Judgment Against Property For Debt In Chicago

Description

Form popularity

FAQ

Statutes of Limitations for Each State (In Number of Years) StateWritten contractsOpen-ended accounts (including credit cards) Georgia 6 6 Hawaii 6 6 Idaho 5 4 Illinois 10 547 more rows

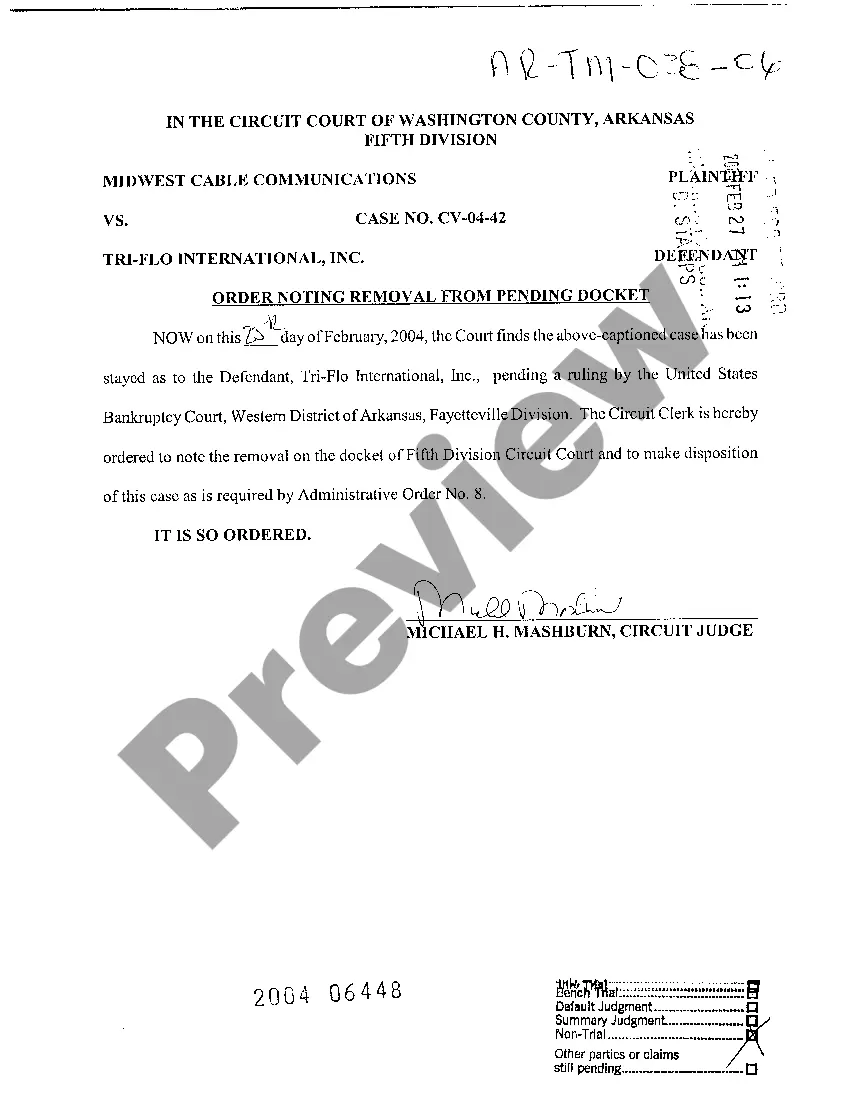

And the amount owed. If you are placing a judgment lean. You first need to obtain a judgement </S>MoreAnd the amount owed. If you are placing a judgment lean. You first need to obtain a judgement </S> in court. Once you have a judgment you can file it with the county recorder's.

In Illinois, the statute of limitations typically ranges from five to ten years, depending on the type of debt. Once this period expires, the debt becomes “time-barred,” meaning that while the debt still exists, collectors can no longer sue you to recover it.

Enforcement proceedings (also known as collection actions) to collect judgments are governed primarily by 735 ILCS 5/2-1402. This statute provides three main tools for enforcing and collecting judgments: (1) the Citation to Discover Assets; (2) wage garnishment proceedings; and (3) non-wage garnishment proceedings.

Enforcement proceedings (also known as collection actions) to collect judgments are governed primarily by 735 ILCS 5/2-1402. This statute provides three main tools for enforcing and collecting judgments: (1) the Citation to Discover Assets; (2) wage garnishment proceedings; and (3) non-wage garnishment proceedings.

In Illinois, a mechanics lien must be filed within 4 months after completion of work to be effective against subsequent property owners.

Personal property Personal property, including family pictures, school books, professionally prescribed health aids, and necessary wearing apparel; A "wildcard exemption" of $4,000 worth of any other property, not including wages that have been garnished. A motor vehicle exemption of $2,400 is included.