Sample Mortgage Statement Format In Virginia

Description

Form popularity

FAQ

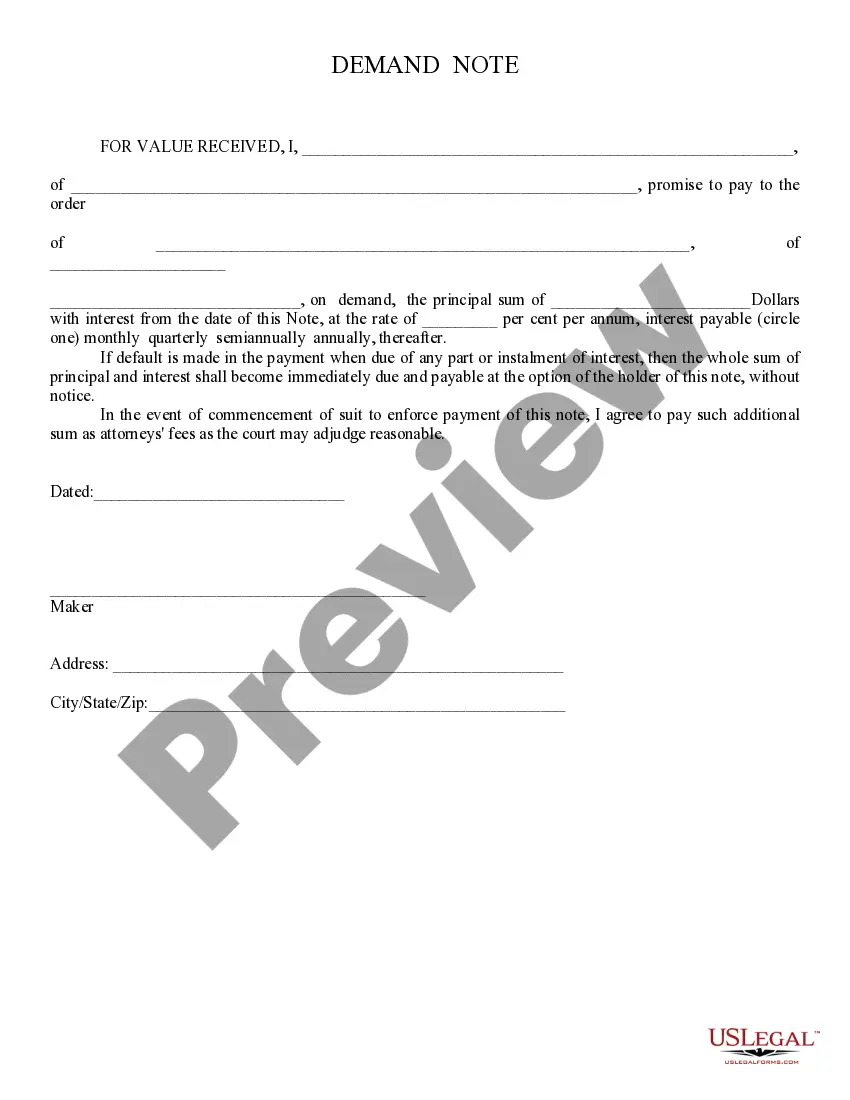

A mortgage statement will show the current mortgage balance, current interest rate, amount remaining on the mortgage term and amortization and the contact information for the mortgage holder. A mortgage statement may also provide a history of payments from the date of the last issuance.

