Donation Receipt Example In Hennepin

Description

Form popularity

FAQ

The same applies to stock gifts/donations. In this case, you should send a donation receipt comprising details such as the ticker symbol, the number of shares, and the donation date. Mentioning the value of the stock is not necessary since a nonprofit is not supposed to be assigning value to stocks or gifts.

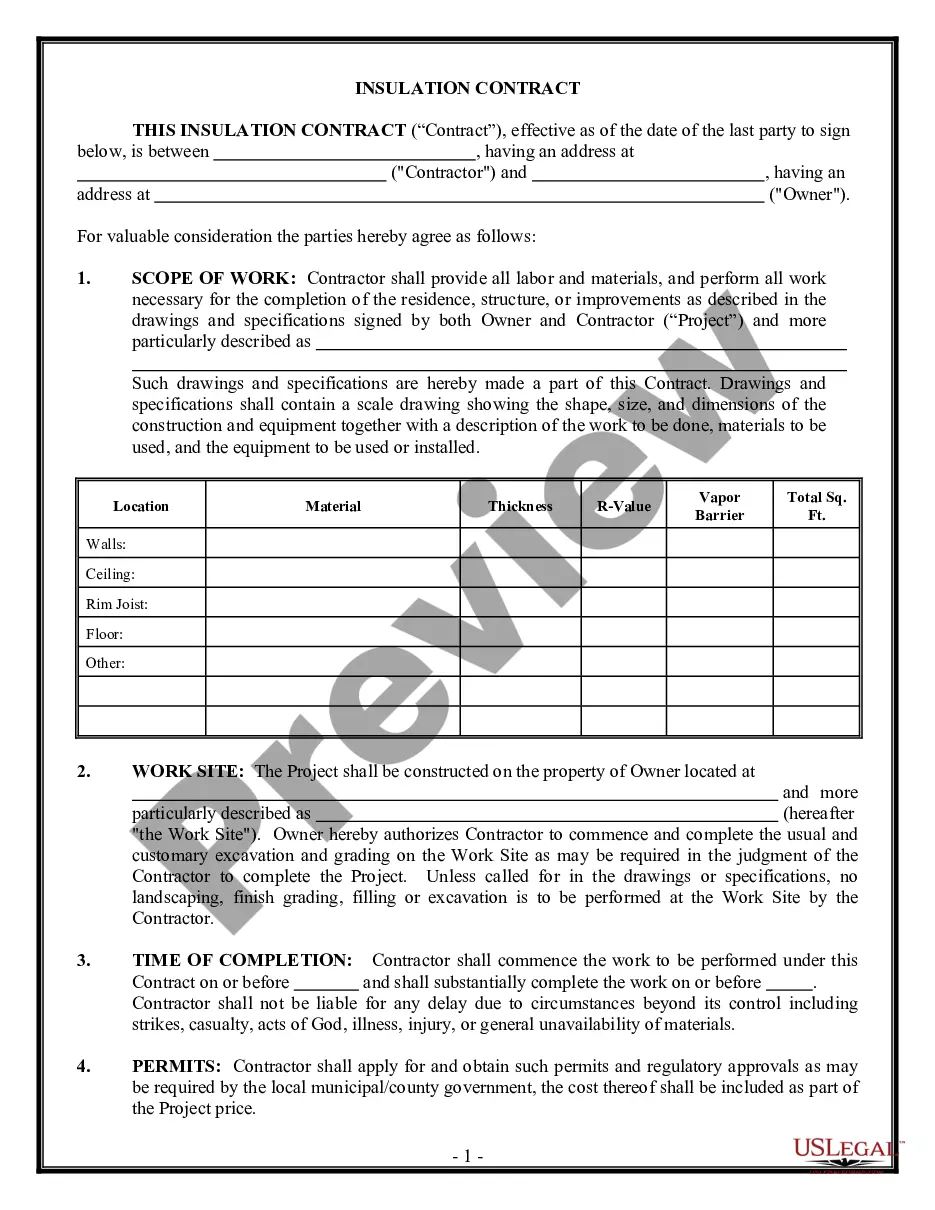

How to fill out a Goodwill Donation Tax Receipt A: Date, Name and Address. This section organizes when a donation was made, who dropped off the donation and your current address. B: Donation Details. C: Tax Year. D. E: Fine Print. F: Goodwill Confirmation. How to deduct your Goodwill donations on your taxes.

