Lien Release Letter For Property In Queens

Description

Form popularity

FAQ

Regular: After your request is received Lien-Pro will process the discharge paperwork and submit it to land titles. Confirmation of removal via our online account is generally given within 5-10 business days. Lien-Pro will provide you with registration confirmation to prove the lien has been removed from the property.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Information on liens on a property in New York may be available through: County Tax Assessor's Office. Government agencies websites (such as the IRS) Public notice through local media or online announcements. Real estate professionals. Legal professionals, and. Online property search services.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

So the property can move into escrow how long does removing a lien take approximately five businessMoreSo the property can move into escrow how long does removing a lien take approximately five business days. That's it to get your own questions answered just visit the link in the description.

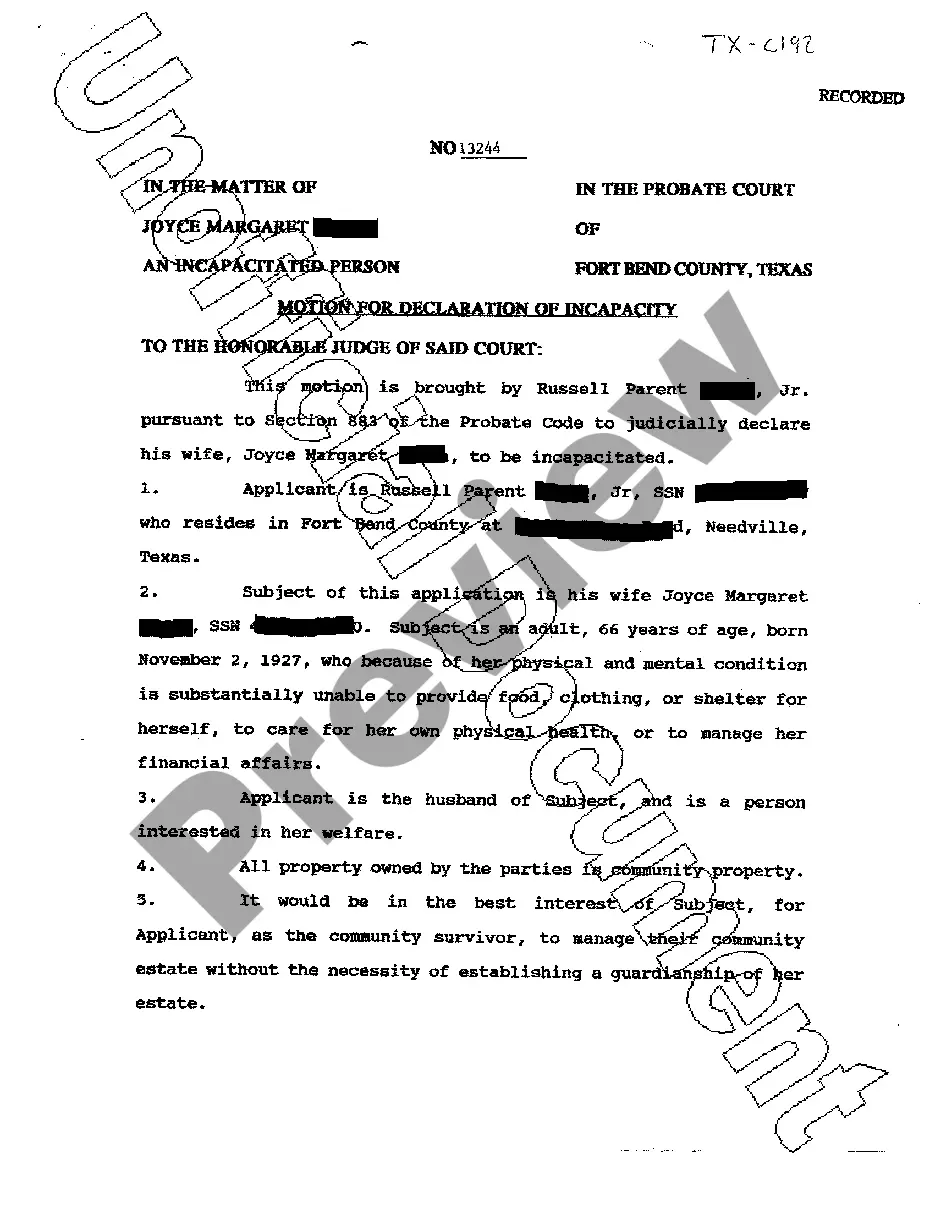

The application must be made upon a verified petition accompanied by other written proof showing a proper case therefor, and upon the approval of the application by the court, justice or judge, an order shall be made discharging the alleged lien of record.

Obtain a Court Order – At times, liens are obtained through fraud, coercion, bad faith, or other illegal means. If you believe your lien is not valid and the creditor will not rectify the situation, you can file a motion in court and ask a judge to remove the lien.

If you believe your lien is not valid and the creditor will not rectify the situation, you can file a motion in court and ask a judge to remove the lien. This can be difficult to prove, so clear evidence will be required.

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.