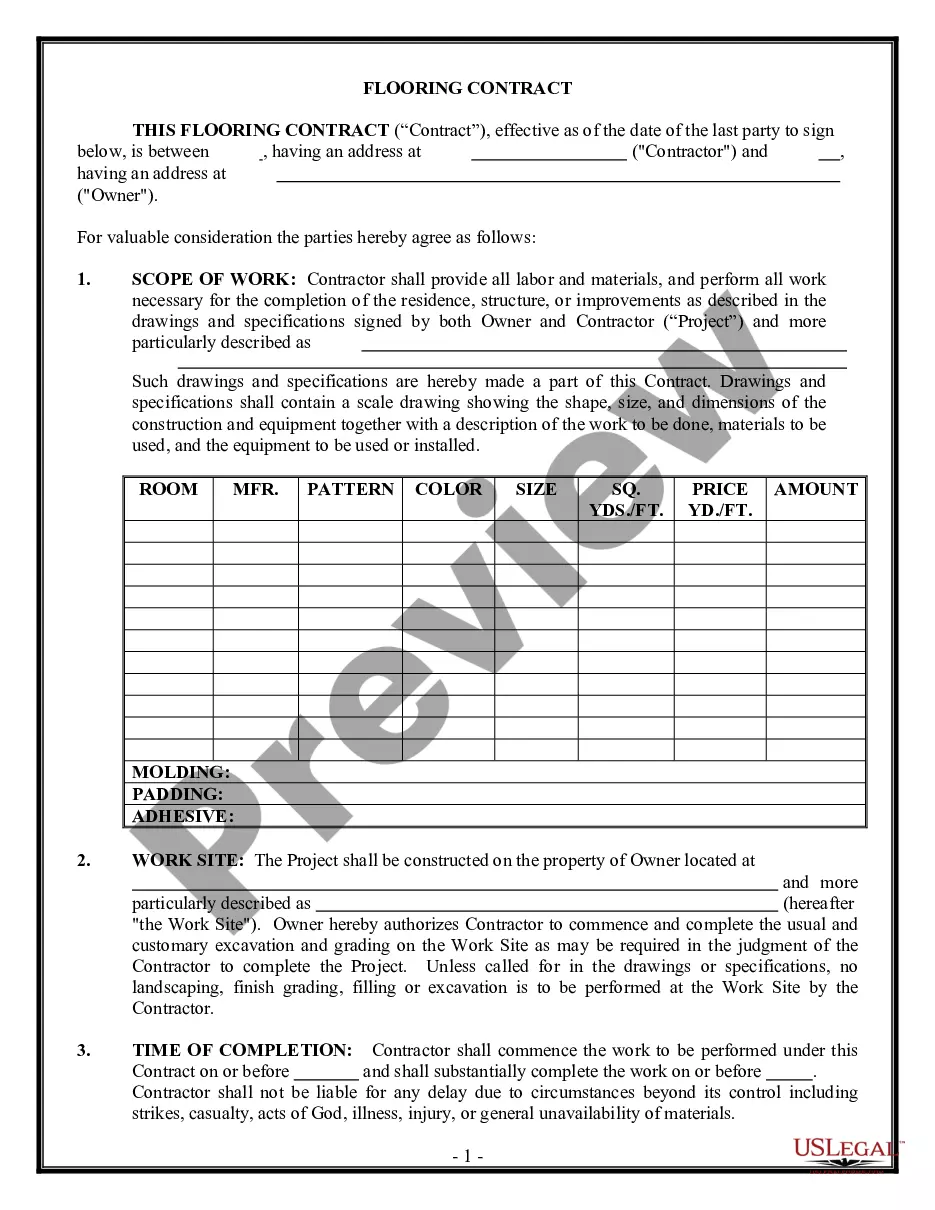

Include details about the property, such as its address, type, and any additional information required by the template. Provide a breakdown of your monthly mortgage payments, including the principal, interest, taxes, and insurance amounts.

The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor and your account number. It should also include an explanation of why you don't see this problem happening again.

Your annual mortgage statement will detail everything about your mortgage, including the: type of mortgage you have. length of your mortgage deal. remaining mortgage term.

You can print a summary of your statement from the Internet Banking mortgage overview screen. You'll need to use a desktop or laptop computer to do this. When you print a statement, you can: Check your current balance.

To begin writing this type of letter, you might explain the situation or circumstance and any contributing factors. Consider including information to answer questions like: What happened? How did it happen?

- Briefly introduce yourself and state the purpose of the letter. - Explain your situation and why you need financial support. - Provide any relevant details, such as your financial circumstances, goals, and how the funds will be used. - Thank the recipient for considering your request.

Tips for writing a letter of explanation Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. If they are not resolved, explain that as well. Detail why problems won't happen again.

You'll also want to include the following elements: Your name, address, and phone number. The lender's name, address, and phone number. The mortgage application number. Your explanation, which should refer to the attached documents that support it. Your signature and the date.

Unexplained income and spending Unexplained deposits in your bank statement may be flagged as illegitimate income sources. Strange expenses will also raise questions because a lender may suspect you are hiding something. Unexplained expenditure also suggests that you are not in control of your finances.