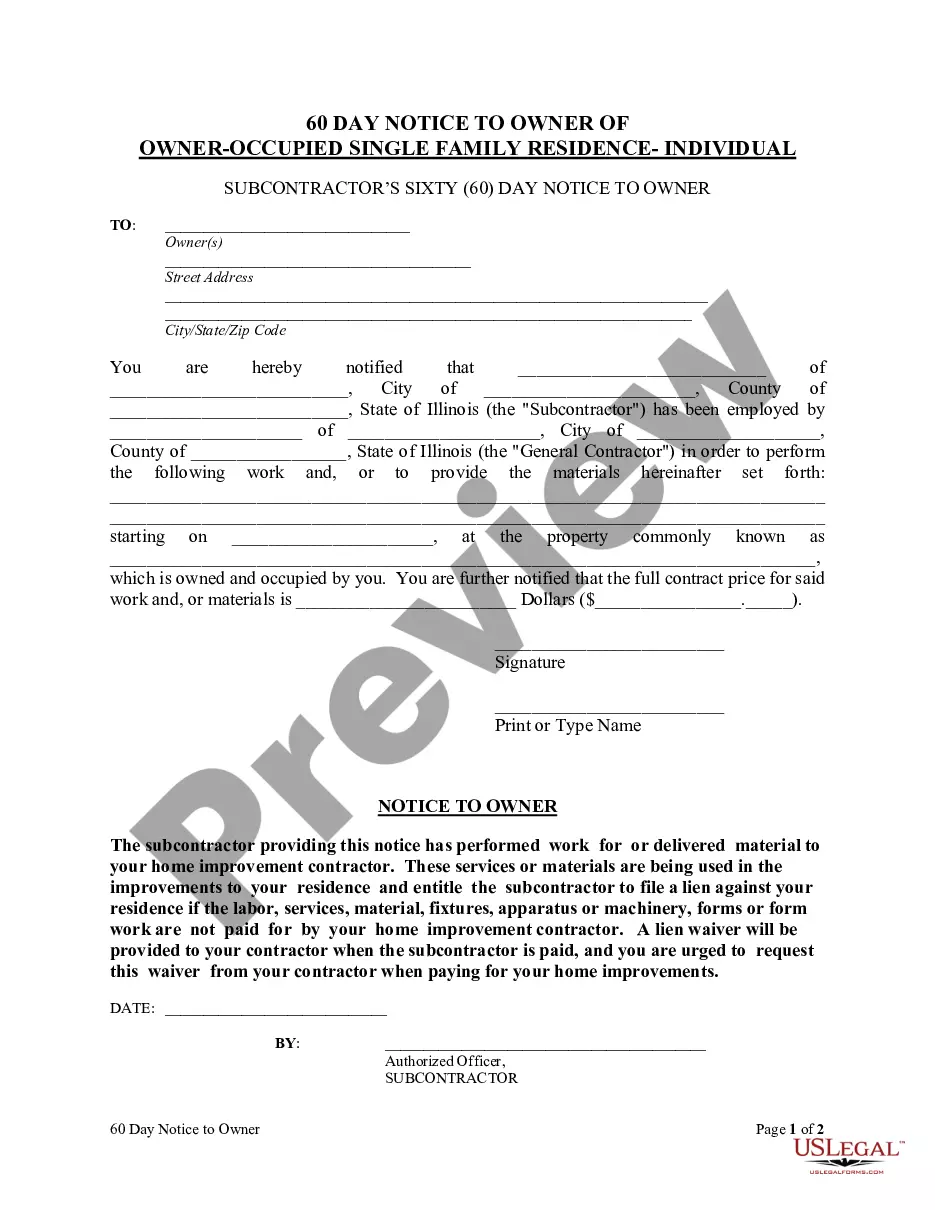

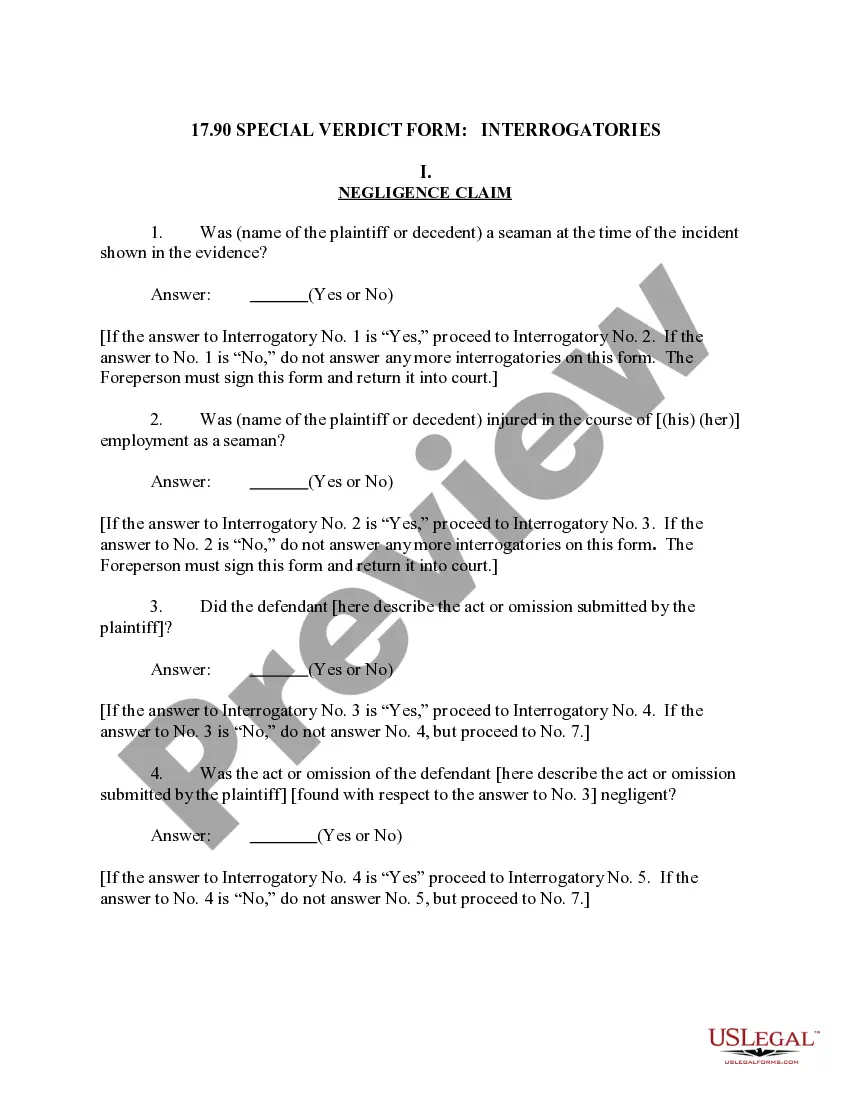

This form is a sample letter in Word format covering the subject matter of the title of the form.

Judgement Lien On My House In Clark

Description

Form popularity

FAQ

How does a creditor go about getting a judgment lien in Nevada? To attach the lien, the creditor files the judgment with the county recorder in any Nevada county where the debtor has property now or may have property in the future.

A state income tax lien is an example of a general lien because it can attach to all property of the debtor. In contrast, mortgage liens, real estate tax liens, and mechanic's liens are specific to certain assets.

For all purposes, a notice of lien shall be deemed to have expired as a lien against the property after the lapse of the 6-month period provided in subsection 1, and the recording of a notice of lien does not provide actual or constructive notice after the lapse of the 6-month period and as a lien on the property ...

A judgment lien in Nevada will remain attached to the debtor's property (even if the property changes hands) for six years.

Nevada Notice of Right to Lien, also known as 31 Day Preliminary Notice or Pre-Lien Notice, is often a requirement for those working or supplying material or labor to a construction project. In Nevada especially, the failure to deliver the notice can be grounds for disciplinary proceedings.

A judgment lien on the debtor's property is created automatically when the property is in the same Washington county where the judgment is entered. But when the debtor's property is in another Washington county, the creditor must file the judgment with the county clerk for that county.