Sample Payoff Letter For Private Mortgage In Suffolk

Description

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

Section 1921(1) of the Real Property Actions and Proceedings Law requires any mortgagee, including a county department of social services, upon payment of a mortgage and upon the request of the mortgagor or any other person interested in the real property, to execute a satisfaction piece certifying that the mortgage ...

If you wish to obtain a Payoff Letter that outlines your financial obligation to satisfy your HPD mortgage or are seeking a Satisfaction of your HPD mortgage, please complete the Mortgage Payoff / Satisfaction / Release Request Form and submit your request via email to mtgsatisfact@hpd.nyc.

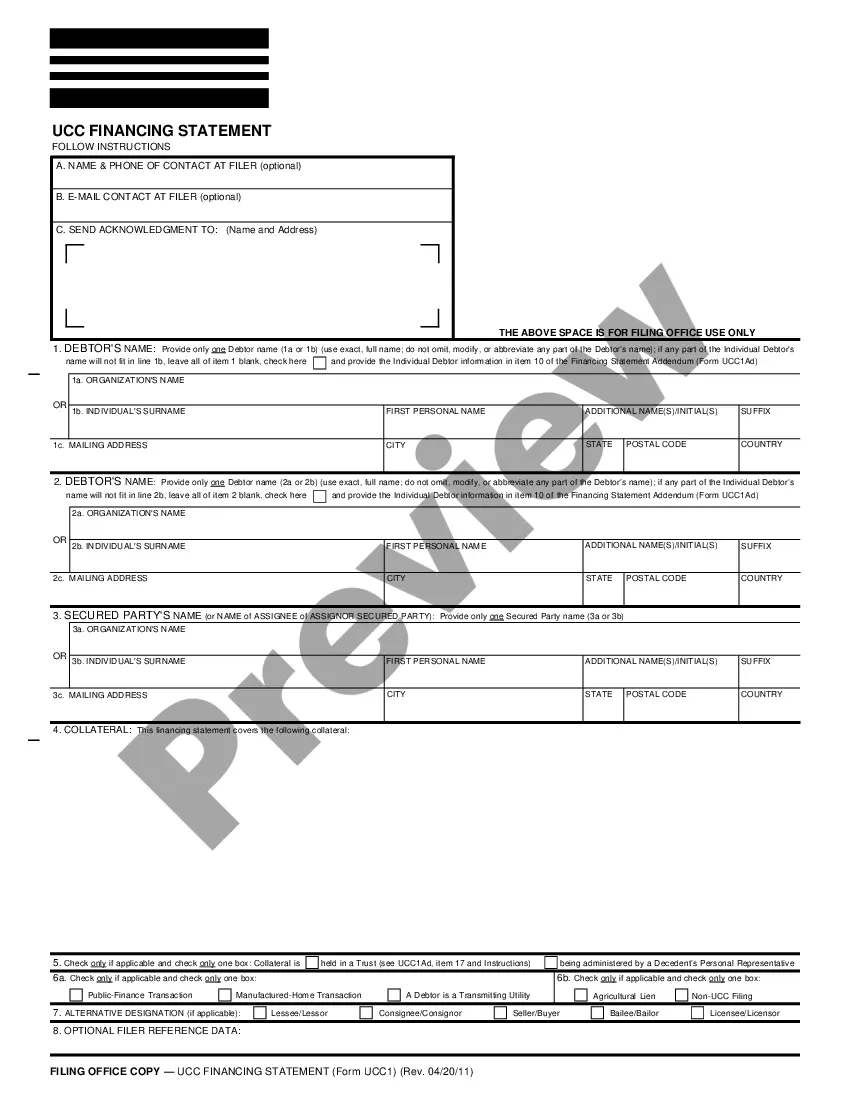

If a Transcript of Judgment has been filed with the County Clerk, once the Debtor pays off the Judgment, the Creditor has a legal responsibility to prepare and sign a Satisfaction of Judgmentfor the benefit of the Debtor, so that all liens and record of Judgment can be removed from the County Clerk's office.

