Payoff Form Statement With Text In Ohio

Description

Form popularity

FAQ

The Attorney General works to resolve problems through informal dispute resolution. We contact the supplier with whom you have a dispute and ask that business to offer a solution that is agreeable to you.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488. For individual taxes call 1-888-301-8885.

The Ohio Attorney General's Legal Community The office's work brings criminals to justice, preserves Ohioans' rights and protects the interests of state government and the citizens it serves. The office also provides formal opinions on legal questions arising during the course of public officials' work.

View an Ohio Sales Tax Map (PDF) comparing current sales tax information for counties in Ohio from the Ohio Department of Taxation (ODT). For more information, please call ODT's Business Taxpayer Services Division at 888-405-4039 or complete the ODT contact form.

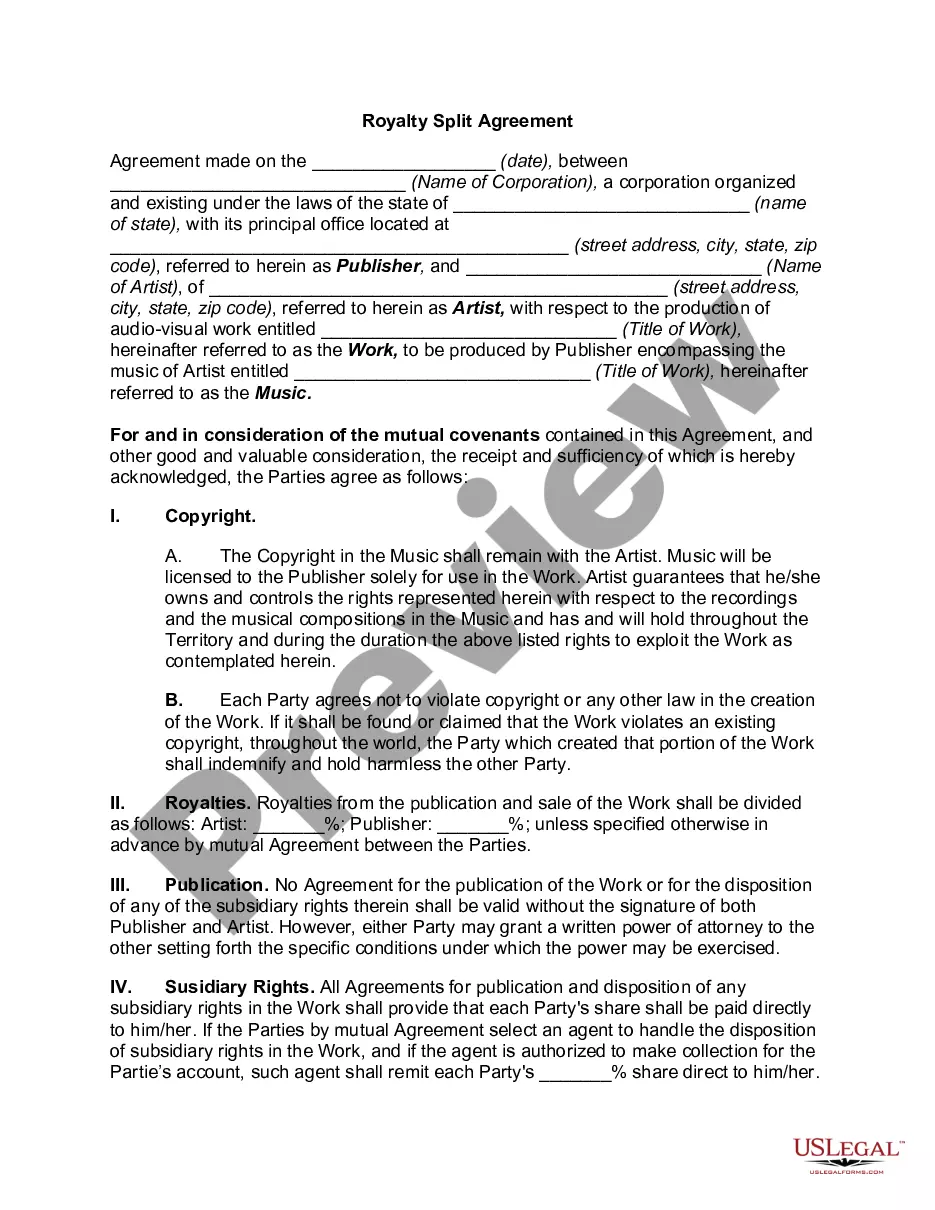

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

If a used car dealer fails to obtain a title in your name within 40 days after the sale, file a consumer complaint with the Ohio Attorney General's Office online or by calling 800-282-0515.

