Donation Receipt For In Kind In Hillsborough

Description

Form popularity

FAQ

An in-kind donation of goods refers to the contribution of materials or assets (typically physical) that nonprofits can use to enhance some aspect of their work. Some common examples include: Supplies to distribute to beneficiaries, like the disaster relief items discussed in the introduction.

Employees make regular donations to charity. Charities appealed for donations of food and clothing for victims of the hurricane.

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

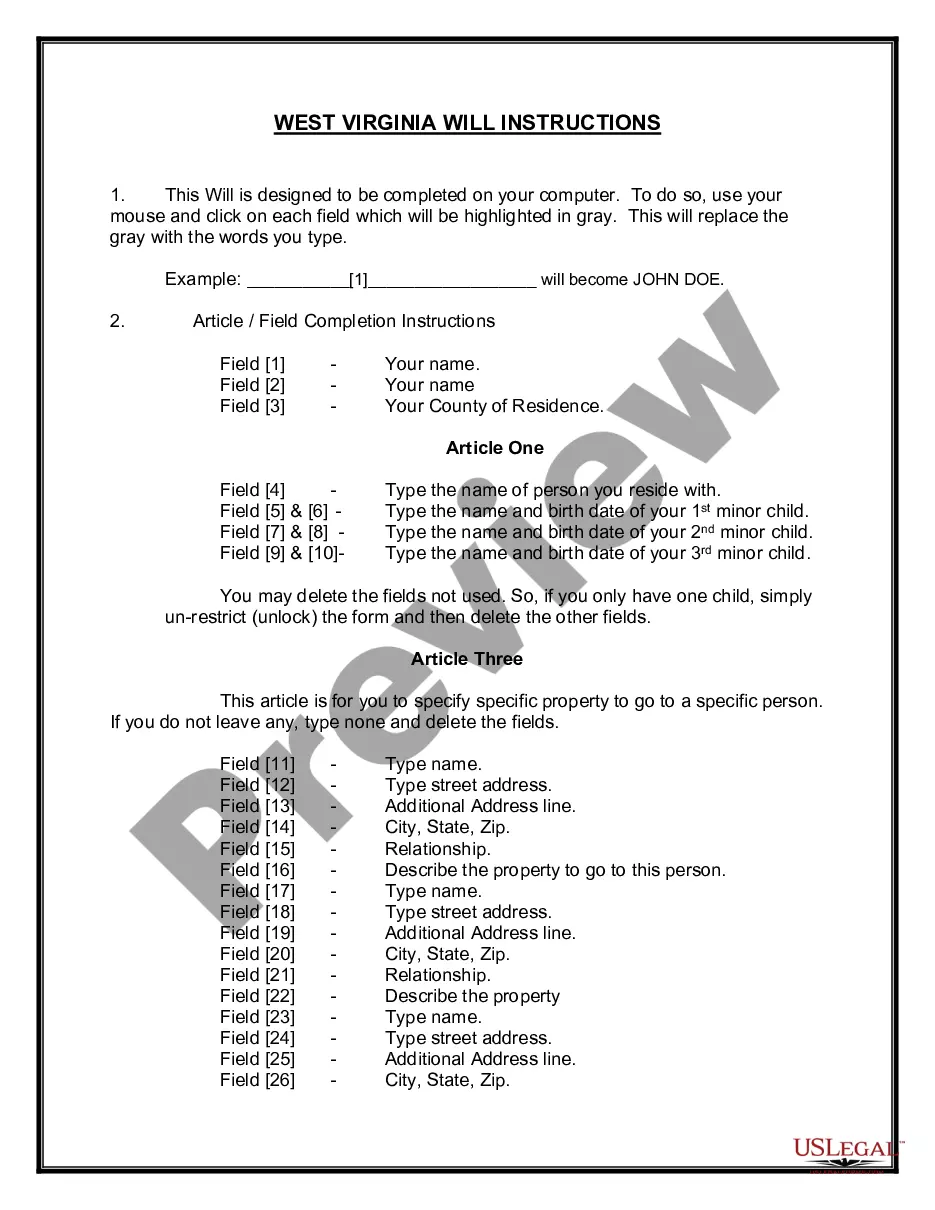

The receipt format for donation requirements is as follows: Donor Information: The name, address, and phone number of the donor. Date of Donation: The date on which you donated. Description of the Donation: A description of the type of donation (monetary or non-monetary)

How to Write an In-Kind Donation Letter that Delights Donors Introduce your organization and its representative. Show how the donation can help solve an issue. Attach a relevant image to make the appeal stand out. Let the donor know how the business will benefit by donating. Say “thank you” up front.

Some common synonyms of donate are afford, bestow, confer, give, and present. While all these words mean "to convey to another as a possession," donate is likely to imply a publicized giving (as to charity).

Unpaid interns or fellows; • donated supplies and loaned equipment; • donated food from food banks, etc.; • donated utilities; • donated or discounted space; transportation services to and from nutrition sites, medical appointments, shopping trips, etc.

A gift in kind is a donation of tangible property, such as an art collection, rare books, academic papers, musical scores, real estate, or other valuables.

Have an item you want to donate? You can drop it off Monday through Saturday, AM – PM at one of our Tampa ReStores located at 8247 N. Florida Ave or at 501 W. Robertson St.

How and When to Record and Report In-Kind Donations Determine the item's fair market value (FMV). Record the in-kind donation. Provide a written acknowledgment to the item's donor. Report the gift on your Form 990.