Judgment Lien On Personal Property With Mortgage In Massachusetts

Description

Form popularity

FAQ

Judgments have expiration dates. If they are not timely renewed, they expire. In CA that is 10 years. However, when a judgment lien has been recorded against your property, it has no expiration date.

As further bad news, default judgments do not simply vanish. The lien of a default judgment lasts five years and may be easily and repeatedly revived and transferred to other counties or states.

A lien which results from a judgment shall terminate not later than twenty years from the date it was created.

All liens signify a debt is owed but it's important to note that not all liens are negative, and at times, are expected. A property owner can choose to place a lien on their property.

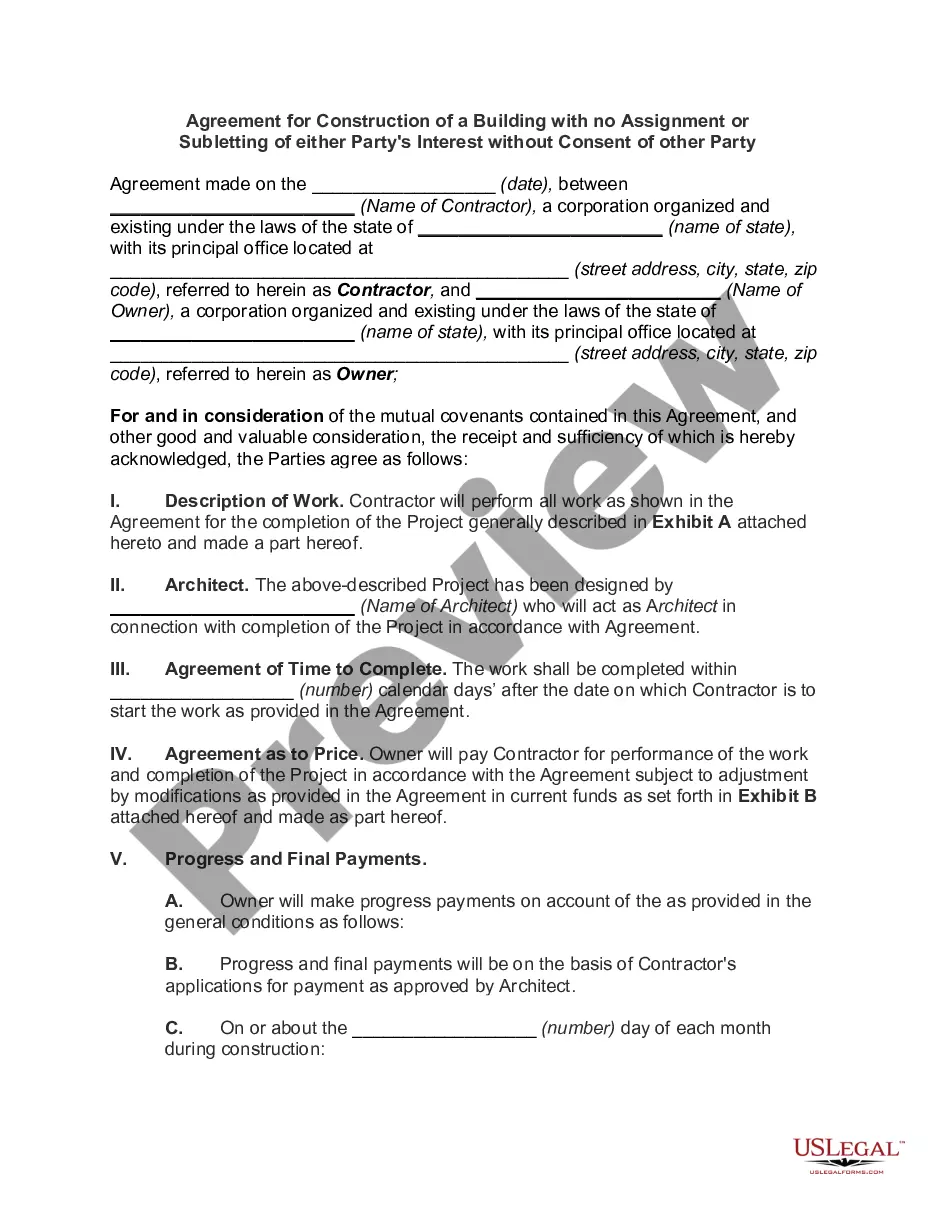

Often, judgment liens are recorded after other types of liens, like mortgages, and are lower in priority.

For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.

Which of the following liens generally holds first priority? Real property taxes are ad valorem taxes which means that they are levied ing to value. Real estate tax liens are in first position and get top priority regardless of when the taxes were incurred.

Creditors typically acquire property liens through your voluntary consent. On the other hand, creditors get judgment liens after winning a lawsuit against you for a debt you owe.