Sample Mortgage Statement For Mortgage In Virginia

Description

Form popularity

FAQ

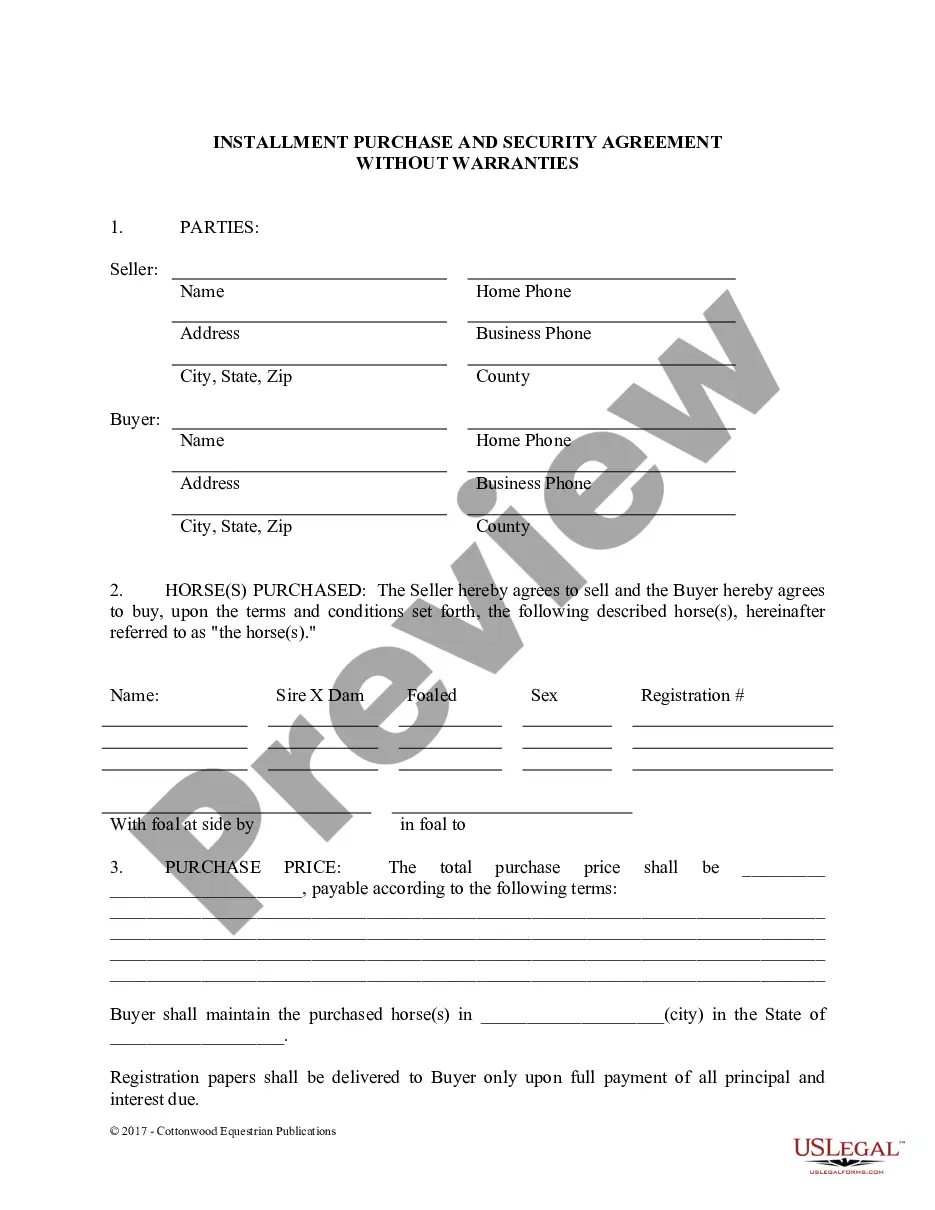

Include details about the property, such as its address, type, and any additional information required by the template. Provide a breakdown of your monthly mortgage payments, including the principal, interest, taxes, and insurance amounts.

Your annual mortgage statement will detail everything about your mortgage, including the: type of mortgage you have. length of your mortgage deal. remaining mortgage term.

A mortgage statement is an accounting of all of the details about your mortgage, including the current balance owed, interest charges, interest rate changes (if you have an adjustable-rate mortgage) and a breakdown of your current and past payments.

