Payoff Statement Template With Credit Card In Travis

Description

Form popularity

FAQ

Change PIN To change your PIN, please call (707) 449-4700 or (800) 578-3282. After logging in, select the pound key (#) followed by Option 8 and follow the menu instructions. If you do not have your member number, please call (800) 877-8328 or visit any branch location for further assistance.

Members now have access to electronic statements for their Trust and Business Accounts through their personal account log in via Online Banking. Simply click on the Estatements tab to get started.

Get a direct deposit form from your employer. Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one.

If you would like to delete your online profile with Travis Credit Union, please call us during normal business hours at 800-877-8328. It may take up to two weeks to remove access once your request is received.

TCU members can enroll in Travis Credit Union's Direct Deposit program through their employers by downloading the Direct Deposit Enrollment Form. Visit our Other Banking Services page to download the form or click the following link: Direct Deposit Form .

Which debt solutions write off debts? Bankruptcy: Writes off unsecured debts if you cannot repay them. Any assets like a house or car may be sold. Debt relief order (DRO): Writes off debts if you have a relatively low level of debt. Must also have few assets. Individual voluntary arrangement (IVA): A formal agreement.

The first step to paying off debt is understanding exactly what you owe. Take time to gather all your credit card statements and calculate your total debt, along with the interest rates for each card. Create a Debt Inventory: List all your credit card balances, due dates, interest rates, and minimum payments.

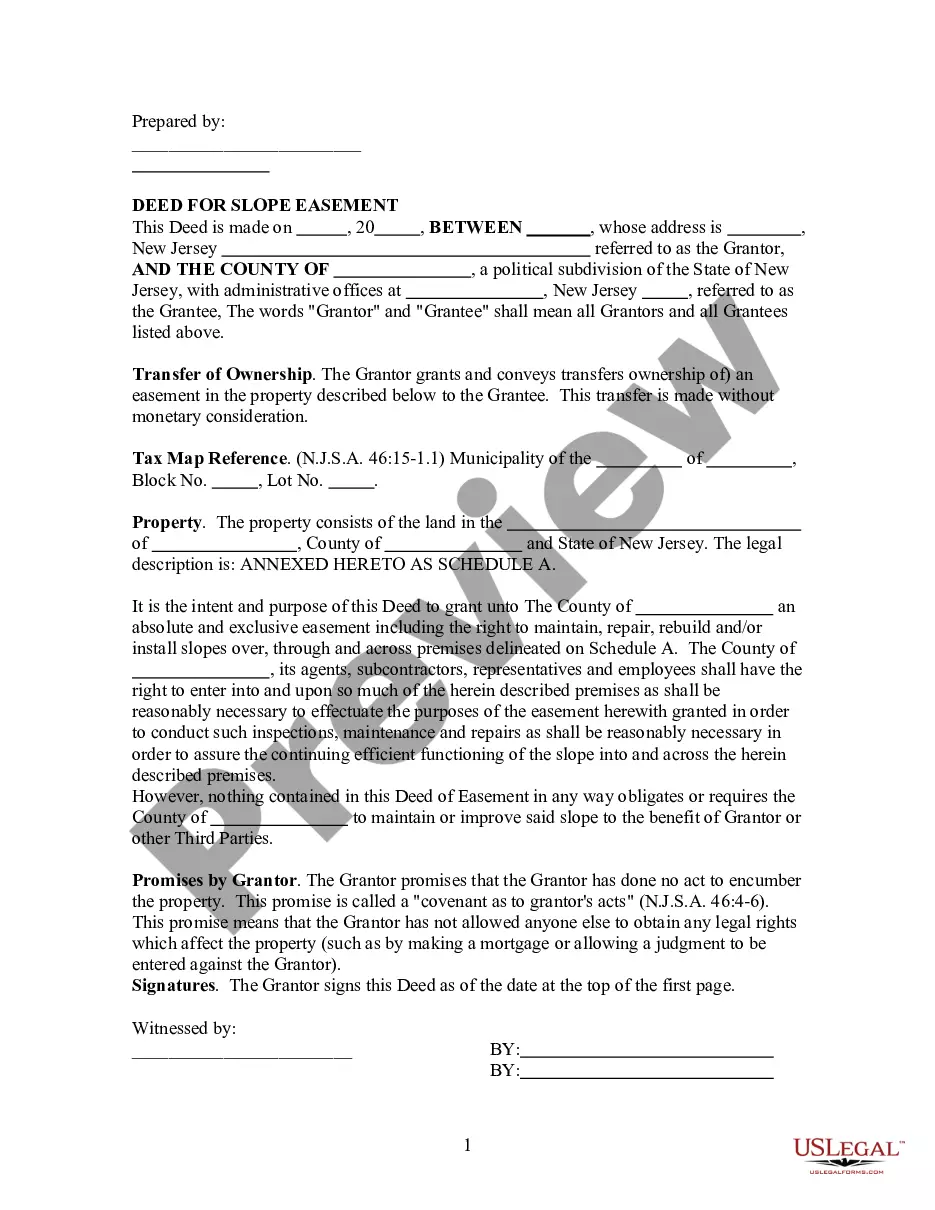

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Paying your credit card early does not directly affect your credit score, but can still positively influence it.