Judgment Lien Forms With Property In Bexar

Description

Form popularity

FAQ

These can range from ownership data to property values. And more it's like a biography of aMoreThese can range from ownership data to property values. And more it's like a biography of a property's. Life in Texas County Appraisal districts are the go-to for property records.

On residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month the contract was completed, terminated, or abandoned.

The Writ of Possession allows for the possession of the property, after a deputy has posted written notice notifying the tenant a writ has been issued. By law, we are required to give a minimum of 24 hours notice before enforcing the writ.

Verify the Lien: Ensure the lien is valid and check for any errors that could invalidate it. Satisfy the Judgment: Paying the debt in full is the most straightforward way to remove the lien. Obtain a satisfaction of judgment from the creditor and file it with the court.

A creditor must file and be approved for a property lien through a county records office. Different states may have their own processes for lien filing. Often, the creditor will notify the debtor of the lien.

Deed/Lien Information To record it in person, bring the original Release to the Bexar County Clerk's Recordings Department at the Paul Elizondo Tower. To record it through the mail, send the original document to the Bexar County Clerk's Office in the Courthouse.

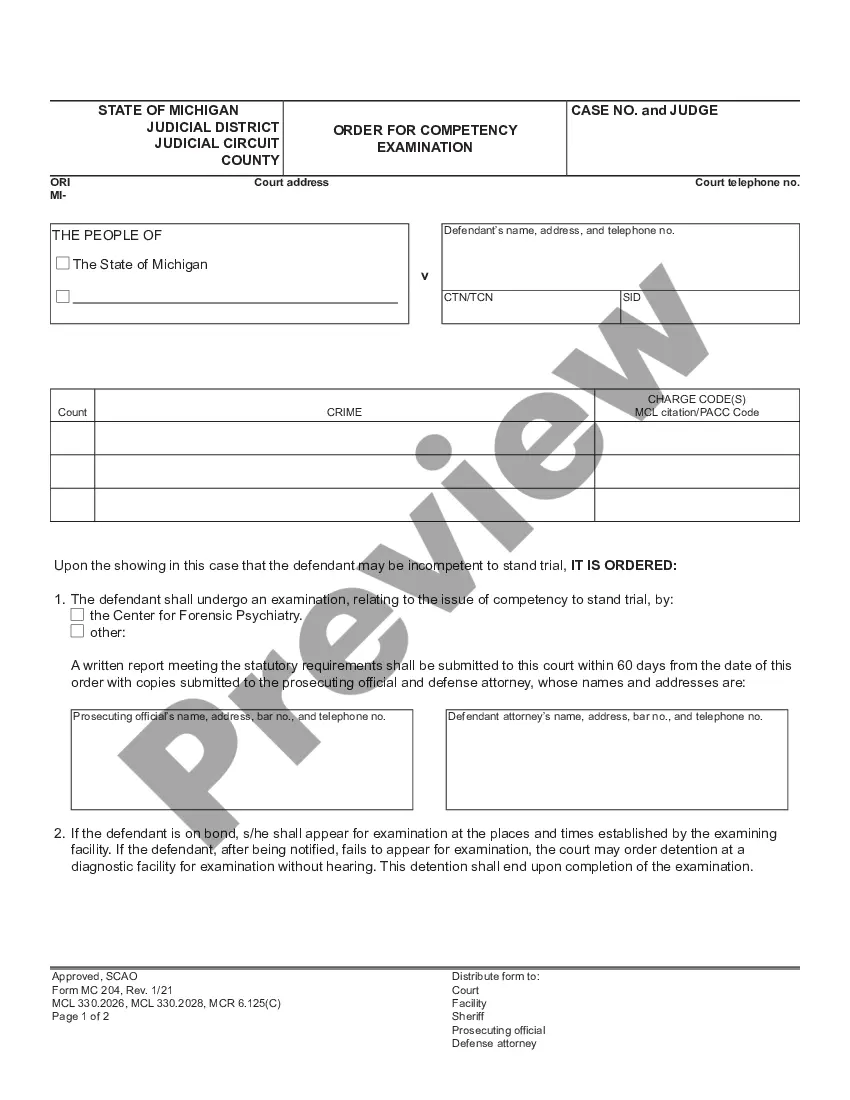

Generally, to file a judgment lien, an abstract of judgment must be issued by the justice court. Some justice courts have a form available on their website to request an abstract of judgment.

In Texas, a judgment lien can be attached to real estate only (such as a house or land).