Erisa Retirement Plan Foreign In Harris

Category:

State:

Multi-State

County:

Harris

Control #:

US-001HB

Format:

Word;

PDF;

Rich Text

Instant download

Description

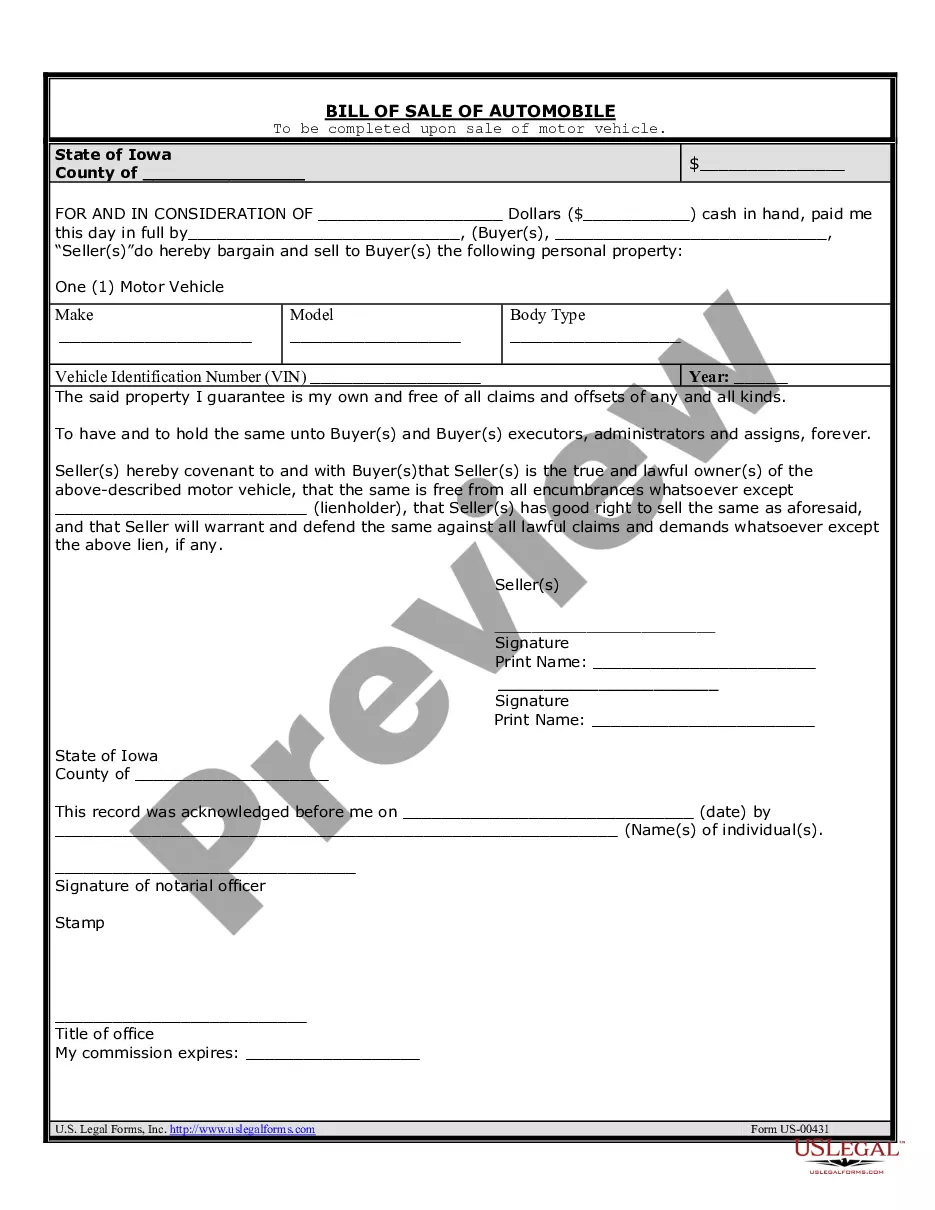

The Erisa retirement plan foreign in Harris focuses on the rights and protections afforded to employees under the Employee Retirement Income Security Act (ERISA). This plan outlines key features such as eligibility criteria, information requirements, and protections against unjust discharge related to pension benefits. Users of this form must understand how to fill it out correctly, providing details on employment history, contributions, and beneficiary information as needed. The form is designed not only for accurately documenting retirement plan details but also to ensure compliance with federal regulations governing pension plans. Attorneys, partners, owners, associates, paralegals, and legal assistants may utilize this form to advise clients seeking to navigate retirement benefits, potentially aiding in claims or disputes with employers who may be withholding benefits. Understanding the intricacies of the ERISA retirement plan foreign in Harris allows legal professionals to better support their clients in maximizing their retirement security and addressing violations of their rights.

Free preview