Word format covering the subject matter of the title of the form.

Lien Judgement On Credit Report In Massachusetts

Description

Form popularity

FAQ

How long does a judgment lien last in Massachusetts? A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

Vacating the Judgment Another avenue for removing a judgment from your credit report is to vacate it. To do so in California, you must present a valid reason like a significant emergency or not being properly served with court forms.

Yes, a house can be sold with a lien on it, but the process involves additional steps to ensure a smooth transaction. The lien typically needs to be resolved before or during the sale to provide the buyer with a clear title. Buyers and lenders usually require assurance that the lien will not transfer with the property.

Massachusetts Tax Liens – Same as federal tax liens, except they expire 10 years and 30 days after the assessment date. See G.L. c. 62C § 50(a) and MA Title Standard No.

The easy answer is yes, credit card companies can put a lien on your house. They can file a claim for your property to cover unpaid debts.

The easy answer is yes, credit card companies can put a lien on your house. They can file a claim for your property to cover unpaid debts.

As a result, in Massachusetts the statute of limitations on a breach of contract claim for non-payment of a credit card will typically be 6 years and 30 days after the last payment made.