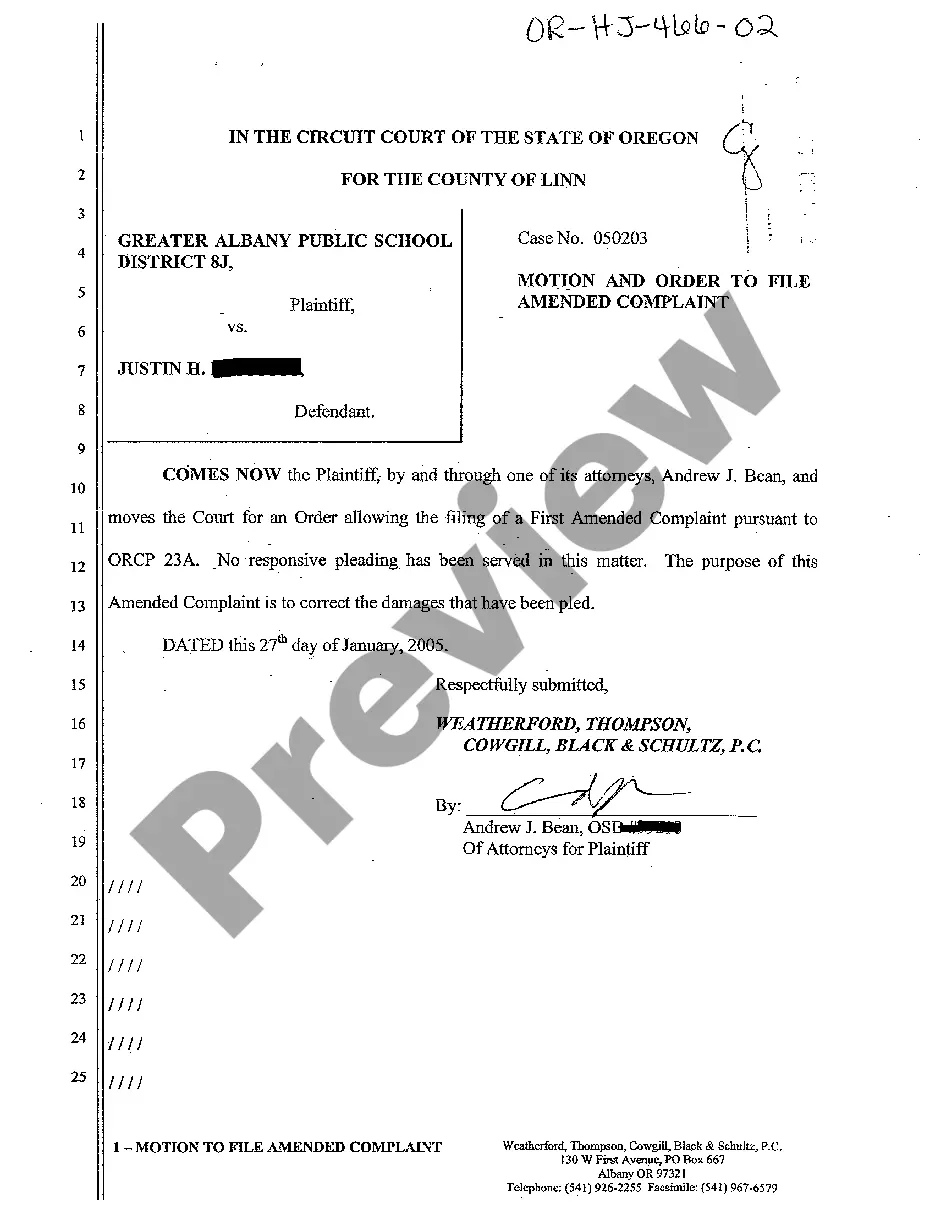

Tax lien: The statute of limitations for a tax lien in Ohio is 15 years from the date the tax liability was assessed. This means that the government has 15 years to collect the taxes owed before the lien expires. Judgment lien: In Ohio, a judgment lien can be valid for up to 5 years.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488. For individual taxes call 1-888-301-8885.

For a Lien Released Manually If your lender does not participate in Ohio's Electronic Lien and Title Program, the lender will mark that the lien was discharged and mail the paper title to you. To remove the lien from BMV records: Take the title to any County Clerk of Courts Title Office.

CRN or DRL (This can be found on your letter from the Ohio Attorney General's office.)