Payoff Form Statement With Text In Wayne

Description

Form popularity

FAQ

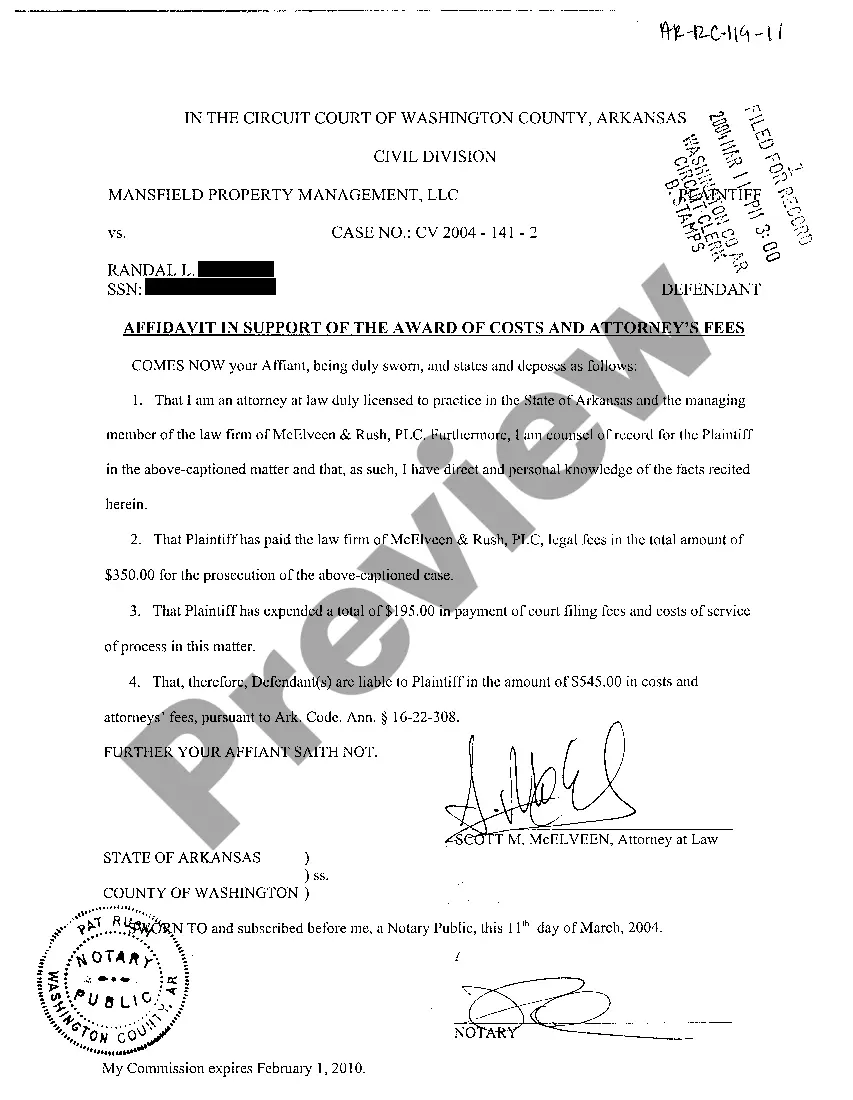

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

Finding your property tax ID number is easier than you might think. If you already own the property, you can find this number on property tax bills, deeds, or title reports. However, for those who do not own the property or need a different approach, many local government websites provide online databases.

These can typically be found through county tax assessor websites or specific online platforms that list properties under tax lien or deed sale.

How do I find the owner of record on a property? The County Clerk's office will have the owner of record for all parcels in Wayne County. You can reach the Clerk's Office at (402) 375-2288, Monday through Friday from a.m.- p.m.

Tax information can be obtained from the Treasurer's Office either by parcel number, address, or owner name. Taxpayers can access tax amounts and taxable values to be used in preparing federal and state tax returns by viewing the information online, visiting the Treasurer's Office, or by phoning 734-722-2000.