Lien Payoff Letter Template For Property In Florida

Description

Form popularity

FAQ

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

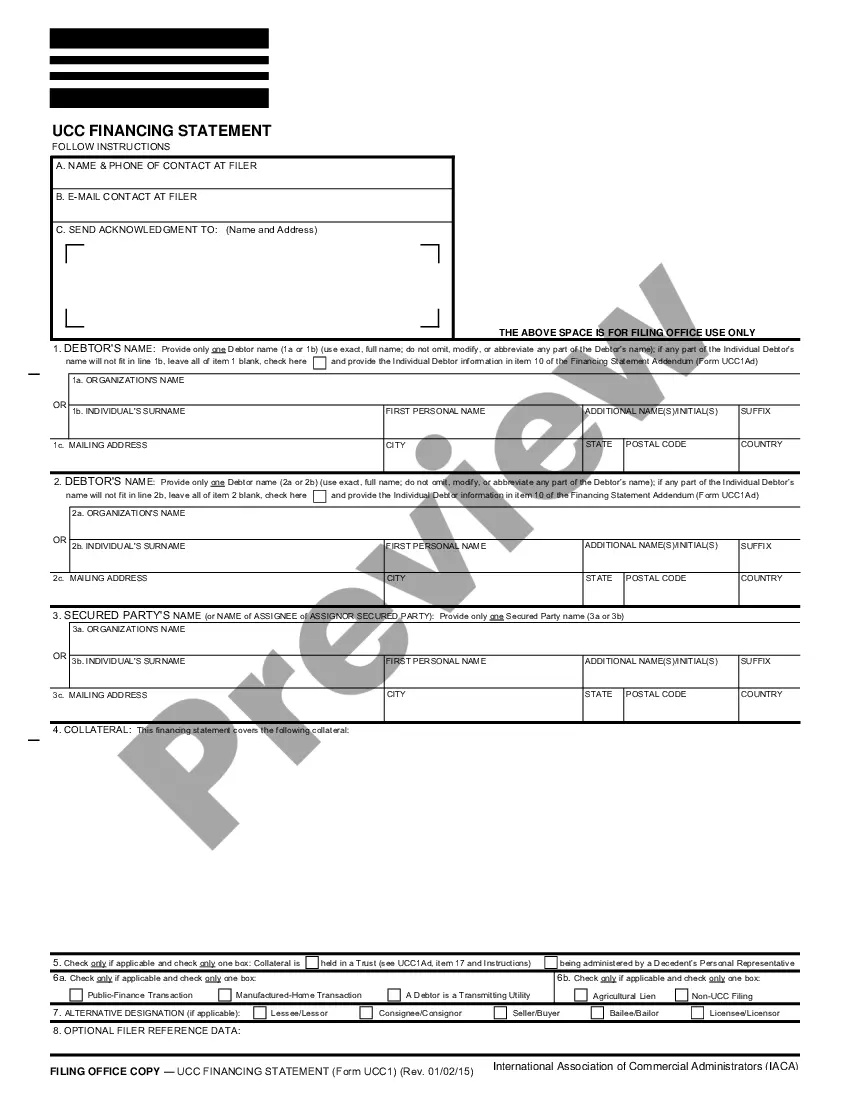

Identify the lien that is being released by entering the necessary details, such as the lienholder's name, the property or asset description, and the date the lien was filed. Clearly state your intention to release the lien and make sure to sign the form using your legal signature.

If a lien is already in place, paying your obligations to the creditor will allow the creditor to remove the lien, giving you a clear title. Once the debt is satisfied, you must remove the lien from your property's title.

Steps to Conduct a Lien Search in Florida Check Local Records: Start by visiting your county's official website. Visit the Assessor's Office: If you need more details or can't find what you're looking for online, you can go to the local assessor's office.

For just $100, you can choose to have our team of search experts perform a Florida Municipal Lien Search, which does not include any permit information.

Do Florida lien waivers have to be notarized? No. Florida statute does not require statutory lien waivers be notarized. However, if using an alternate lien waiver form, and the terms state that the document needs to be notarized, then it will be required.

Yes, it happens. Sometimes a court decision or settlement results in a lien being placed on a property without the owner's immediate knowledge. This typically occurs when a court-ordered lien or certificate of judgment is issued against you and recorded at the county recordings office.

Liens are a matter of public record, so it's simple to find out if there's one on your property, or on anyone else's property for that matter. In most states, you can typically conduct a property lien search by address with the county recorder, clerk, or assessor's office online.

You can remove a lien in Florida by: Paying off your debt. Filling out a release-of-lien form. Getting the release-of-lien form notarized. Filing the release with the county recorder's office. Keeping a copy of the release in your possession.

Visit the Assessor's Office: If you need more details or can't find what you're looking for online, you can go to the local assessor's office. They have all the records about property ownership and debts. Look at State and Federal Records: Sometimes, liens come from unpaid state or federal taxes.