Proxy Corporate Resolutions For Llc In Ohio

Description

Form popularity

FAQ

Corporate Resolution Sample An LLC banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one. Depending on the rules of the bank, you may be required to fill in an additional proprietary form before creating a business bank account.

A board of directors can decide to draft a resolution for almost any reason they choose. For example, some of the common reasons for writing resolutions include board and shareholder decisions on the following scenarios: Retaining a new member of the board.

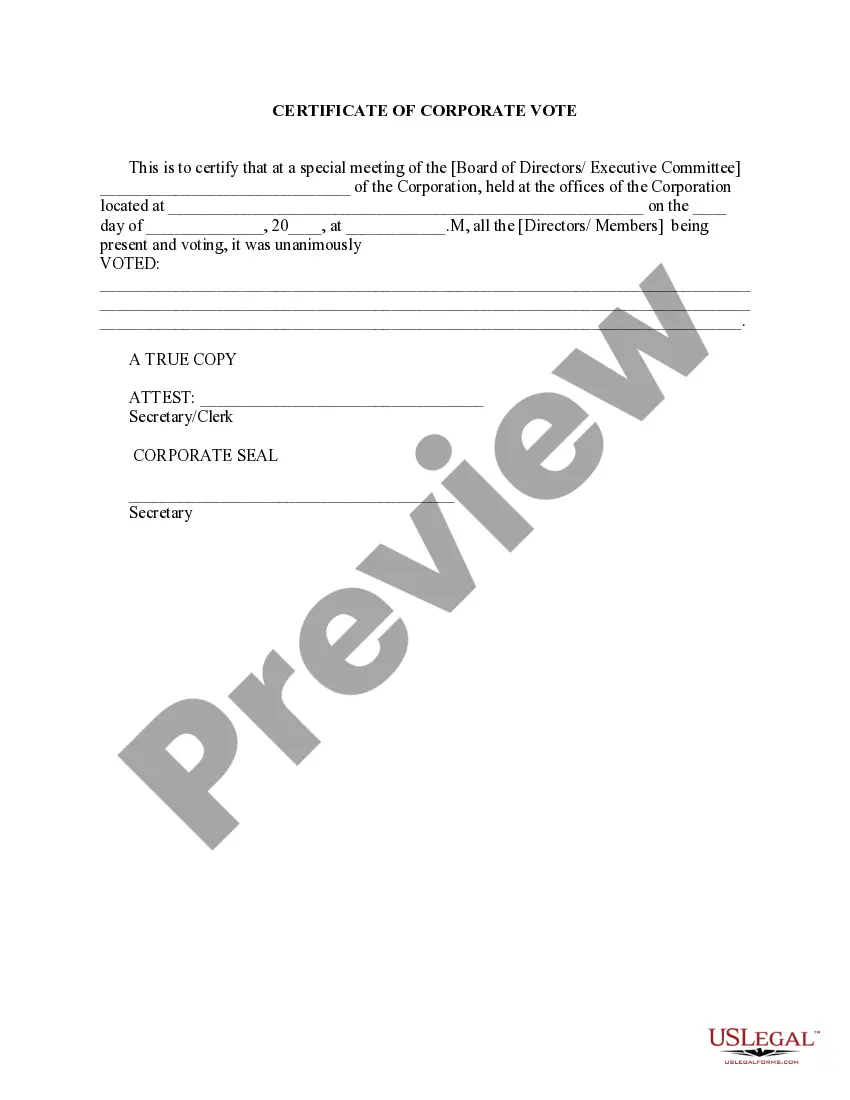

A corporate resolution is a written statement issued by a corporation's board of directors or shareholders to formally document significant business decisions. It serves as a record of the company's intent and authorizations, ensuring that decisions comply with corporate governance policies.

LLC owners are called members and can choose to adopt corporate-style formalities, including resolutions to create records of owner decisions. These adoptions are optional, however, as no government regulations mandate them. LLCs have a major advantage because they enjoy aspects of both a corporation and a partnership.

