Judgment Against Property With Find In Georgia

Description

Form popularity

FAQ

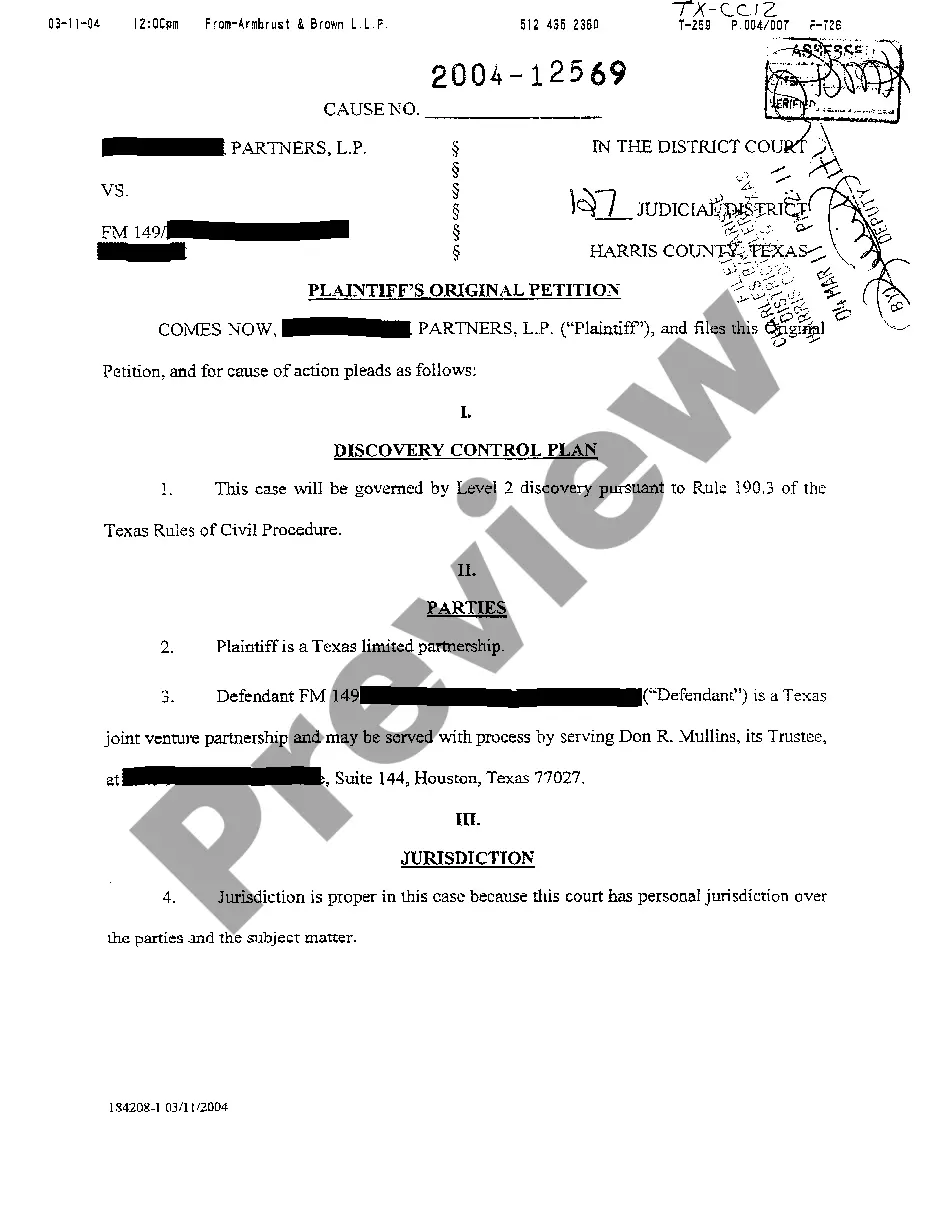

Key Takeaways. A judgment lien is a court ruling that gives a creditor the right to take possession of a debtor's property if the debtor fails to fulfill their contractual obligations. Judgment liens are nonconsensual because they are attached to property without the owner's consent or agreement.

In Georgia, you can attach judgment liens to both real estate—land, buildings, and other improvements—and personal property like cars, artwork, antiques, electronics, and more.

Once a judgment is issued, the creditor has the right to take further actions to collect the debt, such as wage garnishment, bank account levies, or placing liens on your property.

The Georgia Department of Revenue's website is the primary repository for state tax liens. Individuals can visit the agency's Georgia Tax Center to look up tax liens with SOLVED, the Search for a Lien tool. The tool disseminates information on tax liens filed by the state for unpaid taxes.

Regardless of how the judgment is obtained, there are three main options to consider in attempting to collect on the judgment. Filing a Garnishment. First, a party may pursue a garnishment. Recording a Writ of Fieri Facias. Conducting Post-Judgment Discovery.

In cases where the judgment is entered by default, action can be taken immediately to satisfy the judgment, either by garnishment or levy upon the property of the defendant in fi fa. Other judgments may not be enforced for a period of ten days after entry of the judgment.

In Georgia, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest -- or to the debtor's personal property -- things like jewelry, art, antiques, and other valuables.