Donation Receipt For Goods In Orange

Description

Form popularity

FAQ

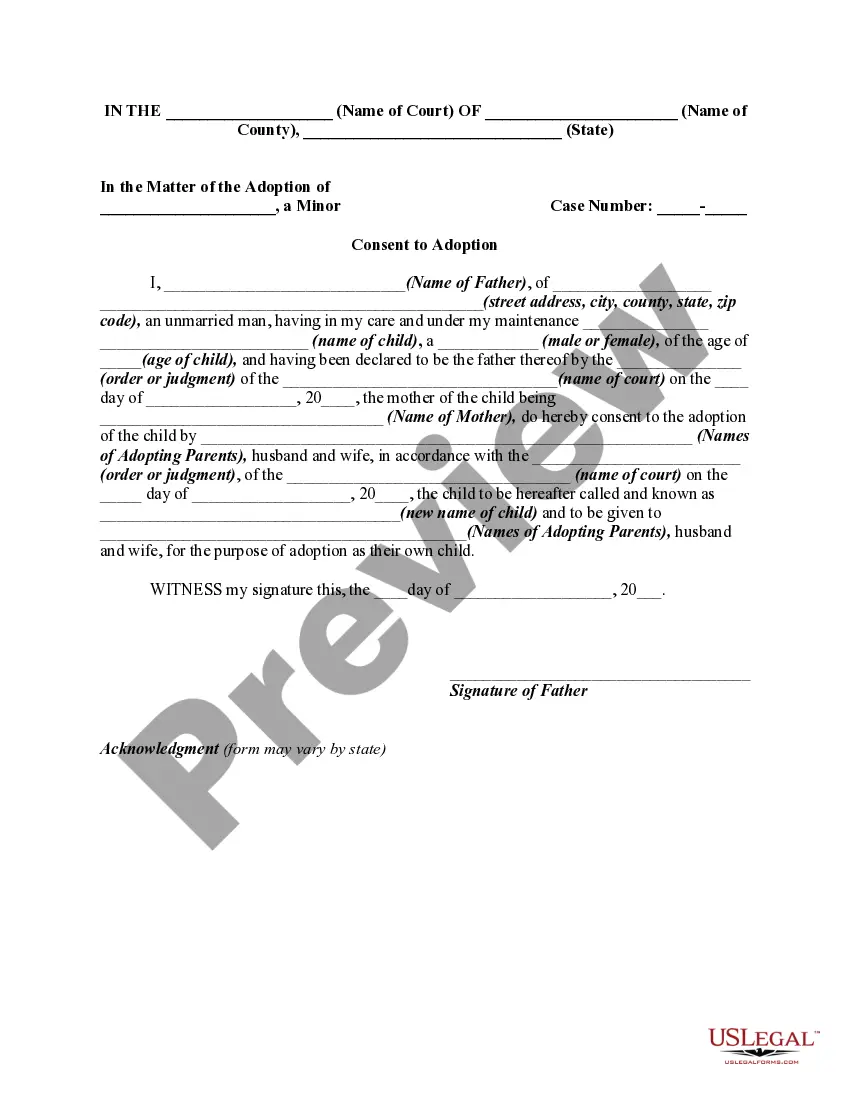

Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition, only on the date of the donation. Goodwill Central Coast information for tax return with address of your donation center.

Recording In-Kind Donations of Goods: Record the same fair market value to either an expense account (if the items will be used immediately) or an asset account (if the items will remain in inventory or are tangible assets, like furniture or equipment).

