Sample Letter Payoff Mortgage Statement With Example In Miami-Dade

Description

Form popularity

FAQ

Record a Document You have three options for recording your documents in the Official Records: You can bring your original documents in person, along with the appropriate fees, and a self-addressed stamped envelope to the Miami-Dade County Courthouse. You can eRecord your document through one of our approved vendors.

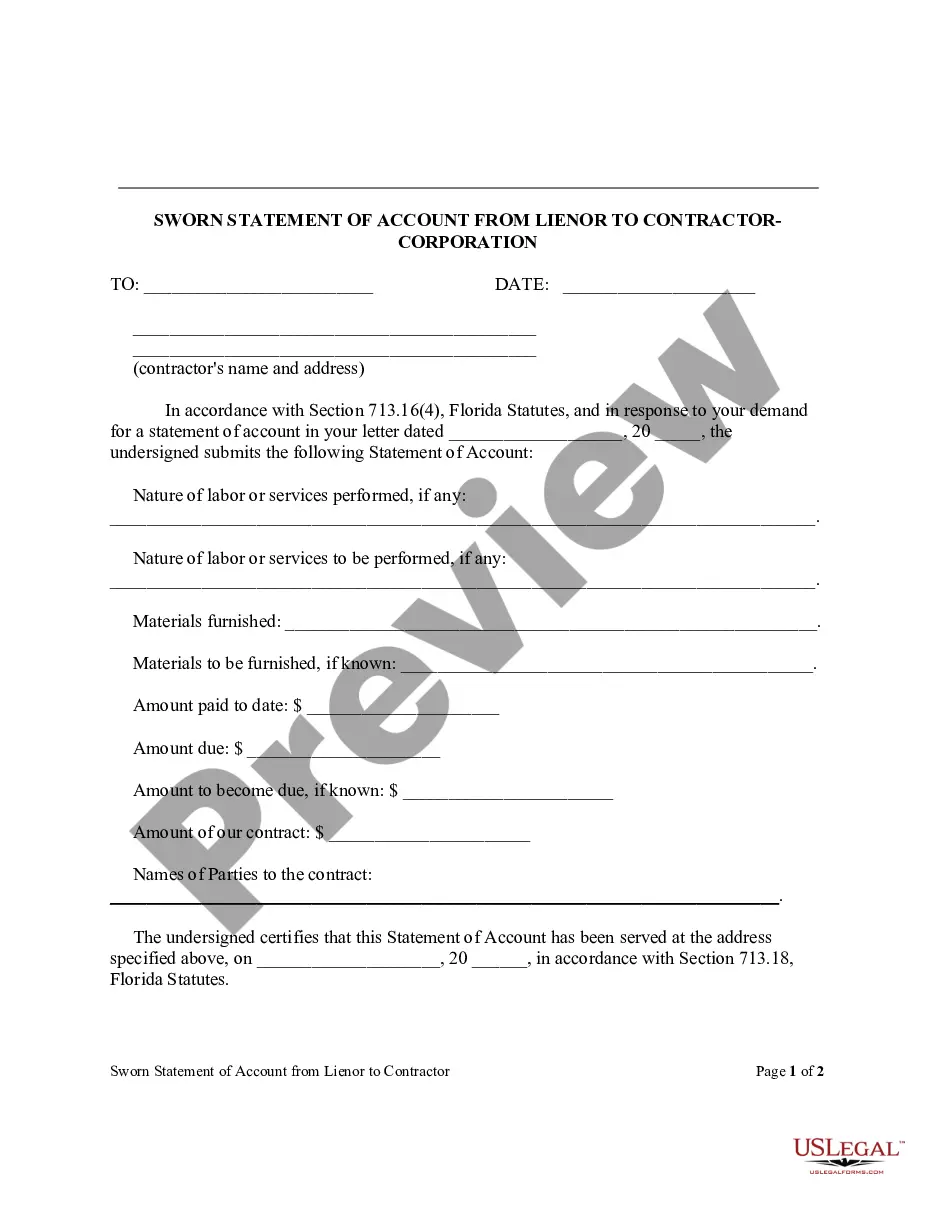

Steps to file a mechanics lien in Miami-Dade County Step 1: Get The Right Form & Meet Margin Requirements. Step 2: Calculating Your Miami-Dade County Filing Fees. Step 3: Serve the Mechanics Lien. Step 4: File your lien with the Miami-Dade County Clerk.

The claim can be filled and submitted online at the Miami-Dade County Clerk's Office. You may print out the application and file the claim in person at a local courthouse if you choose. More resources are available on the Miami-Dade County Law Library site.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.