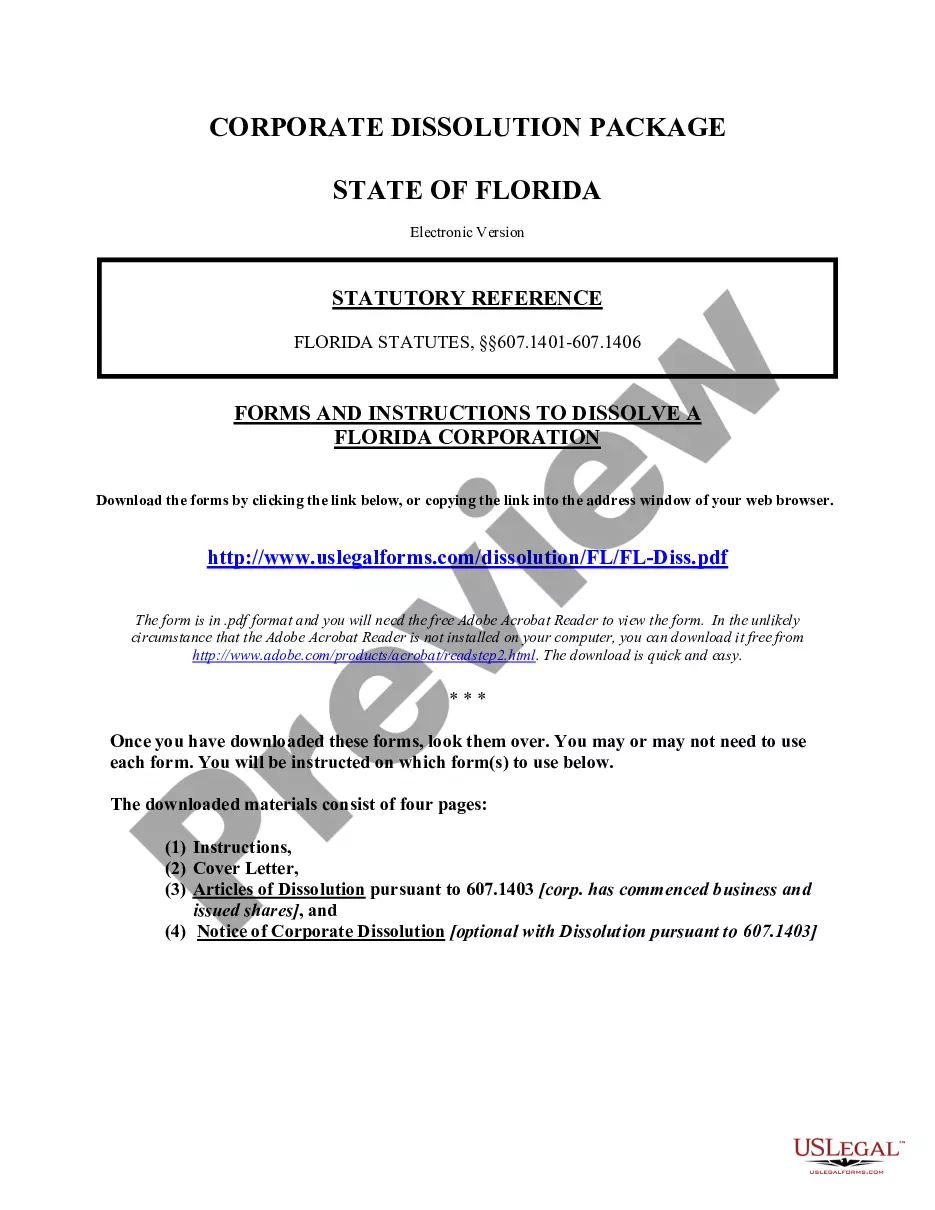

Articles of Incorporation are used when founding a corporation — which differs from an LLC in several ways, including how it's taxed and the formalities involved in its operation. Instead, a California LLC submits a different document, known as Articles of Organization, to the Secretary of State (SOS).

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

Governance structure: Prior to the new law, Ohio LLCs had to be organized as either member-managed or manager-managed companies. The new law eliminates this distinction and permits LLCs to organize their governance structure as they see fit.

Section 1706.30 | Direction and oversight of a limited liability company. (A)(1) The activities and affairs of the limited liability company shall be under the direction, and subject to the oversight, of its members.

Register with the Ohio Secretary of State. Obtain a federal Employer Identification Number (EIN). Open a bank account. Register with the Ohio Department of Taxation at Tax.Ohio.