Mortgage Payout Statement Template In Phoenix

Description

Form popularity

FAQ

Generally, yes. They are public record and subject to public scrutiny for a variety of reasons, starting with the fact that creditors need to know whether the property is subject to judgment or an exposed asset.

Two popular options include: Call – Your mortgage company can give you your mortgage balance over the phone. Simply call and ask. Go online – Your mortgage company website will probably show your mortgage balance.

There are two ways a Proof of Claim may be filed with the court: by mailing or delivering a paper copy of the Proof of Claim form to the Clerk's Office in Phoenix, Tucson or Yuma; or by using our online Electronic Proof of Claim (ePOC) application.

The best way to get the accurate payoff amount is to contact your lender.

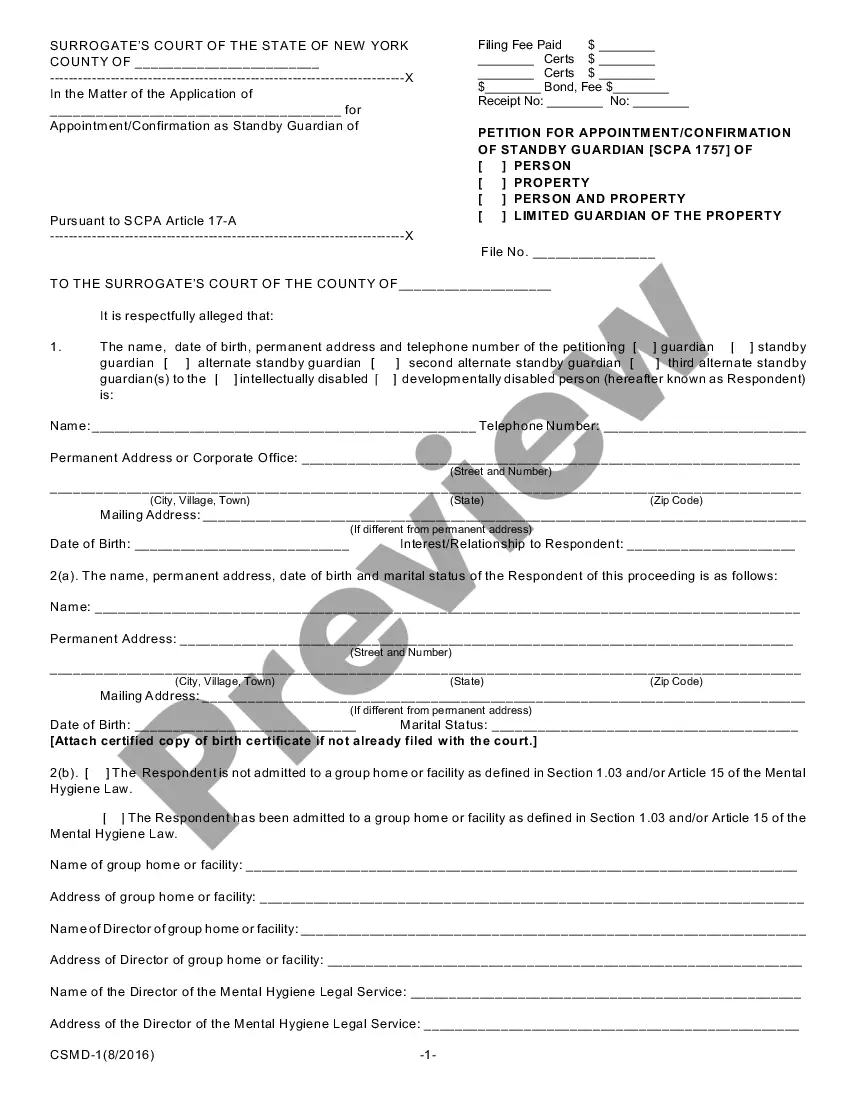

This is a standard form of mortgage payout statement provided by a lender to a borrower. This mortgage payout statement sets out the monies owed by the borrower to the lender as of the date of the statement. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Include details about the property, such as its address, type, and any additional information required by the template. Provide a breakdown of your monthly mortgage payments, including the principal, interest, taxes, and insurance amounts.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.