Mortgage Payoff Form With 2 Points In Tarrant

Description

Form popularity

FAQ

Home prices in Texas have reached an all-time high, and so have mortgage payments. The average monthly mortgage payment is now $2,547, and that is a 15% increase from August and almost 50% higher than in 2021 when the average payment was $1,698.

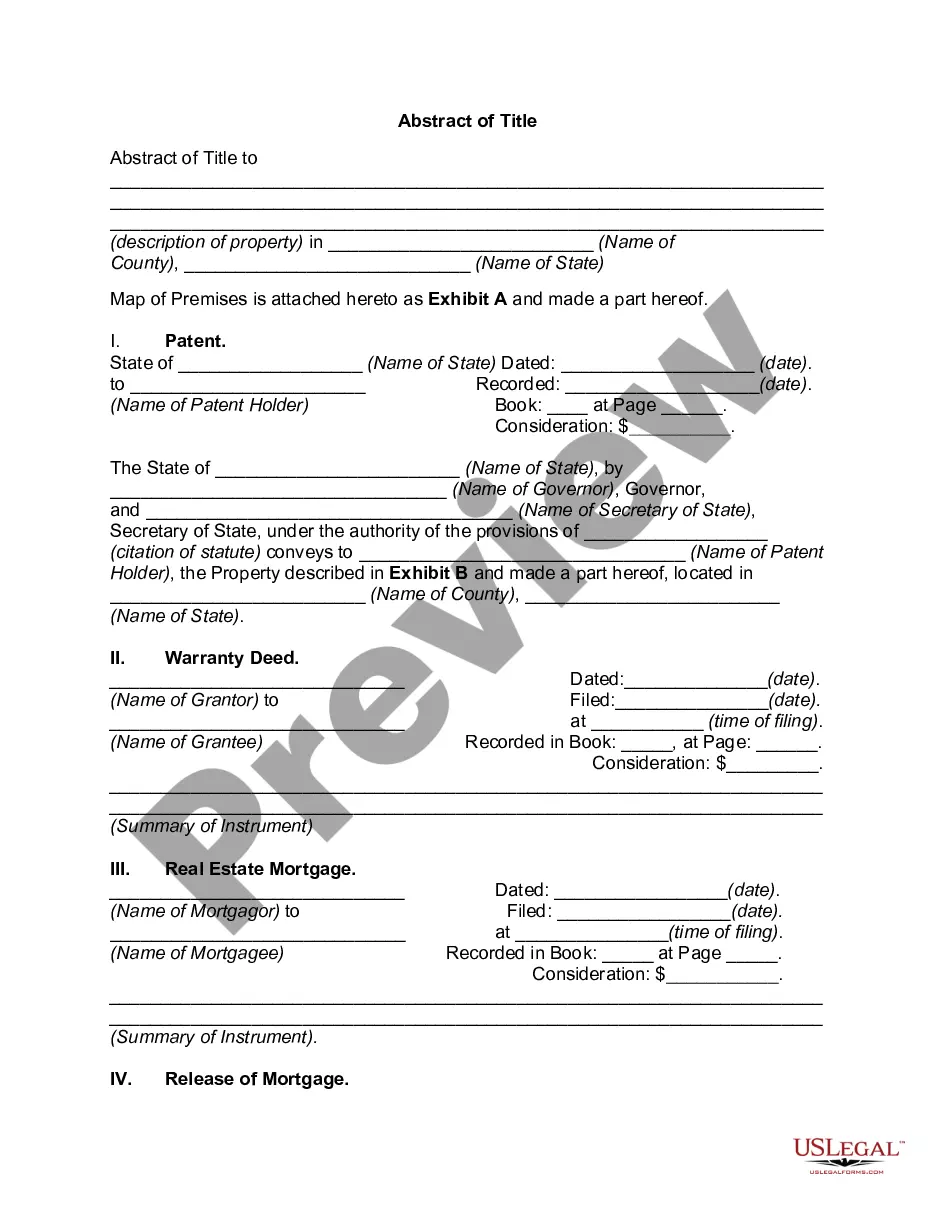

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

Ing to the Texas Comptroller's Office, the following are the counties with the highest property tax rates in Texas: Fort Bend County – 2.48% Tarrant County – 2.37% Harris County – 2.31% Williamson County – 2.22% Collin County – 2.19% Dallas County – 2.18%

Property taxes in NJ are still the nation's most expensive.

Property taxes in NJ are still the nation's most expensive.

A property owner must apply for an exemption in most circumstances. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing an exemption application is before May 1.

Limited State Income Tax and Reliance on Property Taxes: One of the primary factors behind high property taxes in Texas is the absence of a state income tax. Unlike other states that collect income taxes to fund public services and infrastructure, Texas relies heavily on property taxes as a primary source of revenue.

Eliminating property taxes would be prohibitively expensive. Texas would need to spend about $81.5 billion a year to get rid of property taxes collected by school districts, cities and counties, the Legislative Budget Board told Senate lawmakers last year.

A notable exception is Texas, which ranks seventh overall, with an effective property tax rate of 1.356%. Drilling down to the county level, disparities are even more pronounced. Salem County, NJ has the highest effective tax rate in the country at 2.382%, followed by Monroe County, NY, at 2.314%.