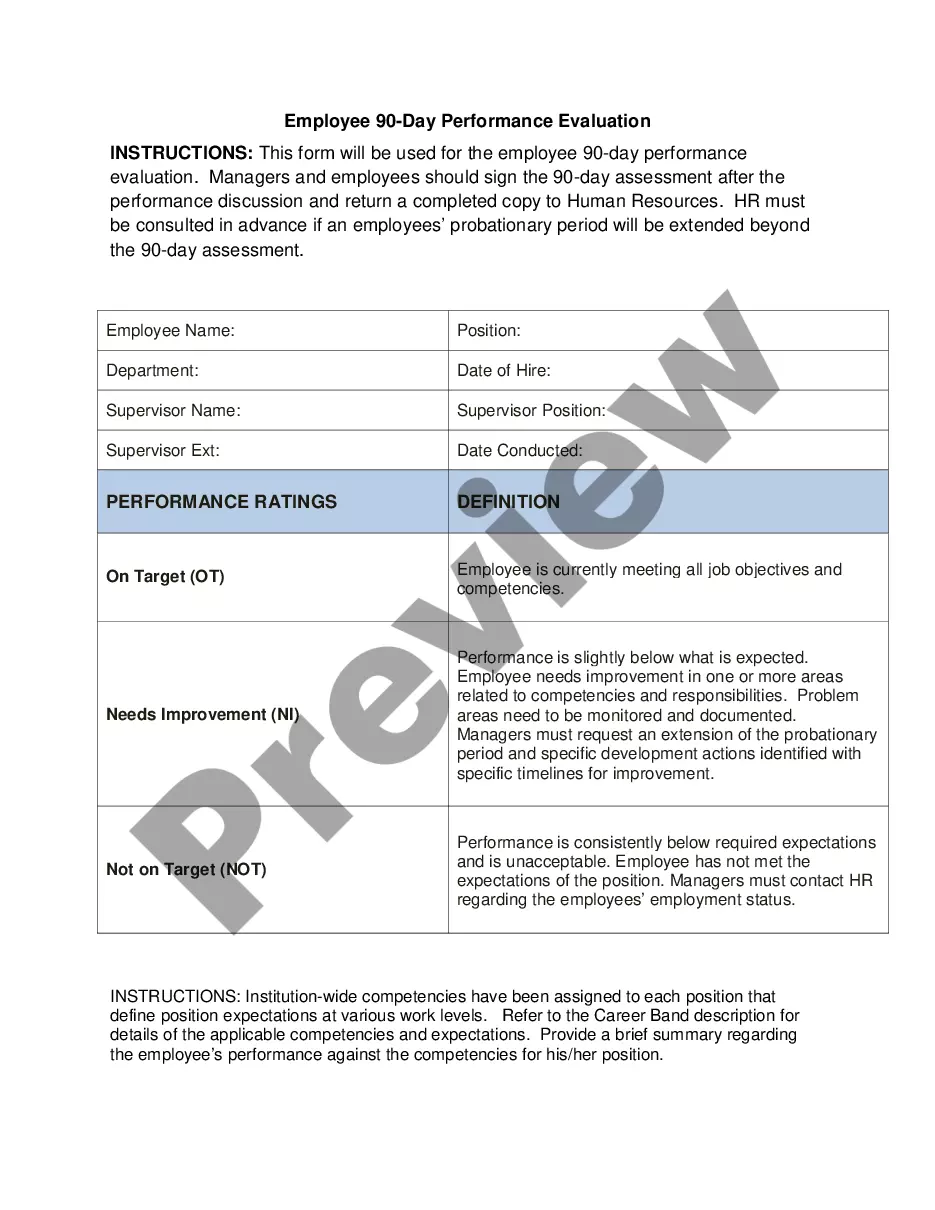

How to fill out a Goodwill Donation Tax Receipt A: Date, Name and Address. This section organizes when a donation was made, who dropped off the donation and your current address. B: Donation Details. C: Tax Year. D. E: Fine Print. F: Goodwill Confirmation. How to deduct your Goodwill donations on your taxes.

You can claim a deduction of up to 60% of your Adjusted Gross Income. If you donated household items in less than good used condition, if the total estimated value is more than $500, you may still take the deduction. However, you should include a qualified appraisal on your return.

Keep Donation Records: Maintain records of all contributions, including bank statements, receipts, and checks. 2. Document Donations: For donations over $250, get a written acknowledgment from the charity. For noncash donations over $500, complete Form 8283 and include an appraisal for items valued over $5,000.

While it's best practice to always send a donation receipt for every gift your organization receives, there are circumstances where a donation receipt is required by the IRS and must meet IRS guidelines, including: When single donations are greater than $250.

You are required to provide this information regardless of the amount of the donation. If you are making a noncash charitable donation you will be required to complete Form 8283: Noncash Charitable Donations and attach it to your tax return if your noncash donation is greater than $500.

Most charitable organizations that run thrift stores have receipts available to print from their websites. You need to make a list of what was donated, and assign the value (the organization cannot value your donation).

However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax deduction. Written records, like check registers or personal notations, from the donor aren't enough proof. The records should show the: Organization's name.