Loan Payoff Letter Example Formula In Orange

State:

Multi-State

County:

Orange

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

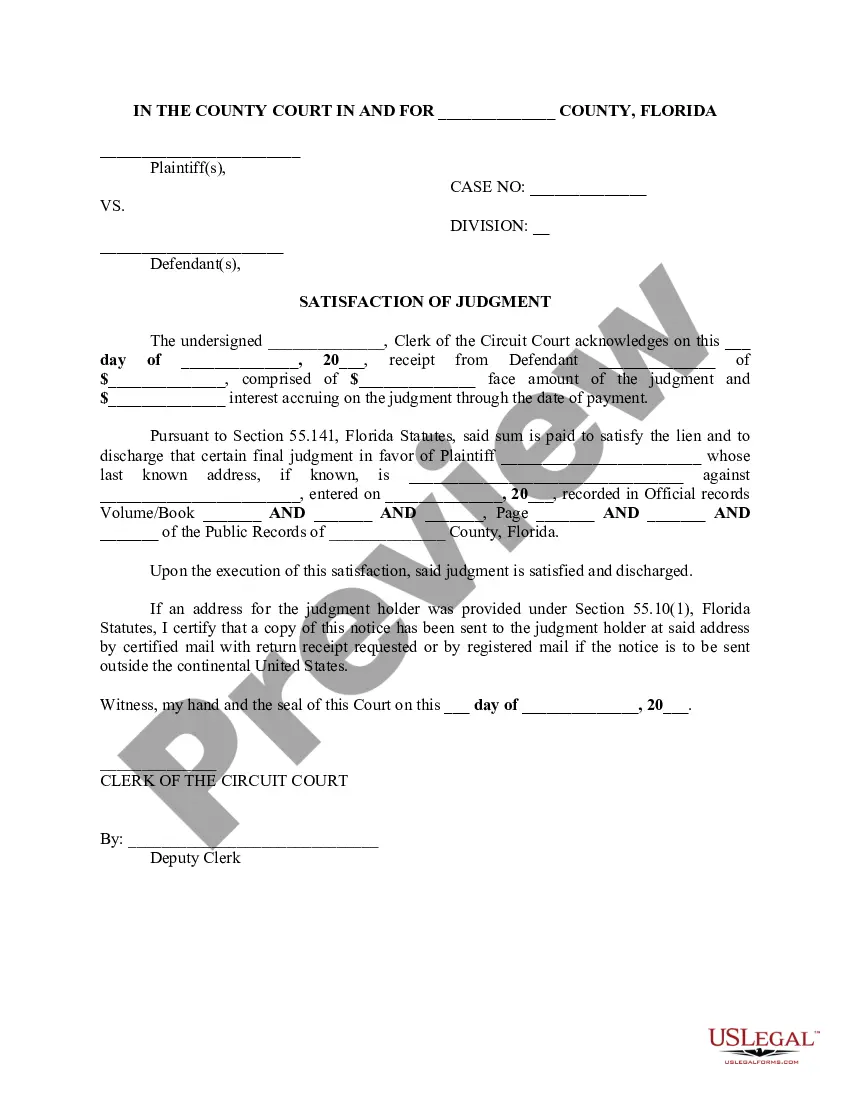

The Loan Payoff Letter Example Formula in Orange serves as a guide for drafting a formal letter requesting information on a loan payoff status. It highlights essential sections such as the date, recipient details, and the nature of the request regarding the loan payoff for a particular matter. Users are instructed to adapt the template to their specific circumstances, ensuring clarity and accuracy in communication. Key features include the request for the status of payment, acknowledgment of any changes to the payoff amount, and a polite closing that thanks the recipient for their cooperation. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who require a straightforward method of following up on loan payments. It facilitates prompt communication and helps in documenting correspondence related to loan management. The template emphasizes the importance of maintaining accurate financial records while ensuring that all relevant information is clearly conveyed to the recipient.

Form popularity

FAQ

P = Ai / (1 – (1 + i)-N) where: P = regular periodic payment. A = amount borrowed. i = periodic interest rate.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.