Mortgage Payoff Statement Form With Tax In Fulton

Description

Form popularity

FAQ

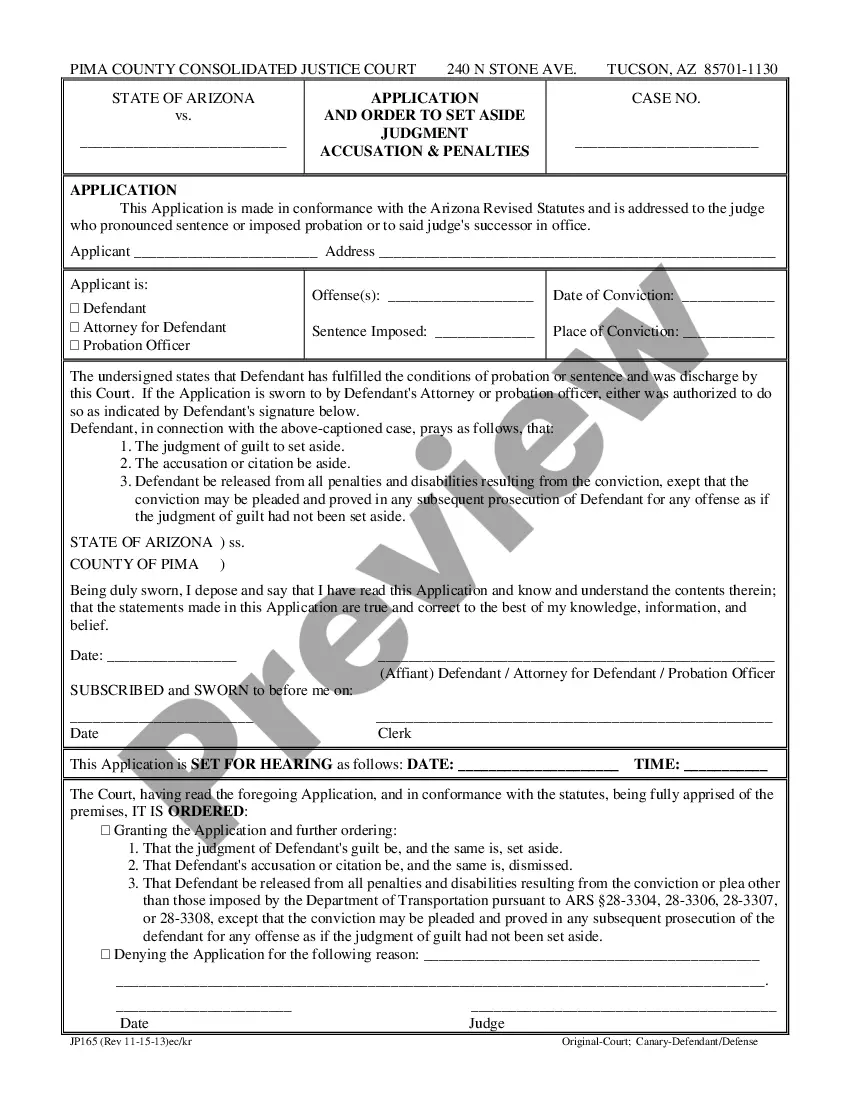

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Close a current account You can close your current account in the Internet Bank, or by visiting one of our branches.

How do I turn my debit card ON or OFF? From the Fulton Bank Debit Card Controls main screen within Online Banking or using the Fulton Bank Mobile App, tap on the toggle switch to turn your debit card OFF or ON. Changes are effective immediately and you can control your debit card 24/7.

It is important to keep your email address and mobile phone number up to date within Online Banking. Updates can be made using the "My Setting" page after logging in.

In order to close any account with Fulton Bank the account must first be at exactly a $0.00 balance for the process to begin. Once you have the desired account at a zero balance please send us a message stating that you would like the account closed.

In order to close any account with Fulton Bank the account must first be at exactly a $0.00 balance for the process to begin. Once you have the desired account at a zero balance please send us a message stating that you would like the account closed.

If you itemize your deductions on Schedule A (Form 1040), only include the personal part of your deductible mortgage interest on Schedule A (Form 1040), lines 8a or 8b.