Loan Payoff Letter Example Format In Phoenix

Description

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

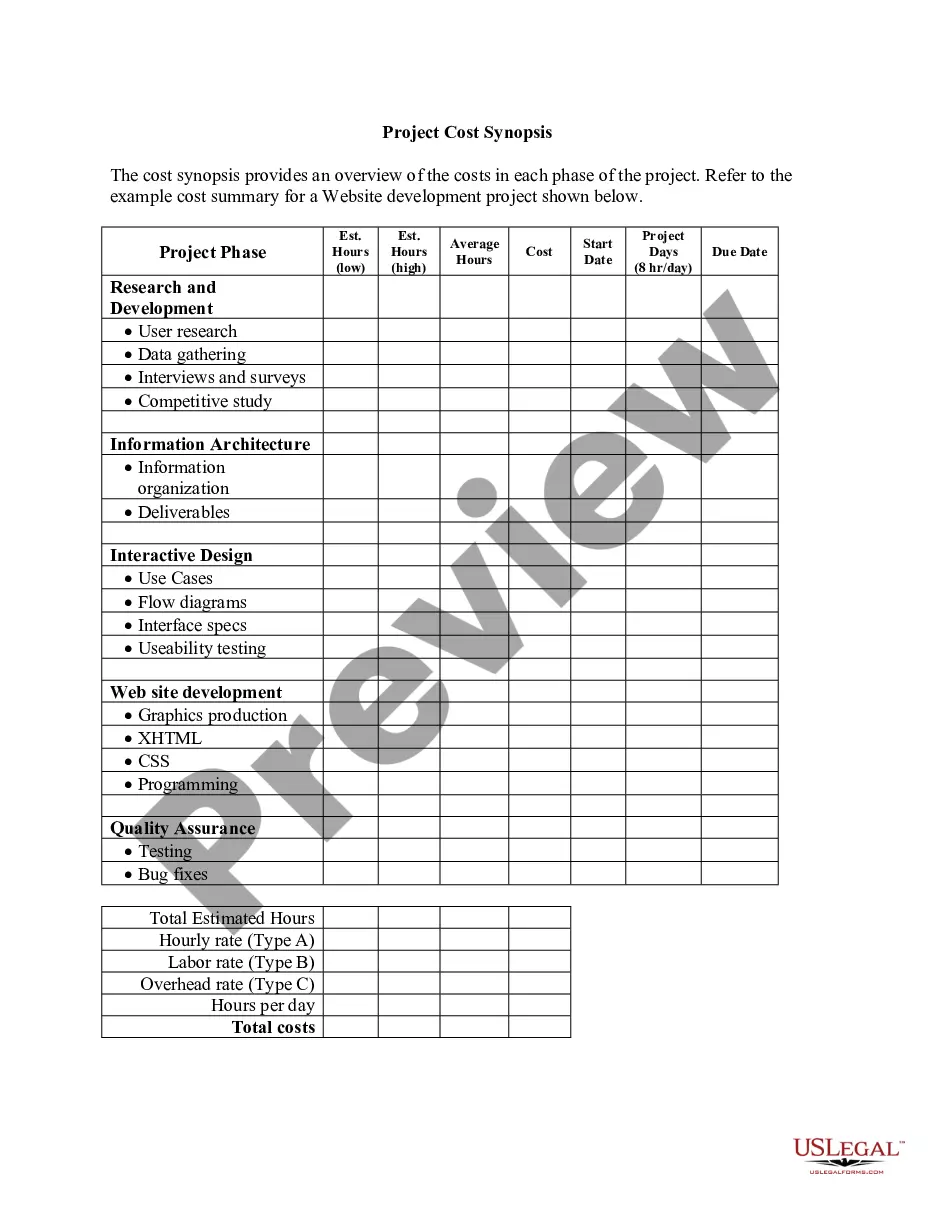

This is a standard form of mortgage payout statement provided by a lender to a borrower. This mortgage payout statement sets out the monies owed by the borrower to the lender as of the date of the statement. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

Purpose, Process, Payoff Having a purpose, process, and payoff statement prepared beforehand can enable you to immediately articulate the benefit of holding a quick conversation and/or capture the attention of everyone participating. It's also a good idea to send this information in the agenda (see point 3).

