Judgment Against Property With Bad Credit In California

Description

Form popularity

FAQ

Here are the California System 1 property exemptions: The Homestead Exemption protects up to $600,000 in your principal residence, which could be a home, boat, condo, or even a planned development. The Motor Vehicle Exemption protects up to $3,625 of equity in your car or other vehicle.

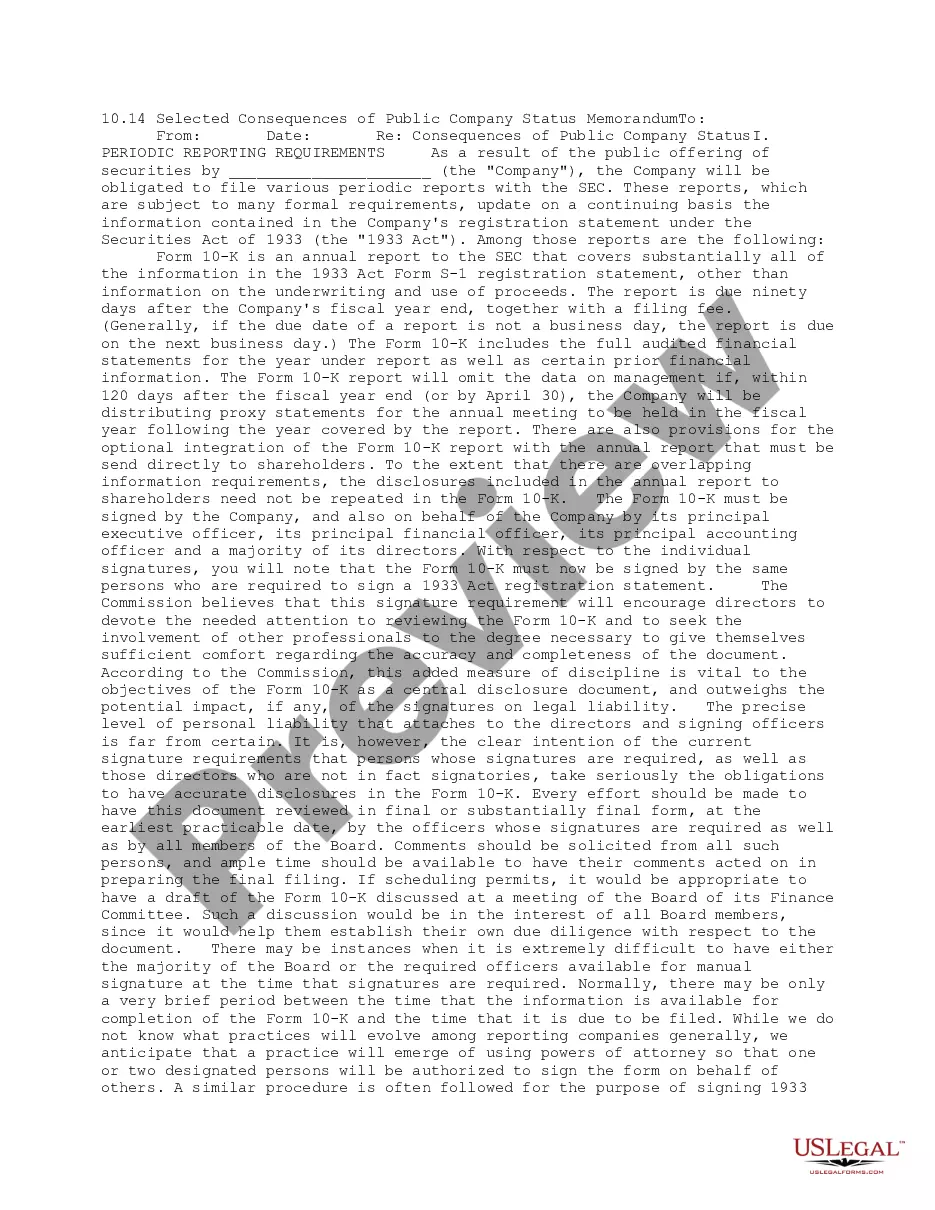

How long can a judgment remain on a credit report? Judgments, which are detrimental to your credit rating, typically remain on your credit report for seven years. In California, however, judgments can be enforced for up to ten years and then renewed ad infinitum as soon as five years after that.

The following kinds of personal property are exempt from debt collection and cannot be seized: Household goods, like furniture, clothing, and appliances. Medical equipment, such as a wheelchair. One television, one radio, one computer and one cell phone.

