Loan Payoff Letter Sample With Payment In Suffolk

Description

Form popularity

FAQ

A tax lien is a legal claim against real property for unpaid municipal charges, such as property taxes, housing maintenance, water, sewer, demolition, etc. An owner whose property is subject to a tax lien sale will receive a lien sale notice and the lien sale list will be published publicly.

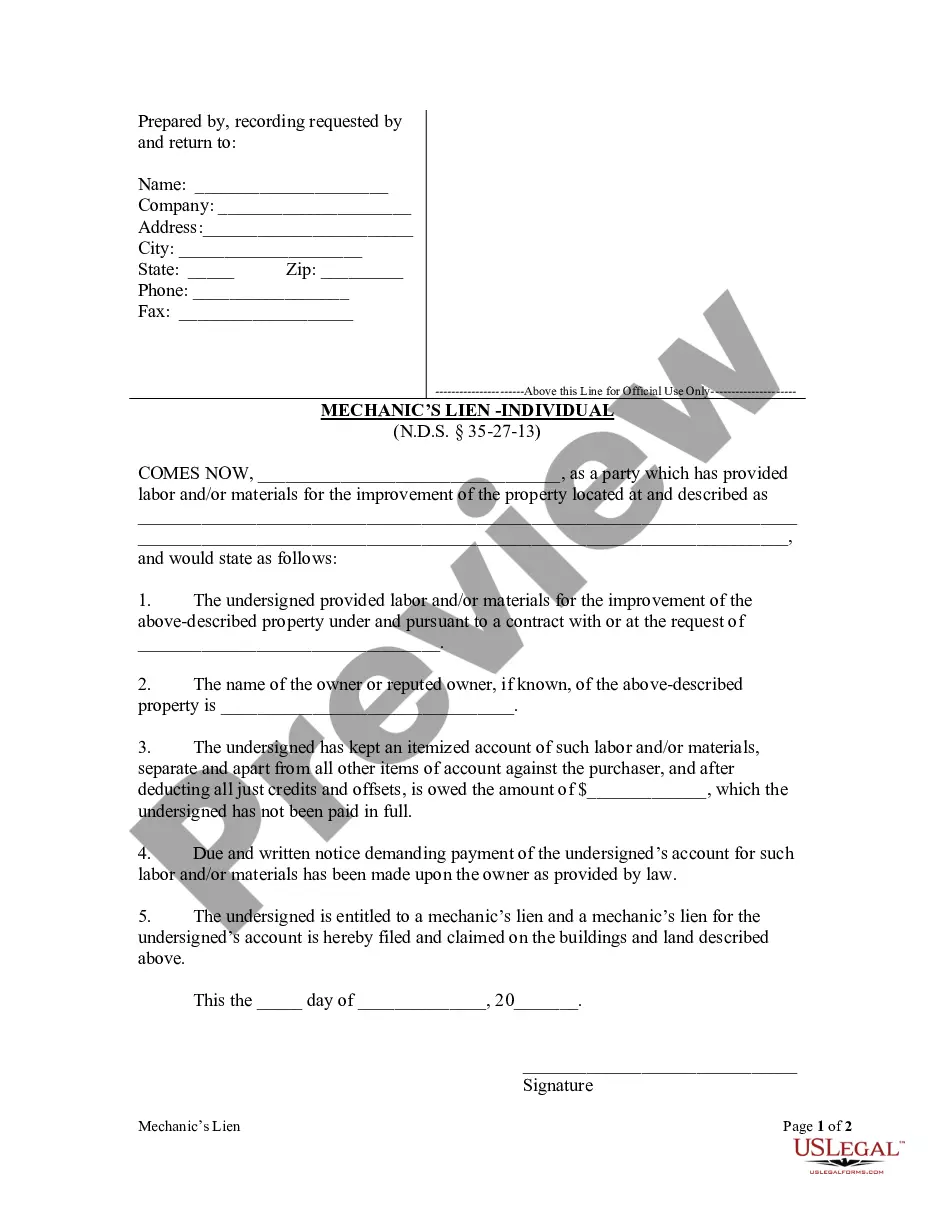

What are Suffolk County's requirements for recording a mechanic's lien? Liens must include your name and other basic information. Next, the property owner's information is required. You'll also need to provide the hiring party's information. Provide a statement of the labor and materials required for the project.

All tax liens of tax districts which become liens against a parcel of real property in the same calendar year shall have priority over all tax liens of preceding years against such parcel except that where a general, special or local law provides that a tax district holding and owning a tax lien for levies imposed by ...

New York State tax warrants expire after 20 years. Importantly, the statute of limitations period starts to run on the first day a tax warrant could have been filed by the Tax Department, not when the warrant was actually filed.

A lien is a legal claim against real property for unpaid property taxes or other property charges, including the interest due on the taxes and charges. The sale will transfer the unpaid liens to an authorized buyer.

A filed tax warrant creates a lien against your real and personal property, and may: allow us to seize and sell your real and personal property, allow us to garnish your wages or other income, affect your ability to buy or sell property, or. affect your ability to obtain credit.

Mechanics liens in NY must be filed in the clerk's office of the county where the property is located. Note that your lien document must also comply with any specific margin requirements that a particular county may have, as well as potentially requiring a county-specific cover page.