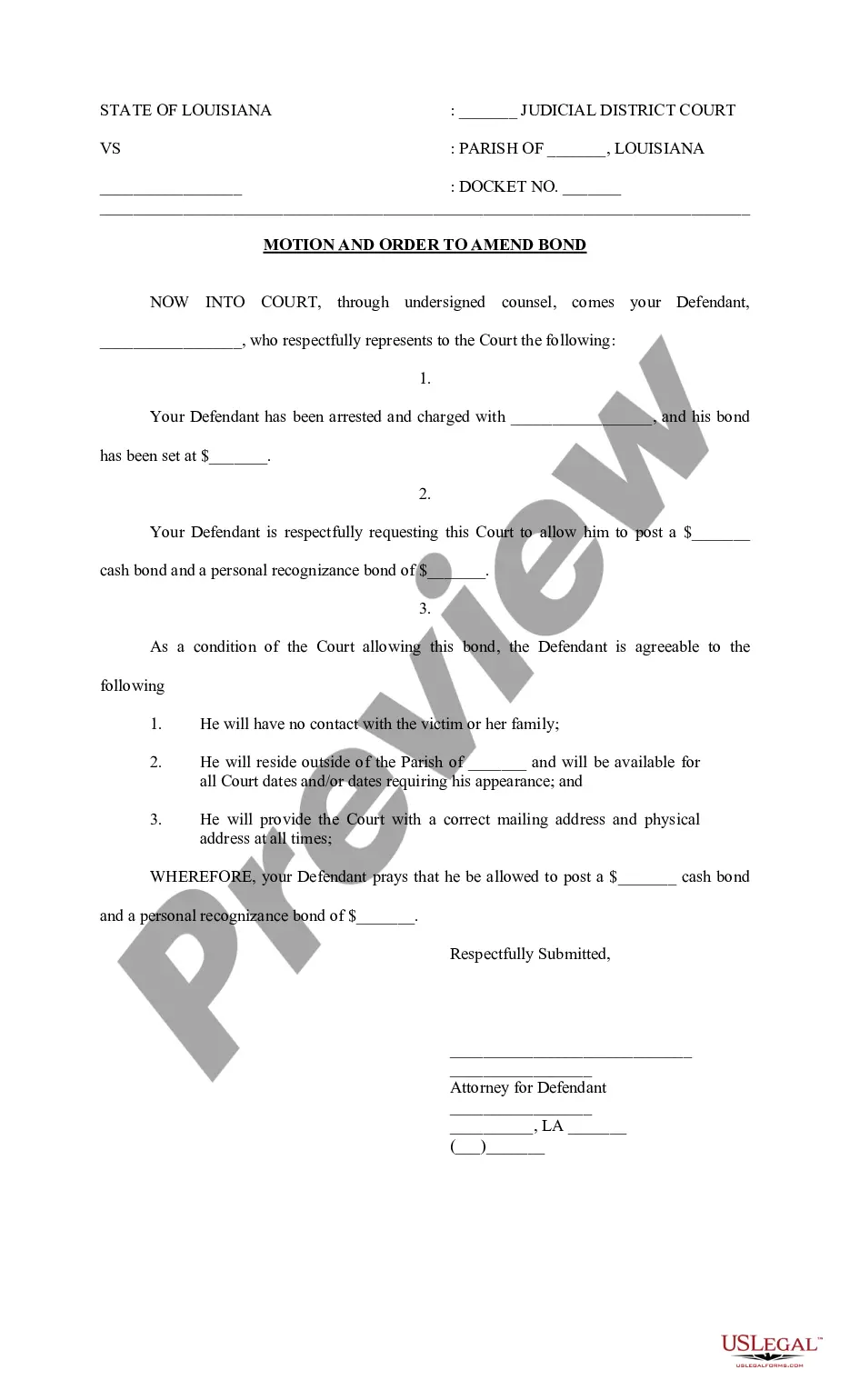

United States. In the United States, tax-exempt organizations, including churches, are required to issue Contribution Statements to donors for any single contribution of $250 or more.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Getting a receipt every time you donate strengthens your tax records if you are audited. If you make a large donation and don't have (or can't find) the receipt, the donation will almost certainly be disallowed on audit. For this reason, it's best to set up a record-keeping system at the start of each year.

Generally, to deduct a charitable contribution, you must itemize deductions on Schedule A (Form 1040). The amount of your deduction may be limited if certain rules and limits explained in this publication apply to you.

The revenue should be reported in the period in which the donation is made and the expense when the donation is used. In the case of a capitalizable item, such as a building or construction equipment, the donation would be recorded as revenue and as an asset on the balance sheet, rather than under expenses.

However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax deduction. Written records, like check registers or personal notations, from the donor aren't enough proof. The records should show the: Organization's name.

In that case, all you need to provide in the donation receipt is the name and EIN of the organization, date of donation, and a description of the donated item. You should also add a note stating that the valuation of the item is the donor's income tax responsibility.