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

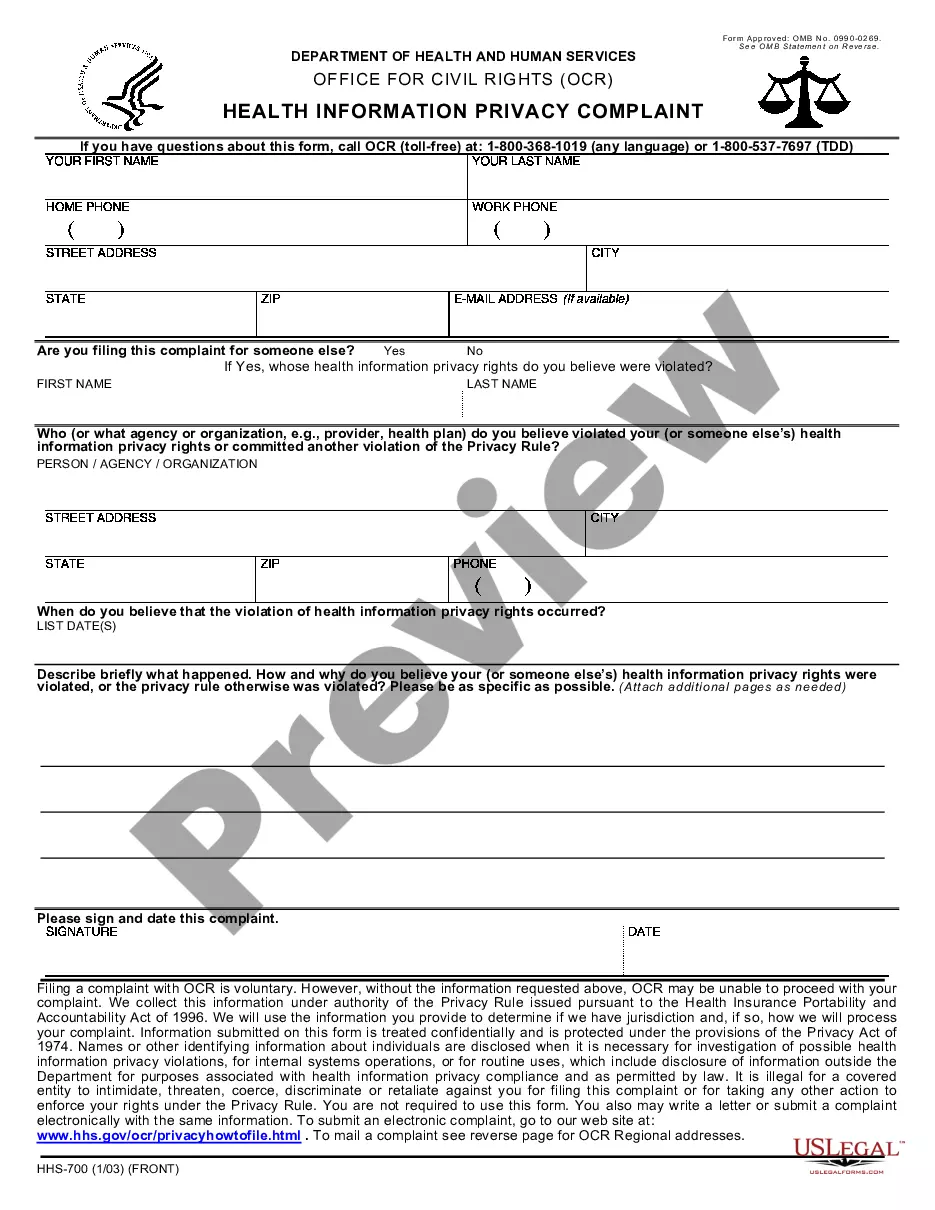

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Instead, you have to get a 10-day payoff estimate from your current lender, which includes the amount you owe, as well as any interest that might accrue on the principal balance in the next 10 days.

The number you see on your mortgage statement is the principal balance, not the payoff amount. The payoff amount showing on the settlement statement takes into account the principal balance plus interest accrued for the number of days between the statement and a few days after the closing.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Examples of payoff in a Sentence Noun You'll have to work hard but there'll be a big payoff in the end. We expected more of a payoff for all our hard work. We made a lot of sacrifices with little payoff.