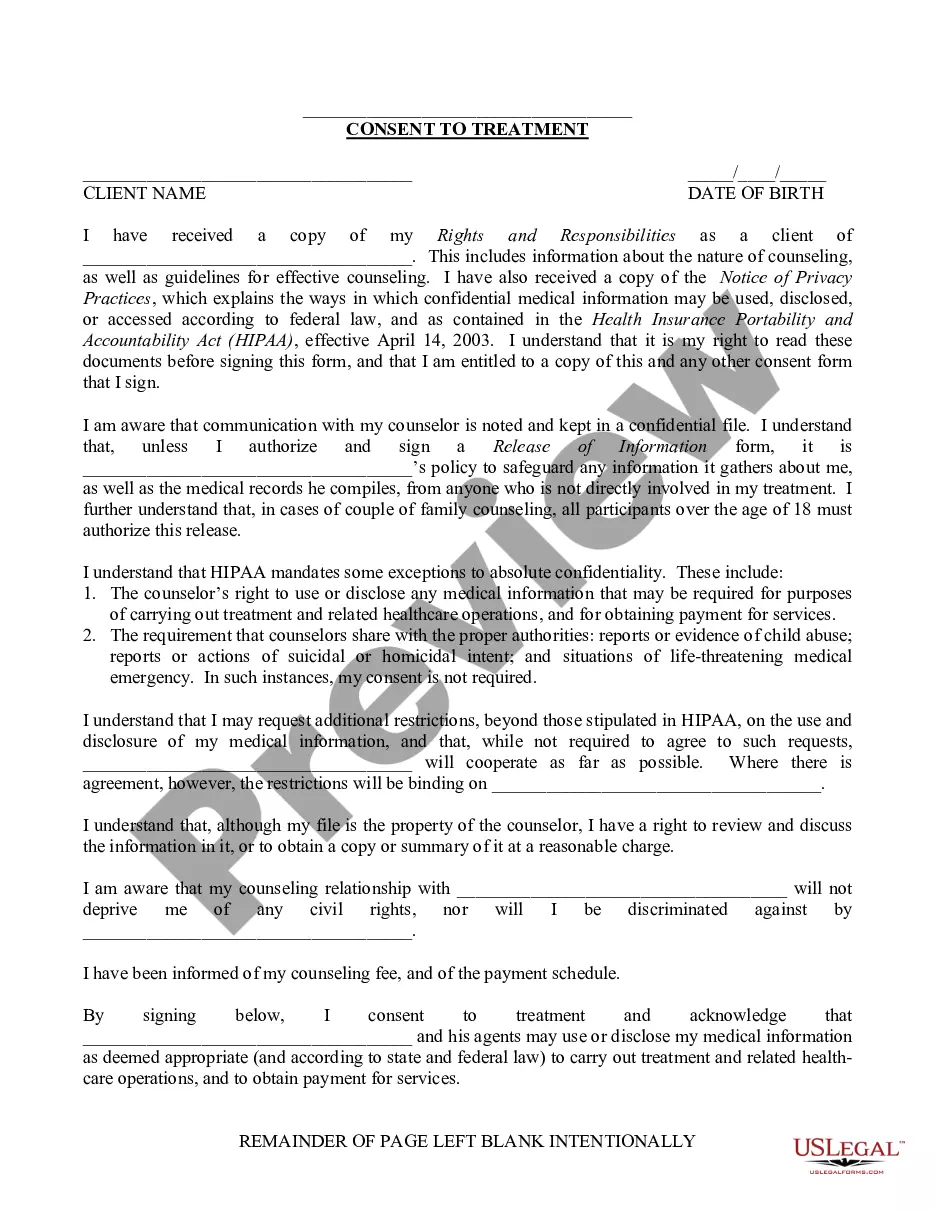

All parties to the original debt instrument normally execute a Payoff Letter before it becomes binding. The final version of the document often reflects specifics of the parties' negotiations. Payoff Letters provide detailed terms and procedures regarding the payoff process.

The letter of intent gives the mortgage lender more certainty about your income and the options for paying the mortgage. With an 'employer statement of intent', or employer's statement, there is a chance that you can also take out a mortgage without a permanent contract.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.