Payoff Form Statement With Multiple Conditions In Nassau

State:

Multi-State

County:

Nassau

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

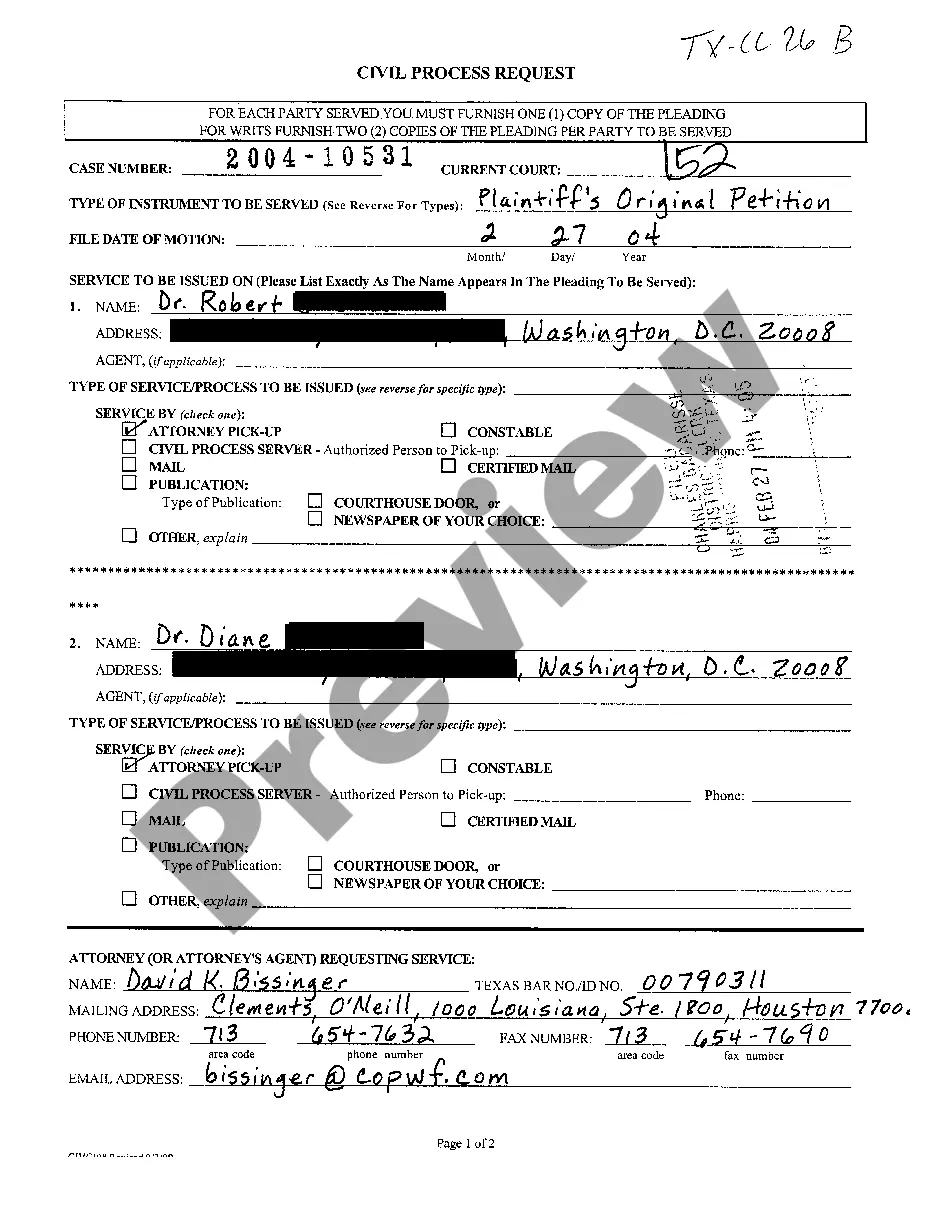

The Payoff Form Statement with Multiple Conditions in Nassau serves as a formal communication regarding the status of loan payoff transactions. It outlines the specific conditions affecting the payoff amount, including increased escrow requirements and accruing interest. This form is vital for ensuring all parties are informed about any changes that may impact the final payment due. Users must accurately fill in relevant dates, amounts, and parties involved, ensuring clarity in communication. The form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants, providing a structured way to manage loan payoff discussions. Completing this form helps streamline the process of resolving financial obligations and ensures compliance with legal standards. The form should be adapted to meet unique circumstances of each case, maintaining professionalism throughout the correspondence. By utilizing this payoff form, users can effectively communicate necessary details, enhancing cooperation among parties involved.

Form popularity

FAQ

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.