Mortgage Payoff Statement With Credit Card Calculator In Phoenix

Description

Form popularity

FAQ

Here are some strategies for building your equity and paying off your mortgage faster. Refinance your mortgage. Make larger mortgage payments. Make one extra payment each year. Switch to biweekly mortgage payments, Use gifts, bonuses and windfalls.

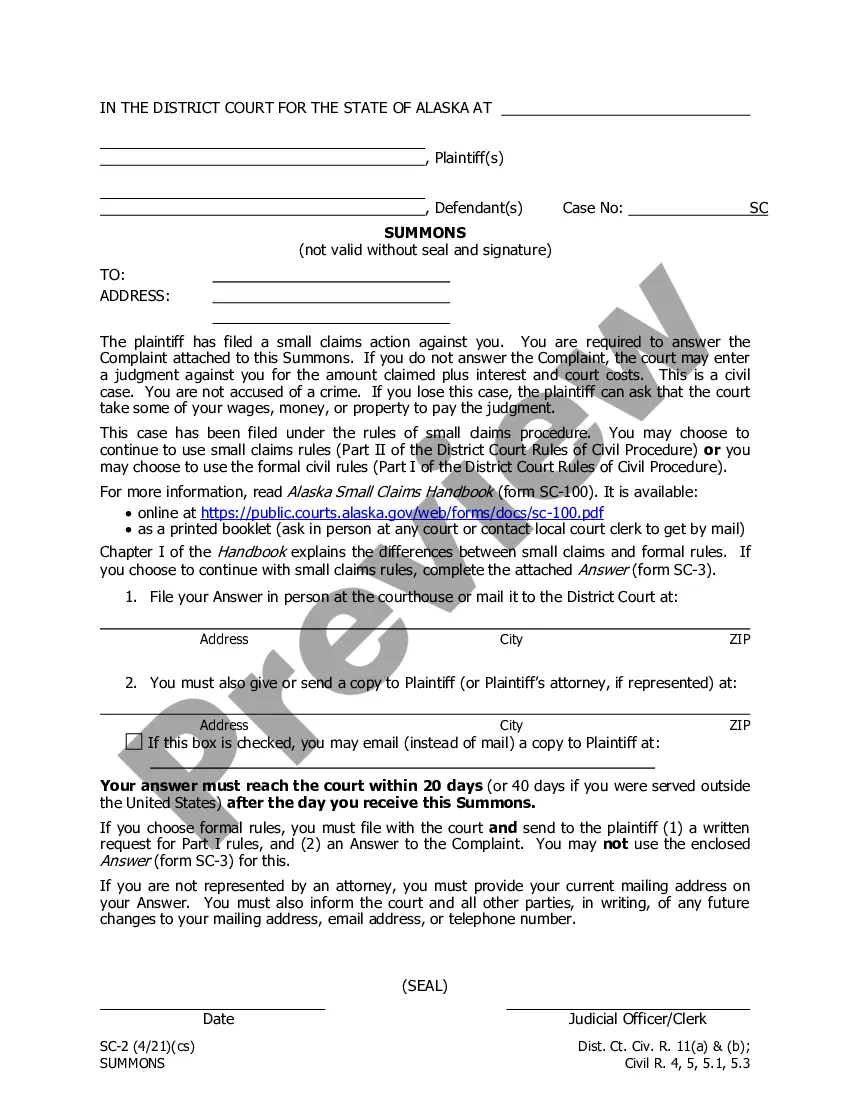

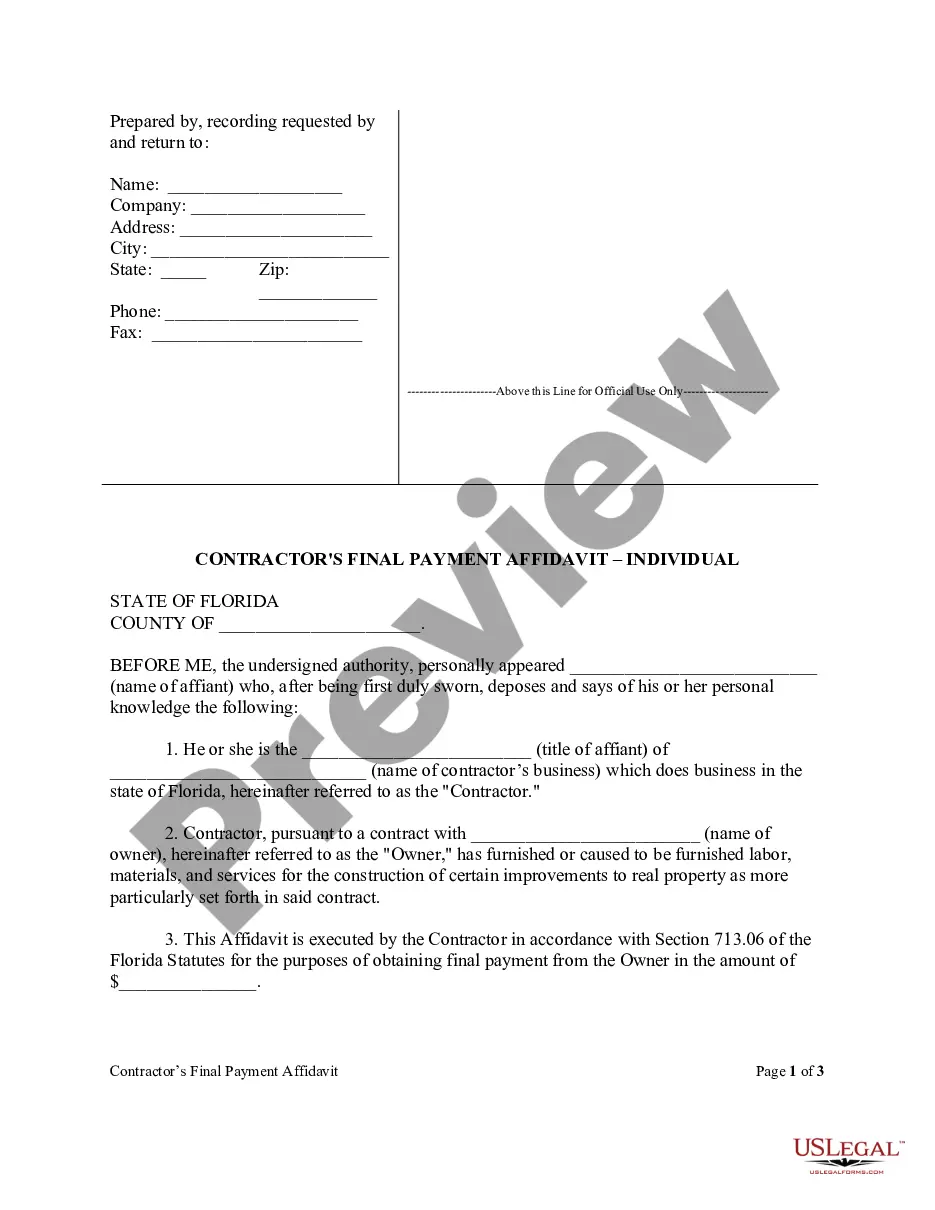

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

A 100K mortgage payment at 7% interest on a 30-year term is $665.30. For this payment to be less than 28% of your monthly income, your monthly income needs to be over $2,376, assuming you have no debt.

The typical monthly repayment for a £200,000 mortgage is £1,188. This calculation is based on an average interest rate of 5.2% as of September 2024 over a 25-year term, with total repayments amounting to £356,400. Your exact payment may vary depending on the interest rate, mortgage term, and specific mortgage type.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Just months after launching its online mortgage tool, Google (NASDAQ: GOOG) is now shutting down the service along with other comparison-shopping services, citing the endeavor did not meet the company's expectations, ing to multiple reports.

Two popular options include: Call – Your mortgage company can give you your mortgage balance over the phone. Simply call and ask. Go online – Your mortgage company website will probably show your mortgage balance.