This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Sba Loan Agreement Without Interest In Alameda

Description

Form popularity

FAQ

The Stand-by Arrangement (SBA) provides short-term financial assistance to countries facing balance of payments problems. Historically, it has been the IMF lending instrument most used by advanced and emerging market countries.

A wide range of banks are SBA-approved lenders and offer SBA loans. Based on data from fiscal year 2025, some of the top bank lenders that issue 7(a) loans include Huntington National Bank, Newtek Bank, Northeast Bank, Live Oak Bank, JPMorgan Chase Bank, TD Bank, BayFirst National Bank and Celtic Bank.

Individuals who own 20% or more of a small business applicant must provide an unlimited personal guaranty. SBA Lenders may use this form.

Like collateral, a personal guarantee is a form of security for the lender. The SBA considers personal guarantees as separate from collateral requirements. As a result, most SBA loans will require a personal guarantee in addition to collateral.

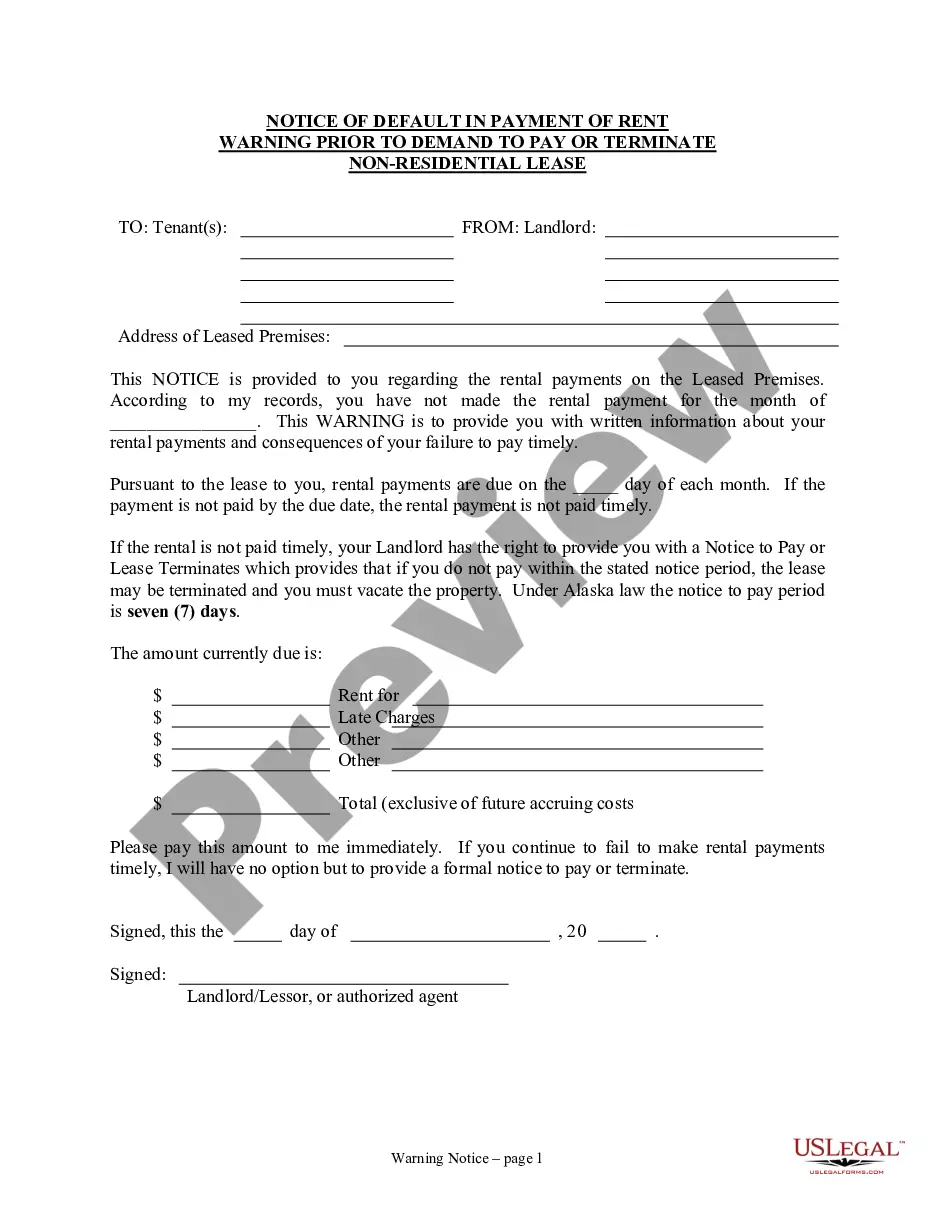

This is a standard form of notice of default and demand for payment provided by a lender to a borrower and a guarantor, if applicable, when a borrower is in default under its mortgage and the lender is ready to accelerate its mortgage and demand repayment.

Ing to the SBA Form 1086, non-PPP loans and payments are due at the Fiscal and Transfer Agent (FTA) on the third calendar day of the month, or the next business day if the third is not a business day. The SBA allows a grace period of two business days after the due date.

The inflation adjustment increases the size standard's level for tangible net worth to $20 million and for net income to $6.5 million. SBA is also adopting, as proposed, the inflation-adjusted thresholds applicable to the statutory ( print page 11707) limits for contract size under the SBG Program.