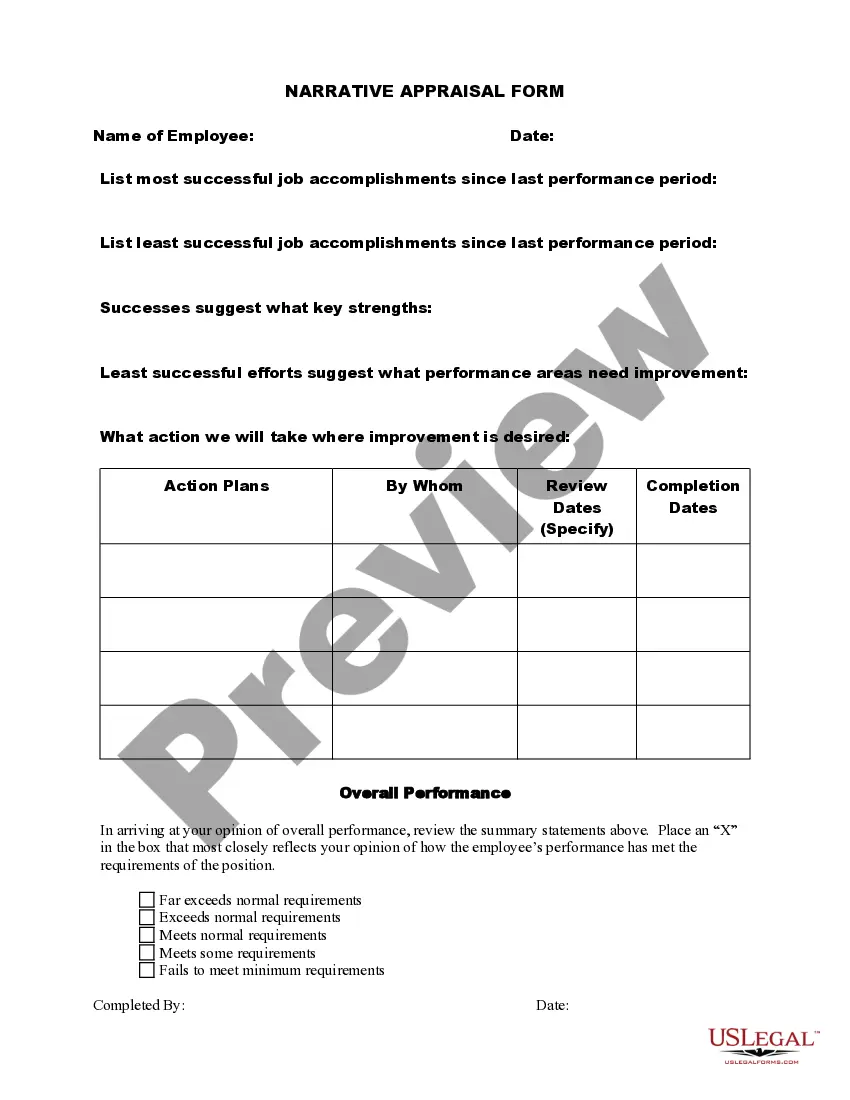

Unexplained income and spending Unexplained deposits in your bank statement may be flagged as illegitimate income sources. Strange expenses will also raise questions because a lender may suspect you are hiding something. Unexplained expenditure also suggests that you are not in control of your finances.

Tips for writing a letter of explanation Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. If they are not resolved, explain that as well. Detail why problems won't happen again.

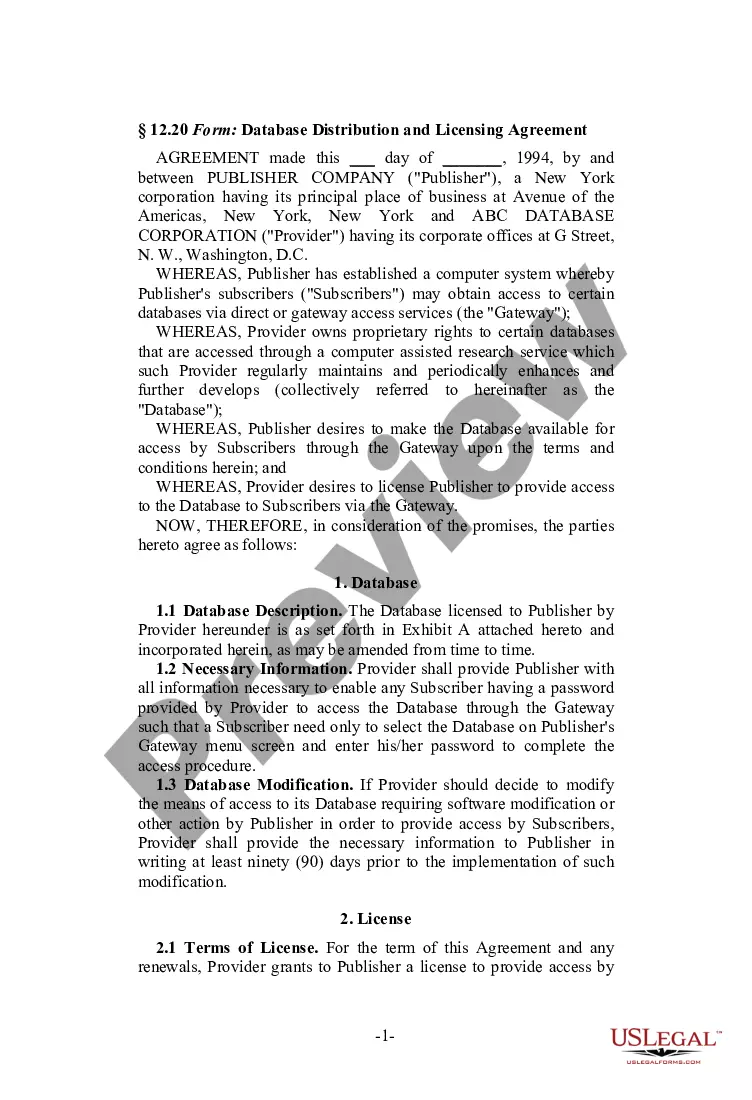

A Guide to Accessing Mortgage Statements Online from Major Banks Log into the TD account online or on the mobile app. From the slide-out menu, select my accounts. Select your mortgage account (your mortgage details will be displayed). Select the summary tab. Select which statement you want to print or download.

Mortgages and related documents, including mortgage notes, are generally considered public records.

If you need another copy of your mortgage statement, you can get one through contacting your lender. Many lenders offer access to past statements through an app or online banking portal. Alternatively, you may be able to call your lender or visit a branch to get a copy.