Exemption from the Enforcement of Judgments Type of PropertyCode Automobiles, Trucks, and other motor vehicles, including proceeds traced to the sale of the vehicle. CCP § 704.010 Art and Heirlooms & Jewelry CCP § 704.040 Relocation Benefits CCP § 704.180 Health Insurance Benefits and Disability Insurance Benefits CCP § 704.13027 more rows

If you don't respond to the lawsuit within the specified time frame (usually 20 to 30 days), the court could eventually issue a default judgment in the debt collector's favor. This gives them powerful tools to collect the debt, including: Wage garnishment (taking a portion of your paycheck)

What About “Exempt” Bank Accounts? So-called exempt bank accounts are special accounts that are not subject to wage garnishment or creditor claims.

Filing of the UCC does not constitute any type of enforcement action at all. It is not a judgment and is not a lawsuit filing. The creditor cannot lien your personal residence and cannot take of your assets, including your home.

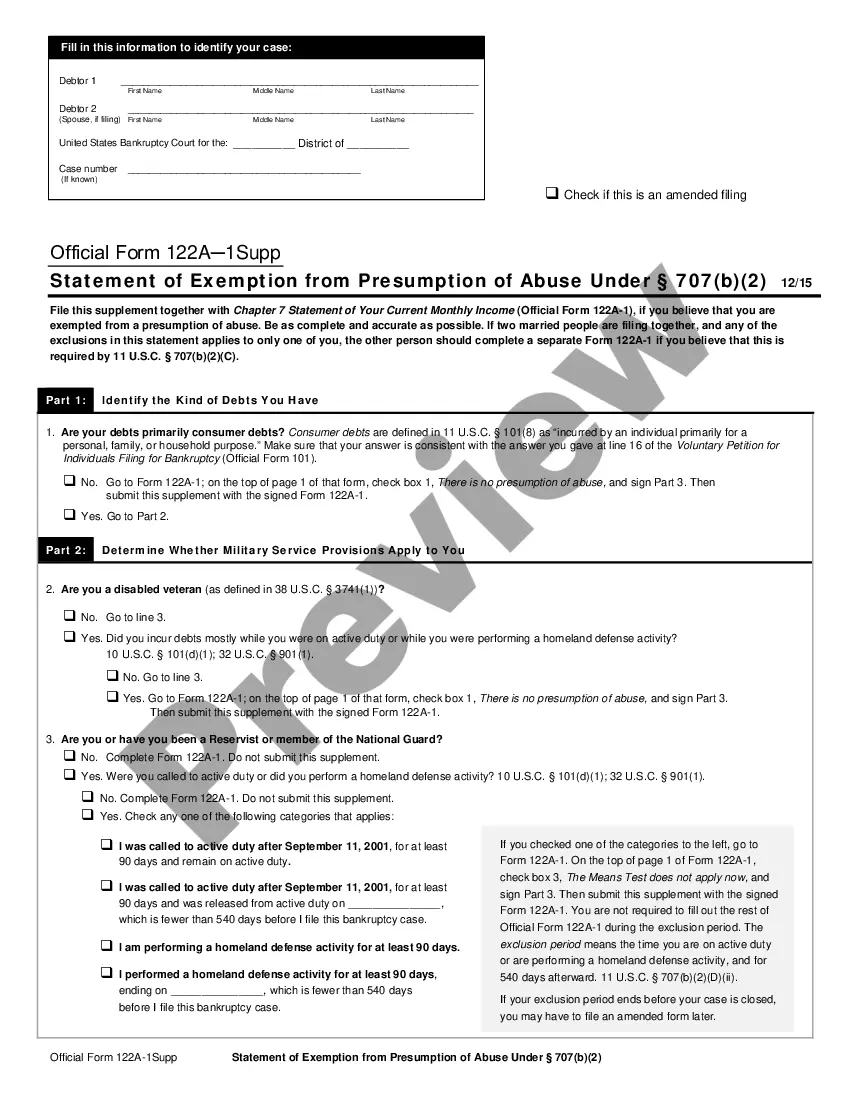

In California, key bankruptcy exemptions include up to $600,000 in home equity, $3,325 in vehicle equity, protected retirement accounts, personal belongings, and public benefits such as Social Security. Exemptions help filers keep essential property while resolving debt through Chapter 7 or Chapter 13 bankruptcy.

As provided by the California Constitution, certain qualified properties are exempt from paying property taxes. Examples include properties used exclusively for religious, scientific, hospital or charitable purposes.