Judgment Against Property With Notice To Garnishee In Alameda

Description

Form popularity

FAQ

3 Action Steps To Take When You Receive the Final Notice of Intent To Levy: Read the notice carefully. It should state “Final Notice. Take notice of the collection date. Next, take notice of the date when the IRS can actually take action to seize your assets. File an appeal.

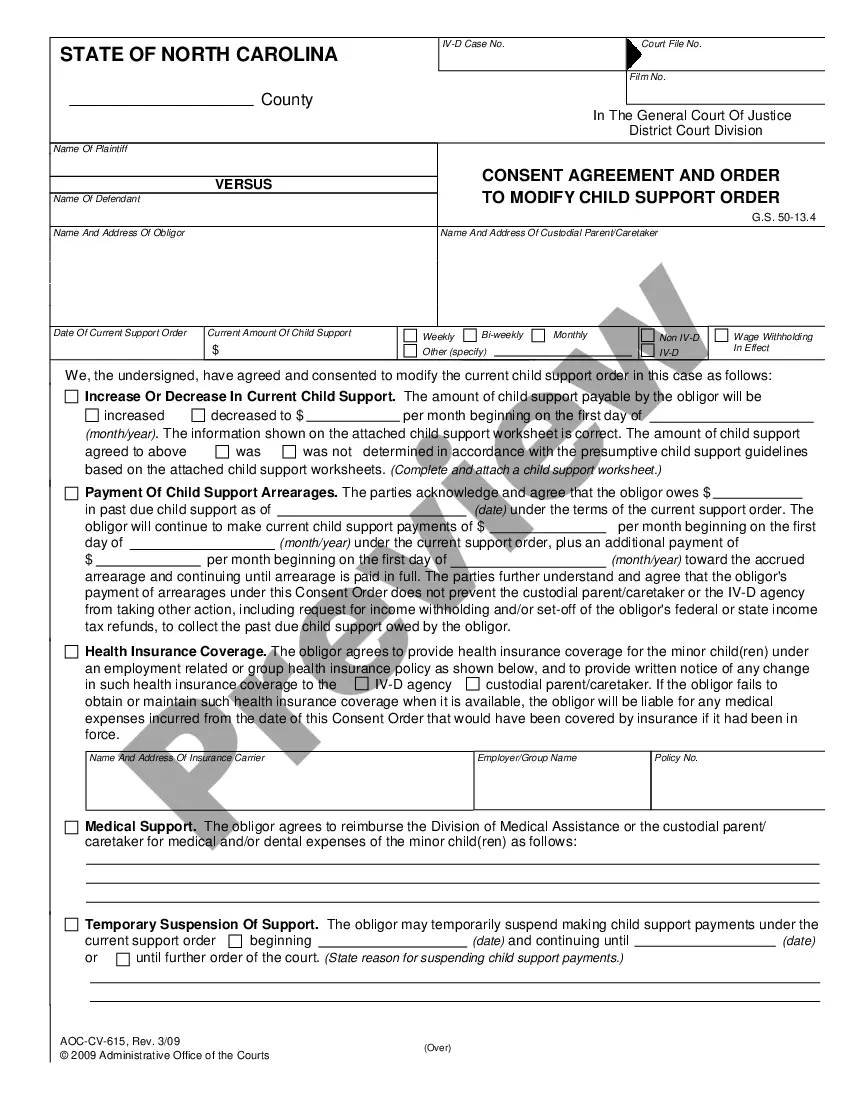

A levy is the legal seizure of property to satisfy a debt. Levies are usually an attachment or garnishment for a tax debt or a court judgment requested by the creditor of the debt. The term levy may be more commonly used than “attachment” or “garnishment” in some cases.

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

Exemption from the Enforcement of Judgments Type of PropertyCode Relocation Benefits CCP § 704.180 Health Insurance Benefits and Disability Insurance Benefits CCP § 704.130 Personal Property used for Business, Trade, or Profession Including: One Vessel (Boat), and other personal property CCP § 704.06028 more rows

An Abstract of Judgment is sent from the Court to the jail and California Department of Corrections and Rehabilitation if the Court sentences a subject to prison and if the subject is in custody and if the subject is detained pending transport.

6 Ways To Protect Assets From Lawsuits Or Creditors Limited Liability Company (LLC) Trust (Irrevocable) Insurance Policies. Homesteads. Titling – Play Safely. Transfer The Assets.

The short answer is yes, but it's not always easy or common for a judgment creditor to take your car. If a creditor sues you and wins, they can request a judgment lien against your property, including your car.

Exemption from the Enforcement of Judgments Type of PropertyCode Automobiles, Trucks, and other motor vehicles, including proceeds traced to the sale of the vehicle. CCP § 704.010 Art and Heirlooms & Jewelry CCP § 704.040 Relocation Benefits CCP § 704.180 Health Insurance Benefits and Disability Insurance Benefits CCP § 704.13027 more rows

130). The "judgment against garnishee defendant" means the employer withheld the funds as requested by the Writ. Your husband will continue to be garnished until the debt is satisfied. The plaintiff may need to renew the writ after sixty days.