Payoff Form Statement For Auto Loan In Orange

Description

Form popularity

FAQ

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

The routing number for Orange County's Credit Union is 322281989.

You can find the ABA Routing Number at the bottom of your checks. The ABA Routing Number is the left-most number, followed by your account number, and then by the number of the check.

322281989. This 9-digit number is used to identify where your account was opened. You'll need our routing number and your account number to get Direct Deposit, make payments, and complete bank-to-bank transfers.

Format. A routing number consists of a five digit transit number (also called branch number) identifying the branch where an account is held and a three digit financial institution number corresponding to the financial institution.

How do I increase my credit limit? You can request a credit line increase by visiting a local Orange County's Credit Union branch or contacting our Call Center at (888) 354-6228.

Your savings at Orange County's Credit Union are federally insured up to $250,000 by the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF insurance coverage is the same as that provided for the Federal Deposit Insurance Corporation (FDIC), which insures bank deposits.

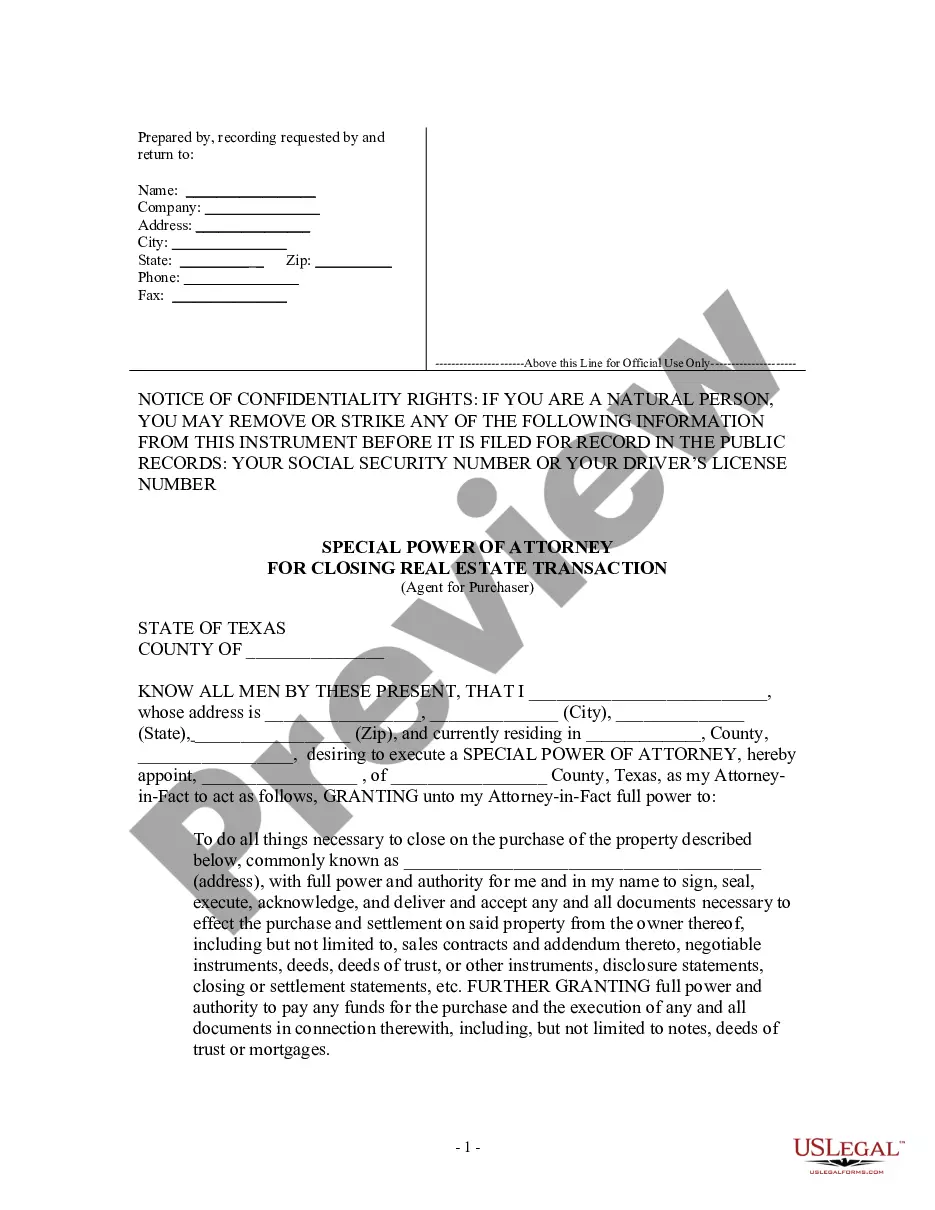

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.